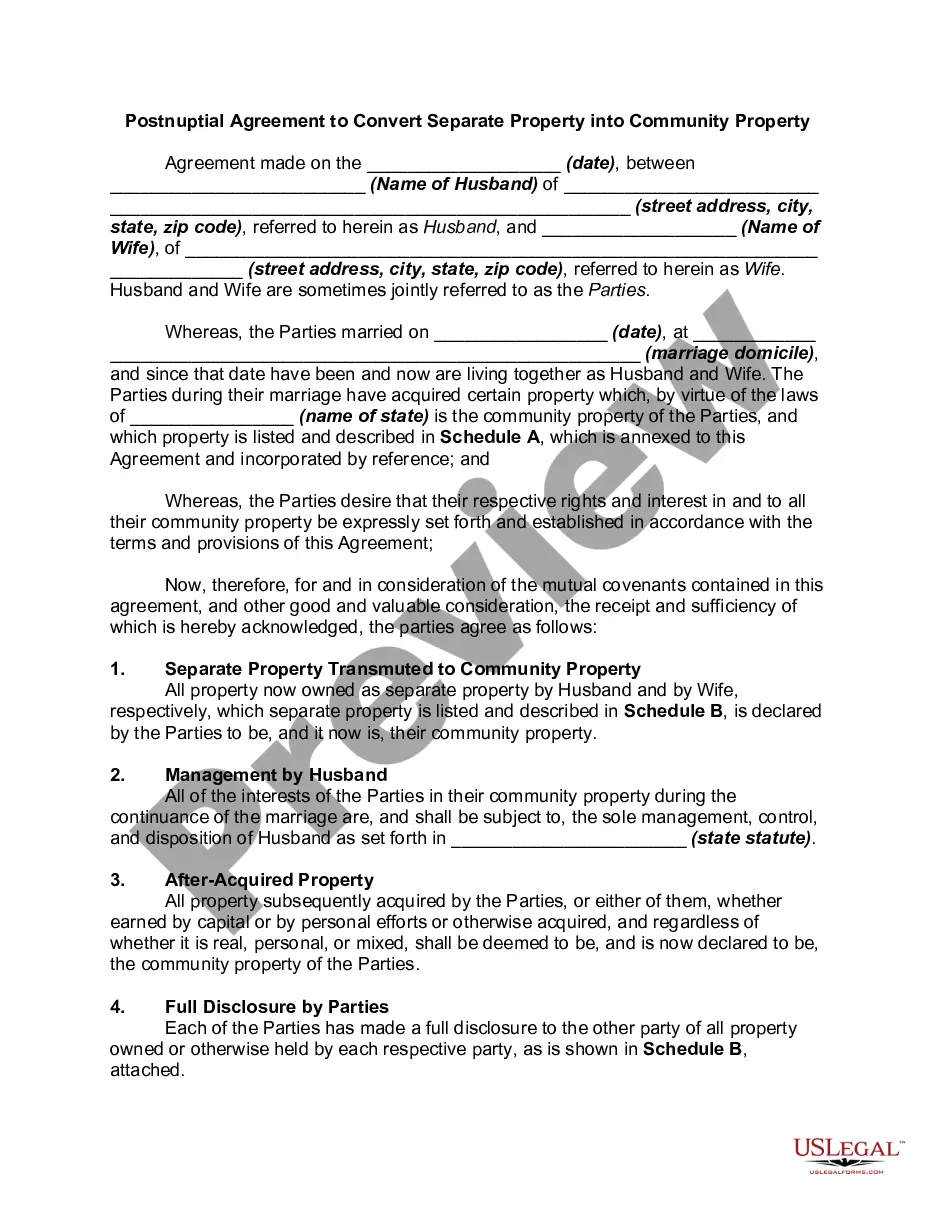

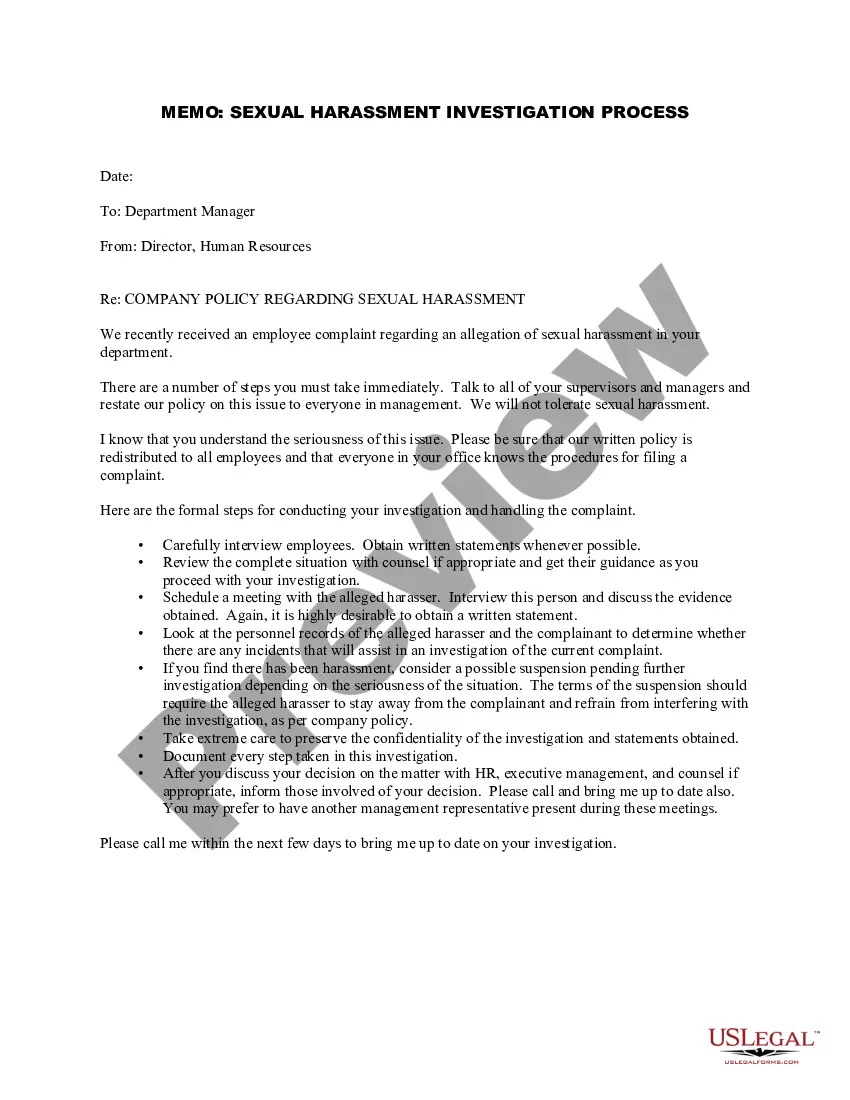

This is a rider to the software/services master agreement order form. It provides that a related entity of the customer may use the software purchased from the vendor.

Broward Florida Related Entity

Description

How to fill out Related Entity?

A documentation routine consistently accompanies any legal endeavor you undertake.

Establishing a business, submitting or accepting a job proposal, altering ownership, and numerous other life circumstances necessitate you to prepare formal paperwork that differs from state to state.

That is why consolidating it all in one location is so advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

Utilize it as required: print it or complete it electronically, sign it, and file where needed. This is the easiest and most dependable method to acquire legal documents. All samples in our library are professionally composed and verified for compliance with local laws and regulations. Prepare your documents and manage your legal matters appropriately with US Legal Forms!

- Here, you can effortlessly locate and acquire a document for any personal or commercial purpose needed in your locale, including the Broward Related Entity.

- Finding samples on the site is incredibly simple.

- If you currently have a subscription to our library, Log In to your account, locate the sample through the search bar, and click Download to save it on your device.

