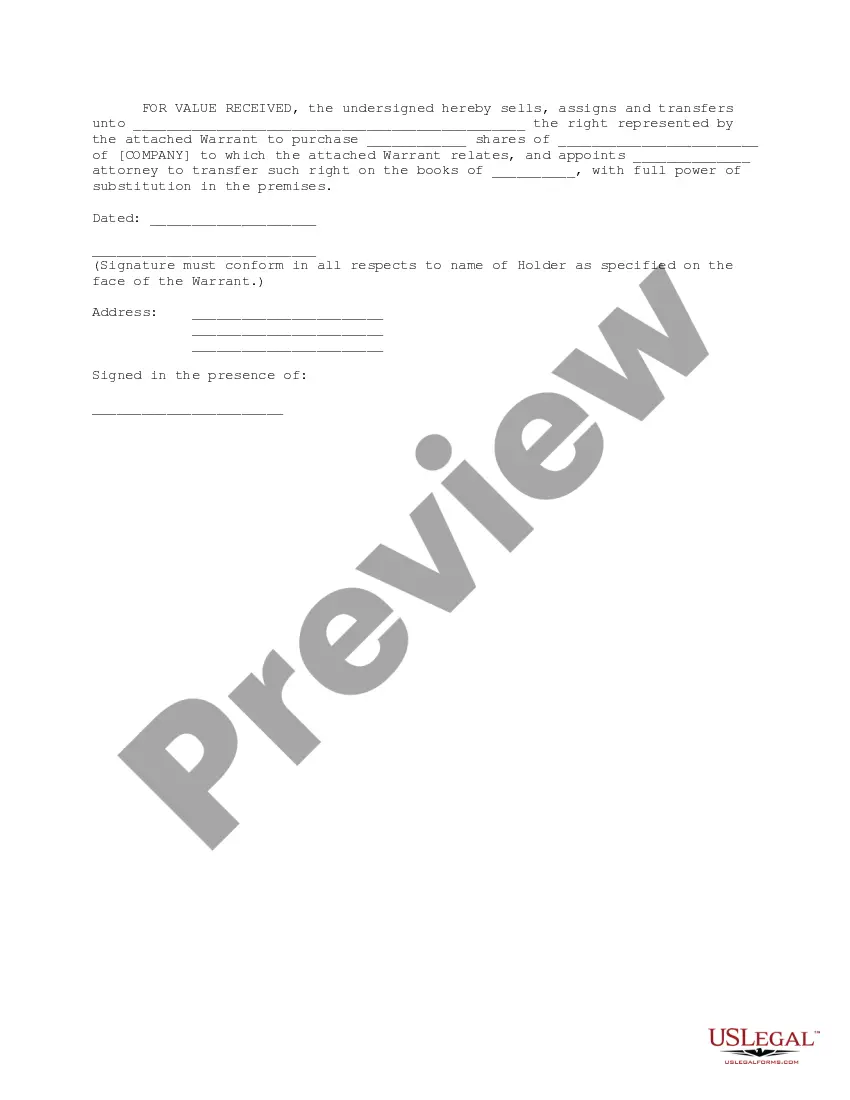

This Warrant is to be used in bridge financing when the bridge investors are making a bridge loan to the company and receiving convertible notes and warrants. The warrant provides for several events subsequent to the bridge financing that fix the number of shares and exercise price for the warrant.

Middlesex Massachusetts Bridge Financing Warrant

Description

How to fill out Bridge Financing Warrant?

If you need to discover a reliable legal document supplier to obtain the Middlesex Bridge Financing Warrant, look no further than US Legal Forms. Whether you aim to initiate your LLC venture or handle your asset allocation, we have you covered. You don't need to be well-versed in law to find and download the required template.

You can easily decide to search or browse the Middlesex Bridge Financing Warrant, either by a keyword or by the state/county for which the document is prepared.

After finding the necessary template, you can Log In and download it or save it in the My documents section.

Don't have an account? It's simple to start! Just find the Middlesex Bridge Financing Warrant template and review the form's preview and brief introductory details (if available). If you're confident about the template’s language, proceed and click Buy now. Create an account and select a subscription plan. The template will be instantly available for download once the payment is completed. You can then complete the form.

Managing your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove that. Our wide range of legal documents makes these tasks less costly and more affordable. Establish your first business, arrange your advance care directives, create a real estate agreement, or execute the Middlesex Bridge Financing Warrant - all from the comfort of your home. Sign up for US Legal Forms today!

- You can choose from over 85,000 forms categorized by state/county and situation.

- The user-friendly interface, plethora of educational resources, and committed support team make it easy to find and complete various documents.

- US Legal Forms is a trustworthy service providing legal forms to millions of clients since 1997.

Form popularity

FAQ

Bridge Warrant means the common stock purchase warrant issued on the date hereof to the Bridge Investors to purchase a number of shares of Parent Common Stock equal to the Bridge Warrant Share Number.

Conventional loans are traditionally longer-term loans, usually ten to twenty plus years in length as either variable or fixed rates. Bridge loans are gap loans. They tend to be three years or less and focus on bridging the liquidity gap in a project.

Drawbacks of Bridge Loans If you default on your loan obligations, the bridge loan lender could foreclose on the house and leave you in even more financial distress than you were prior to taking the bridge loan. Plus, the foreclosure might leave you with no home.

Most bridging loan providers require property as security. This could be just one property, or several. They will secure their loan by taking a charge over the property or properties. This is registered at land registry by way of a first charge, second charge or even a third charge.

Can homebuyer bridge loans be extended when they reach maturity? There cannot be any written agreement to extend the loan beyond the 12-month maturity limit. However, if lender and borrower both agree, the loan can be modified at maturity to provide an extension of up to 12 additional months.

Bridge loans are secured by your current home as collateral, just like mortgages, home equity loans and HELOCs. Bridge loans aren't a substitute for a mortgage, however. Bridge loans are short-term, designed to be repaid within six months to three years.

Bridge loan terms are typically six months but can range from 90 days to 12 months or longer. To qualify for a bridge loan, a firm sale agreement must be in place on your existing home. This type of financing is most common in hot real estate markets where bidding wars are the norm.

Some may be willing to offer you a bridging loan with a term of anywhere between 18 months and two years, under the right circumstances. The longest bridging loan term you'll find is 36 months, offered by a minority of lenders.

Although bridge loans are secured by the borrower's home, they often have higher interest rates than other financing optionslike home equity lines of creditbecause of the short loan term.

A bridge loan is a short-term loan used to bridge the gap between buying a home and selling your previous one. Sometimes you want to buy before you sell, meaning you don't have the profit from the sale to apply to your new home's down payment.