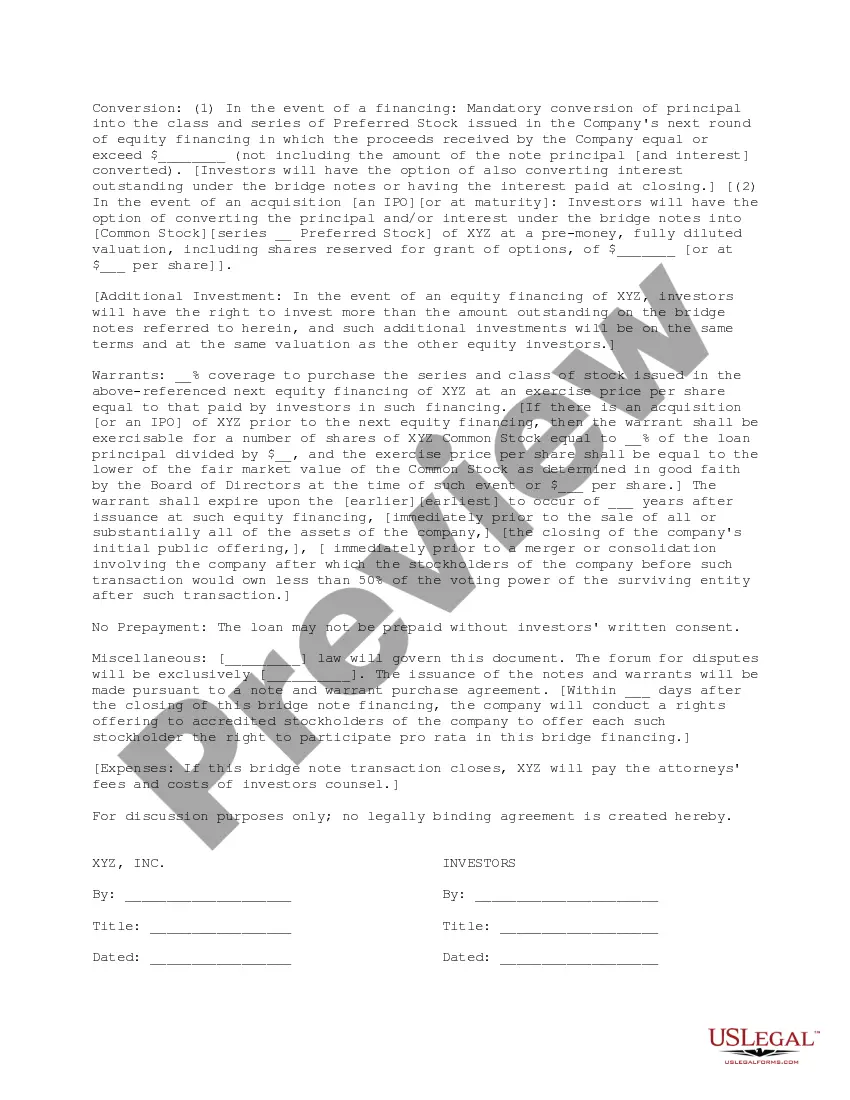

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Suffolk New York Term Sheet for Bridge Financing

Description

How to fill out Term Sheet For Bridge Financing?

Regardless of whether you plan to launch your enterprise, engage in a transaction, request your ID modification, or address familial legal issues, it is essential to gather certain documentation that aligns with your regional laws and regulations.

Locating the appropriate documents can require considerable time and effort unless you utilize the US Legal Forms library.

The platform offers users over 85,000 expertly crafted and verified legal forms for any personal or commercial circumstance. All documents are organized by state and purpose, making it easy to select a form like the Suffolk Term Sheet for Bridge Financing.

Documents available on our site are reusable. With an active subscription, you can access all of your previously bought paperwork anytime in the My documents section of your account. Stop wasting time on a never-ending quest for current official documents. Sign up for the US Legal Forms platform and keep your paperwork organized with the most extensive online form library!

- Ensure that the template satisfies your individual requirements and adheres to state legal stipulations.

- Review the form details and examine the Preview if it is accessible on the page.

- Use the search feature provided above to find another template suited to your state.

- Select Buy Now to acquire the template once you identify the correct one.

- Pick the subscription plan that best fits your needs to proceed.

- Log in to your account and complete the payment using a credit card or PayPal.

- Download the Suffolk Term Sheet for Bridge Financing in your preferred file format.

- Print the document or fill it out and electronically sign it via an online editor to save time.

Form popularity

FAQ

The Cons of Bridging Loans High Interest. The comparatively high interest rates attached to bridging loans make for steeper borrowing costs on longer terms. Collateral. It may be impossible to qualify for a bridging loan in the first place, without enough equity to guarantee the loan. Fees.

Bridge Loan Costs Bridge loan interest rates depend on your creditworthiness and the size of the loan but generally range from the prime ratecurrently 3.25%to 8.5% or 10.5%. Interest rates for business bridge loans are even higher and typically range from 15% to 24%.

As a condition of the bridge loan, you put up your current home as collateral. If the loan term expires and you still haven't sold your former home, there's a chance you'll be able to request an extension from the lender. However, if the extensions run out as well, the lender could foreclose on your old home.

A bridge loan is a short-term interest-only loan that usually has a maximum term of 18 months. Bridging loans can be as short as one week but are usually between 1 and 12 months.

Bridge loan terms are typically six months but can range from 90 days to 12 months or longer. To qualify for a bridge loan, a firm sale agreement must be in place on your existing home. This type of financing is most common in hot real estate markets where bidding wars are the norm.

Bridging loan costs typically include arrangement fees and they usually amount to a percentage of the loan. Around 2% is standard, but some lenders may drop to 1% if you take out a particularly large sum, and others may waive this fee entirely.

Can homebuyer bridge loans be extended when they reach maturity? There cannot be any written agreement to extend the loan beyond the 12-month maturity limit. However, if lender and borrower both agree, the loan can be modified at maturity to provide an extension of up to 12 additional months.

A bridge loan is short-term financing used until a person or company secures permanent financing or removes an existing obligation. Bridge loans are often used in real estate, but many types of businesses use them as well.

Bridging loans are usually offered for between 1-18 months, with the loan repayable in full at the end of the term. Unlike other forms of borrowing the monthly interest is often rolled into the loan, meaning there are no repayments to make during the term of the loan.