- Subsequently, the Broward Related Entity will be available for continued use in the My documents section of your profile.

- If you are utilizing US Legal Forms for the first time, adhere to this quick guide to obtain the Broward Related Entity.

- Ensure you have accessed the correct page with your localized form.

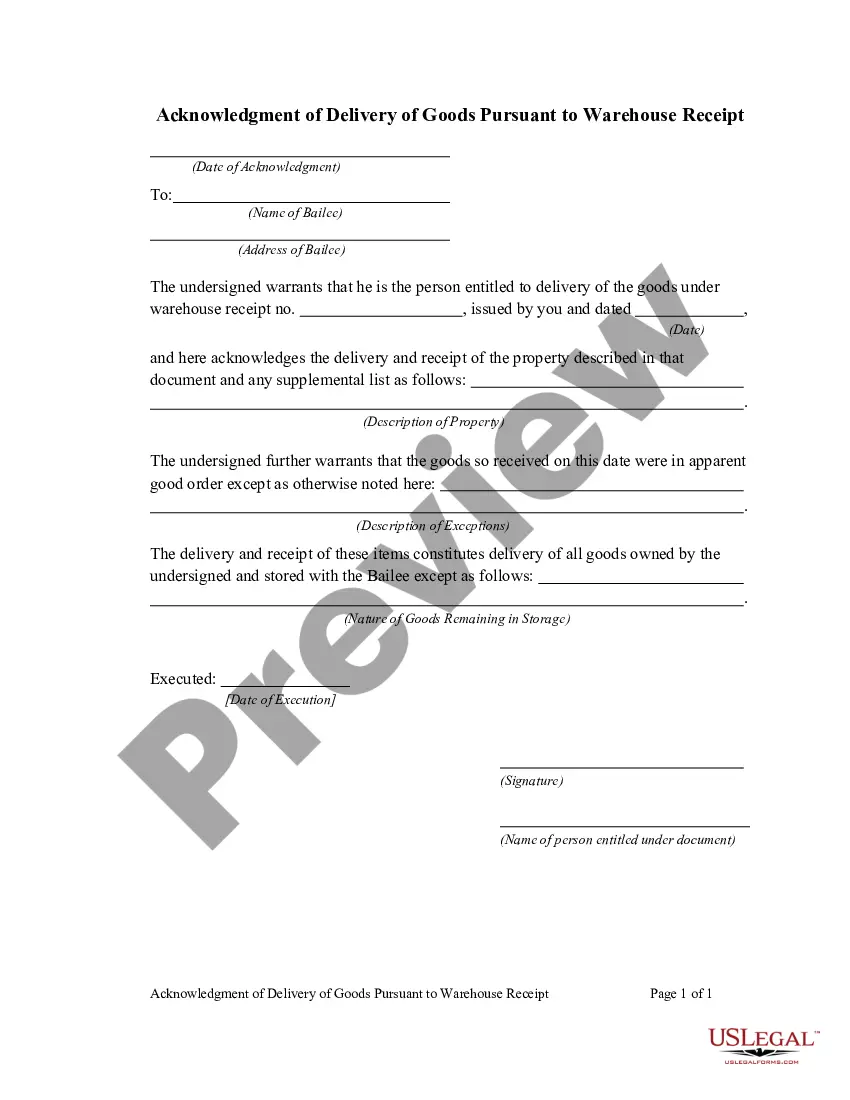

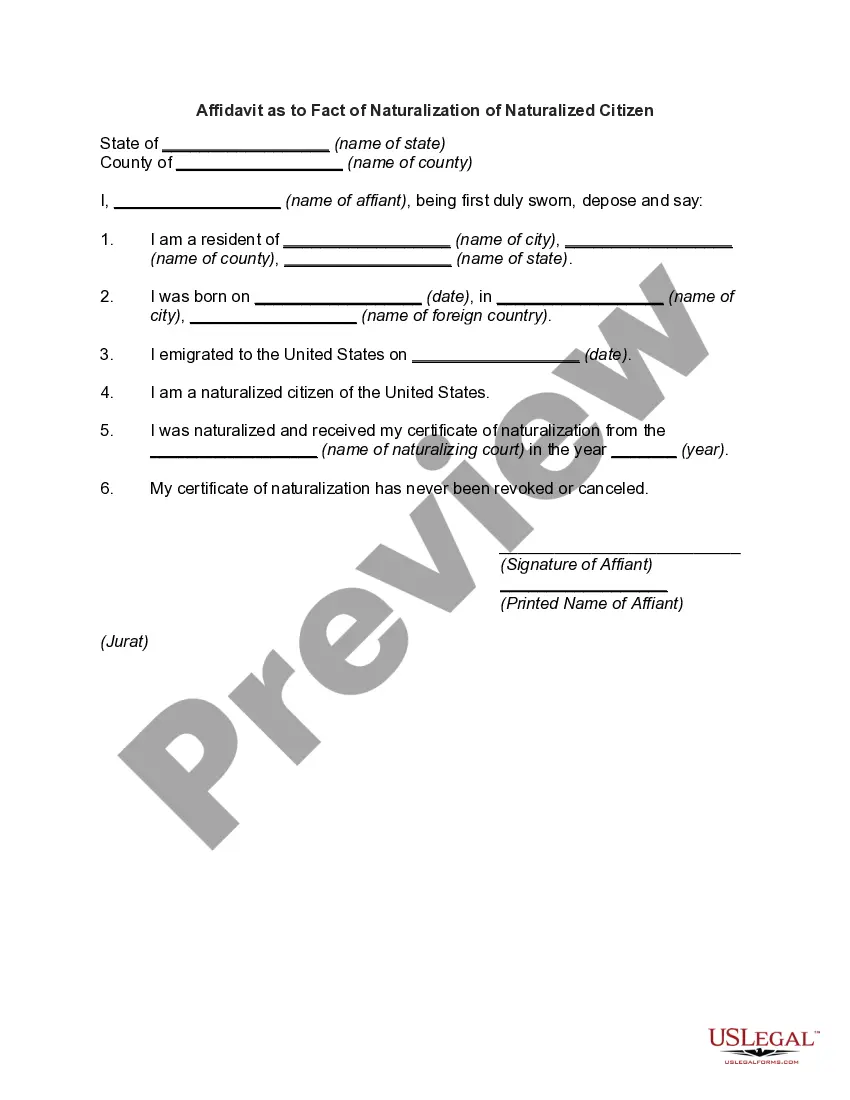

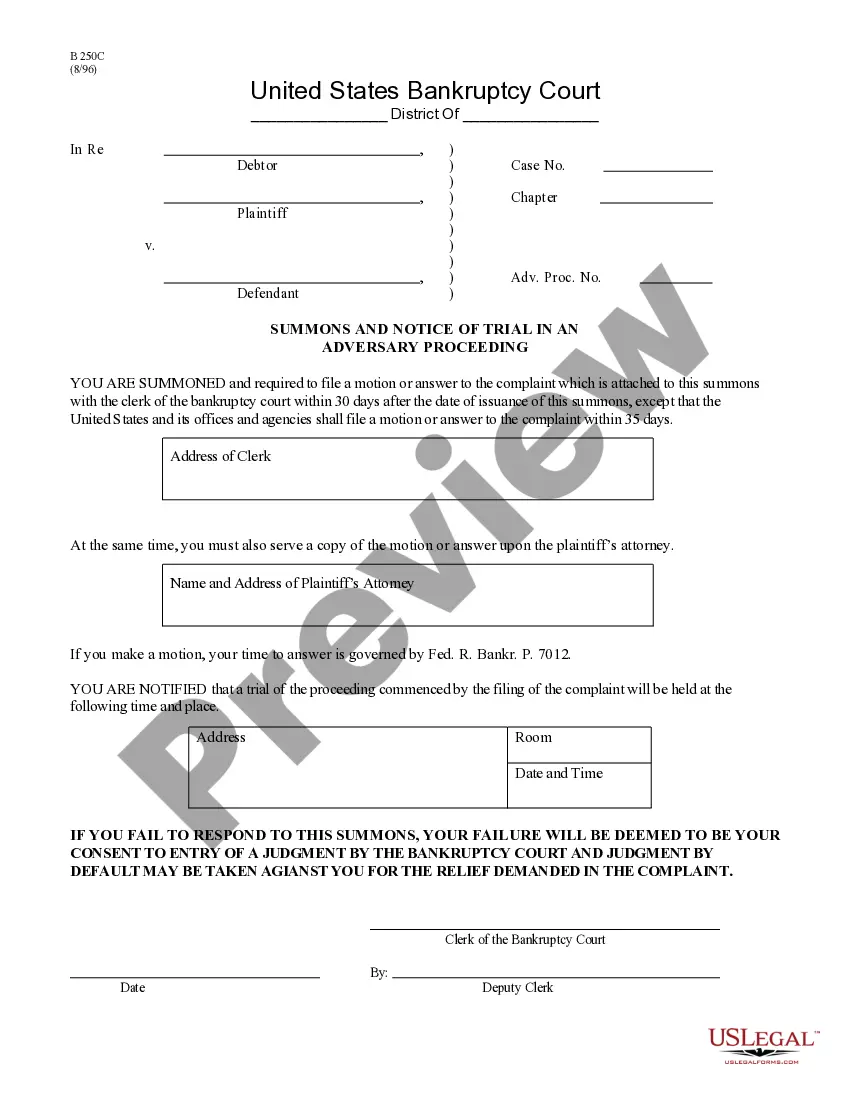

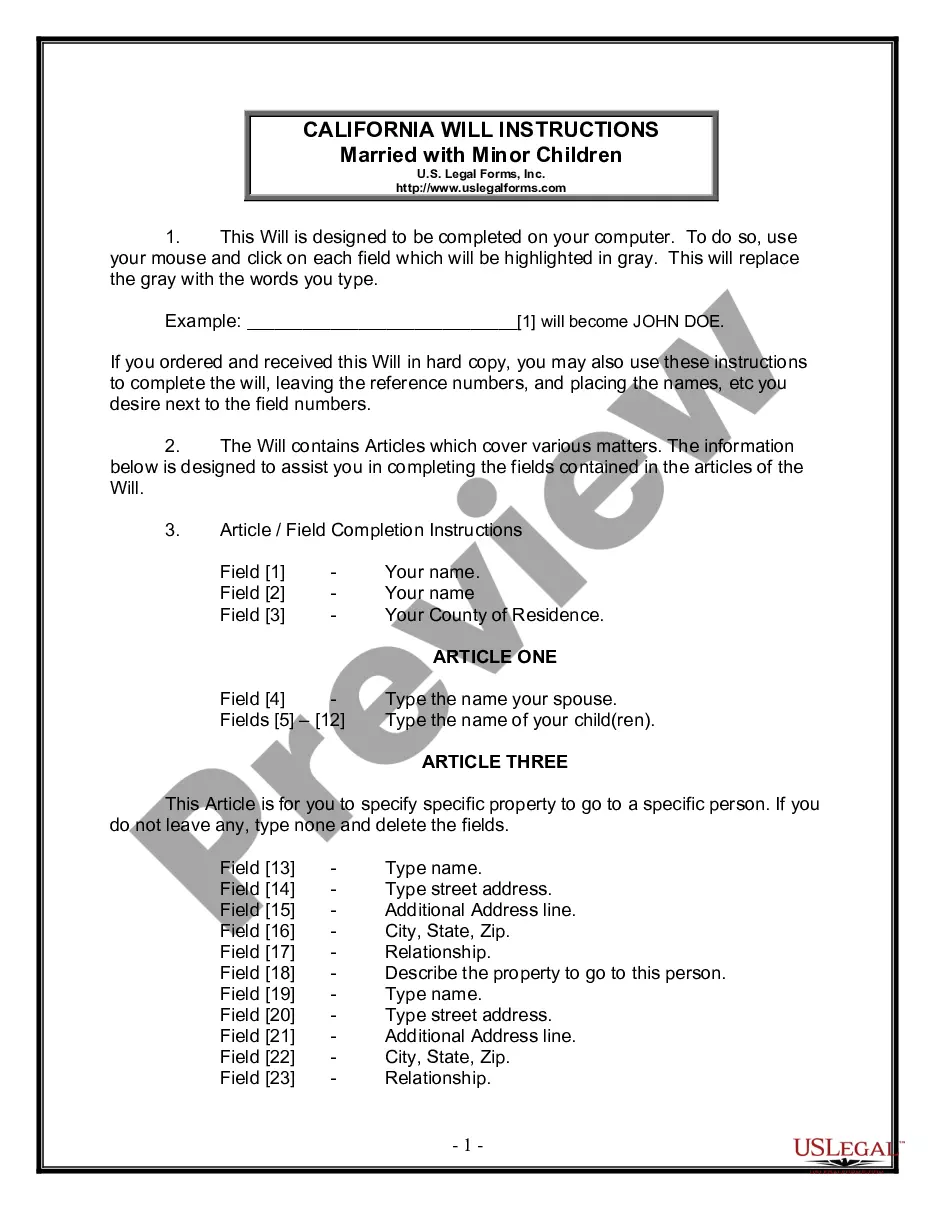

- Make use of the Preview mode (if accessible) and scroll through the template.

- Examine the description (if present) to verify the form meets your needs.

- If the sample does not suit you, search for another document using the search tab.

- Click Buy Now once you locate the necessary template.

- Choose the appropriate subscription plan, then Log In or sign up for an account.

