This is the "National UCC Finanacing Statement," and it is an American Lawyer Media form. It contains an acknowledgement copy, a debtor copy, a search request copy, and the secured party's copy.

San Diego California UCC Financing Statement

Description

How to fill out UCC Financing Statement?

How long does it generally require you to create a legal document.

Taking into account that every state possesses its own laws and regulations for every life situation, locating a San Diego UCC Financing Statement that satisfies all local criteria can be draining, and acquiring it from a qualified attorney is frequently costly. Many online platforms provide the most prevalent state-specific documents for downloading, but utilizing the US Legal Forms repository is the most advantageous.

US Legal Forms is the largest online collection of templates, categorized by states and areas of application. Besides the San Diego UCC Financing Statement, here you can find any particular form to manage your business or personal matters, adhering to your local regulations. Experts review all samples for their accuracy, so you can trust that you will prepare your documents correctly.

Print the document or use any preferred online editor to fill it out digitally. Regardless of how many times you need to access the purchased document, you can locate all the files you’ve previously downloaded in your profile by clicking the My documents tab. Give it a try!

- Utilizing the service is exceptionally straightforward.

- If you already possess an account on the platform and your subscription is active, you just need to Log In, pick the needed form, and download it.

- You can keep the document in your account at any time later on.

- If you are new to the site, there will be additional steps to take before obtaining your San Diego UCC Financing Statement.

- Examine the content of the page you’re visiting.

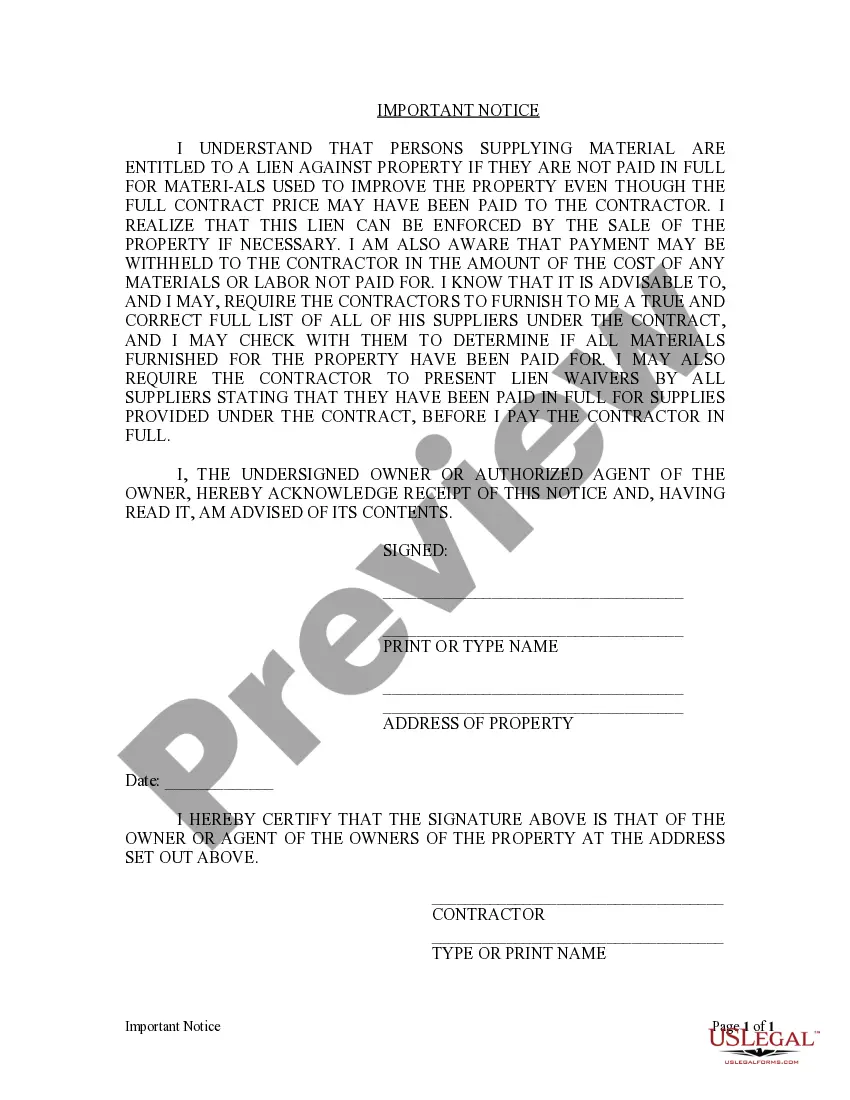

- Read the description of the example or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you are confident in the selected document.

- Select the subscription plan that fits you best.

- Establish an account on the platform or Log In to move on to payment options.

- Pay through PayPal or with your credit card.

- Change the file format if required.

- Click Download to save the San Diego UCC Financing Statement.

Form popularity

FAQ

If you are a foreign entity looking to file a San Diego California UCC Financing Statement, you should file it with the California Secretary of State. This filing will establish your security interests in California. Utilizing platforms like US Legal Forms can guide you through this process, making it easier to navigate legal requirements.

Most states in the U.S. have adopted some form of the Uniform Commercial Code; however, Louisiana is a notable exception as it uses a different system. Understanding this can be essential if you are conducting business across state lines. For activity in San Diego, be assured that the UCC is an integral part of California operational law.

You can file a San Diego California UCC Financing Statement online through the California Secretary of State's website. In addition, many local county clerks or recorders offer filing services. Utilizing platforms like US Legal Forms can simplify this process and ensure that your statement is filed correctly and efficiently.

Receiving a UCC financing statement usually means a lender has claimed a security interest in your property or assets. This document serves to protect the lender's rights should you fail to meet your financial obligations. Understanding your rights and responsibilities in this matter is crucial. Our platform, uslegalforms, provides resources to help you navigate your situation effectively.

The UCC-1 Financing Statement is filed to protect a lender's or creditor's security interest by giving public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt with a certain debtor.

A UCC financing statement also called a UCC-1 financing statement or a UCC-1 filing is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.

A request for a certified search of the UCC records must be submitted in writing to one of the Clerk of Court offices. The fee for the search is $30 per debtor name. The Secretary of State offers subscriptions to the UCC database for an annual fee of $400.

The court noted that the California Commercial Code provides that a person may file a UCC-1 only if the debtor authorizes the filing by (1) authenticating a security agreement; (2) becoming bound as debtor by a security agreement; or (3) acquiring collateral in which a security interest is attached.

(a) Fiveyear effectiveness. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing statement is effective for a period of five years after the date of filing.

UCC-1 Financing Statements, commonly referred to as simply UCC-1 filings, are used by lenders to announce their rights to collateral or liens on secured loans. They're usually filed by lenders with the debtor's state's secretary of state office when a loan is first originated.