- Select your preferred payment method (using credit card or PayPal) to proceed.

- Pick the file format and download the Broward Related Entity on your device.

Form popularity

FAQ

Obtaining General Business Licenses. In Florida, you will need a general business license, called a business tax receipt, if you provide goods and/or services to the general public whether you are operating your new business at home or in a separate commercial location.

Anyone providing merchandise or services, including a sole proprietor or home based business, must obtain the Business Tax Receipt to operate. A Business Tax Receipt must be obtained for any for profit LLC, Corporation, or Fictitious name registered with the State. 101 N.

In order to search business entities in Florida, you must go to the SunBiz Secretary of State's Website. Once on the page, you have the option to lookup an entity (Corporation, LLC, Limited Partnership) by; Name, Officer, Registered Agent, Tax (EIN) Number, or Document Number. Click Here to lookup a Partnership.

Names with an INACTIVE or INACT status are available. Names with an ACTIVE, ACT, or INACTIVE/UA status are not available for use. Names with an INACTIVE/UA status are being held for a specified period of time for that particular entity to reactive its filing should it decide to do so.

Similar to what the Delaware Division of Corporations does, SunBiz is simply the Florida Division of Corporations. It's the state division where Florida companies are registered or where Florida Foreign Qualification applications are submitted for approval.

Anyone who provides merchandise or services to the public, even if only a one-person company or home-based business, must obtain the business tax receipt in order to operate. If the business location is within the city limits, a city-issued business tax receipt is first required, as well.

NAME HS: This status stands for name history, which indicates that the company has changed its name. CROSS RF: This status stands for cross reference, which means that the company made an attempt to qualify in the state.

Assistant (when used with another title, such as AV for Assistant Vice President) AMBR. Authorized Member. AP. Authorized Person.

The Local Business Tax (formerly known as Occupational License) is required of any individual or entity any business, or profession in Broward County, unless specifically exempted.

Business tax receipts are required by some local governments to show proof that a business tax payment was made and/or a business is able to operate within a certain city or county. Business tax receipts require an application and a fee payment that typically ranges from $25 to $500.