Omaha Nebraska First Time Homebuyer Program Realtor Packet

Category:

State:

Multi-State

City:

Omaha

Control #:

US-RE-GH-1050-1

Format:

Word;

Rich Text

Instant download

Description

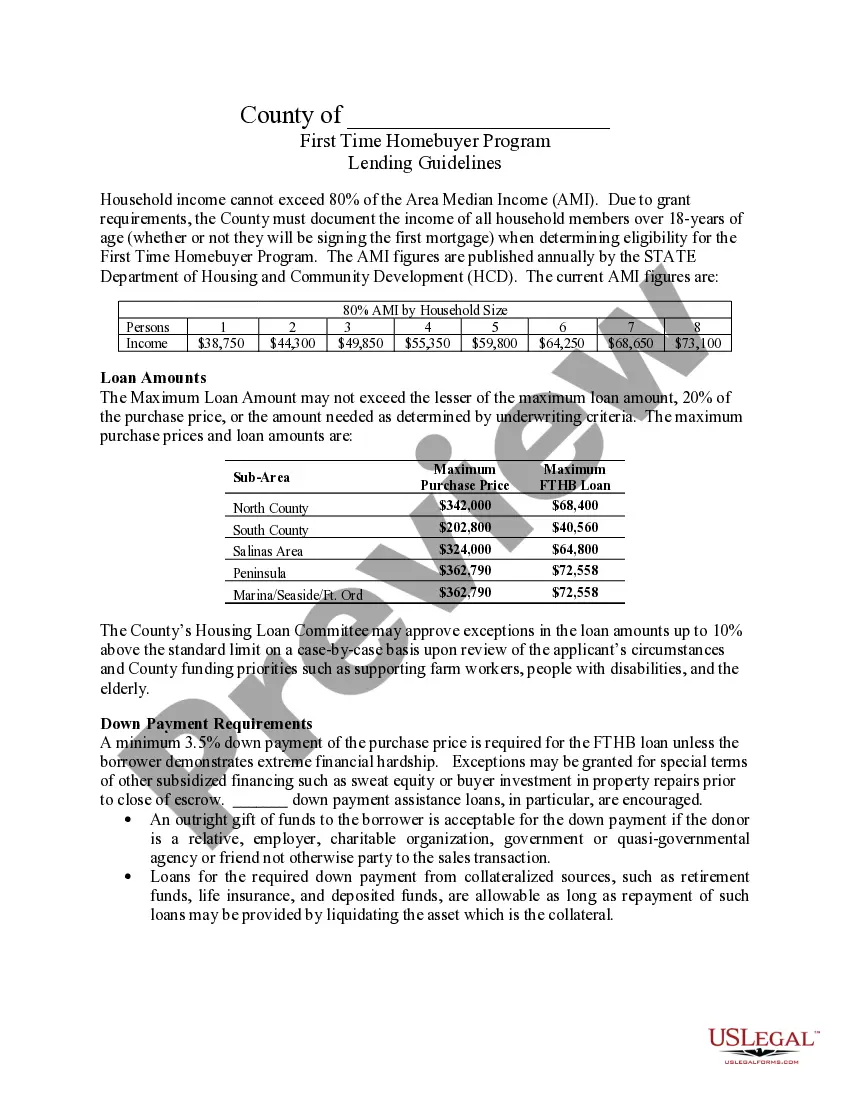

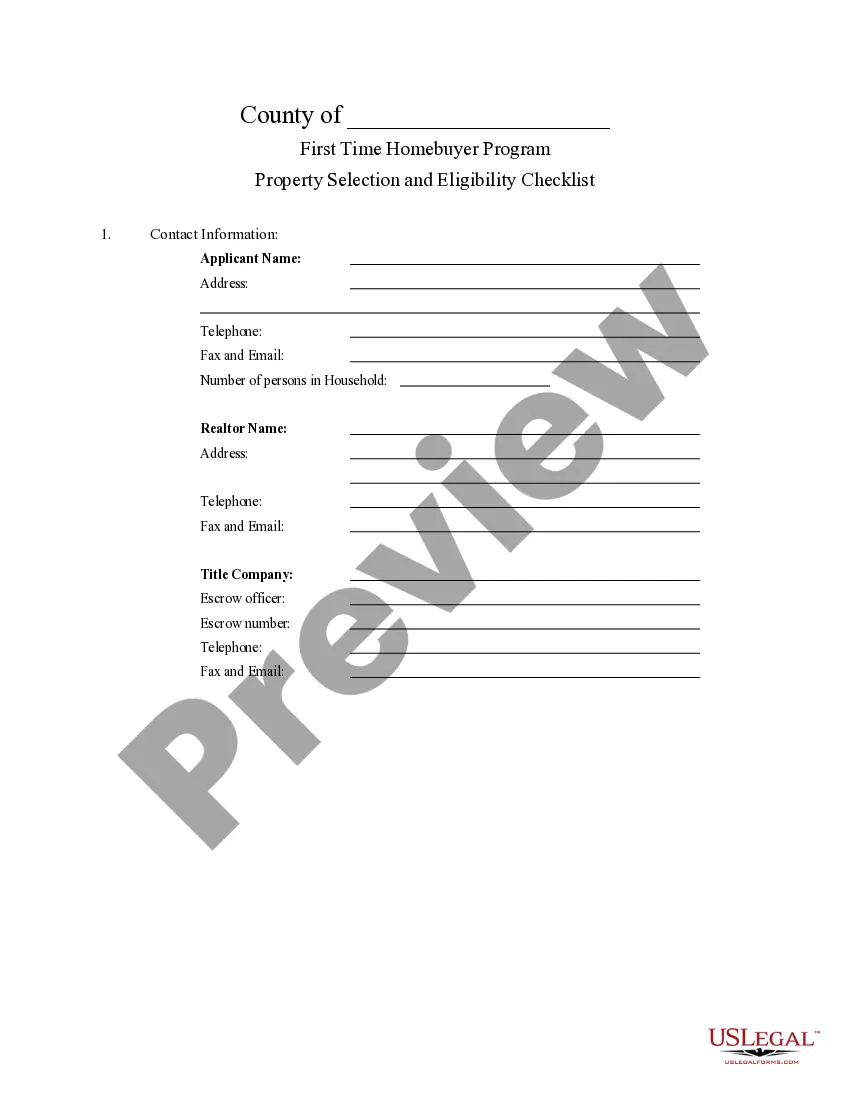

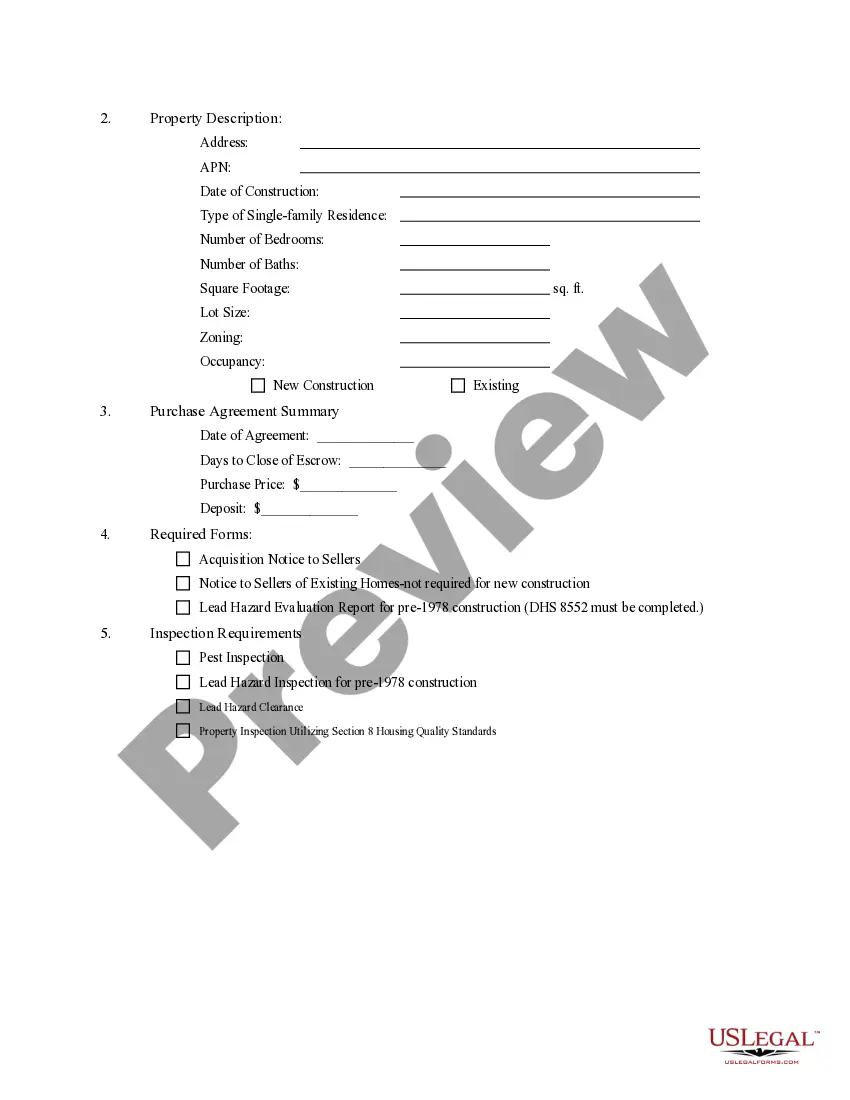

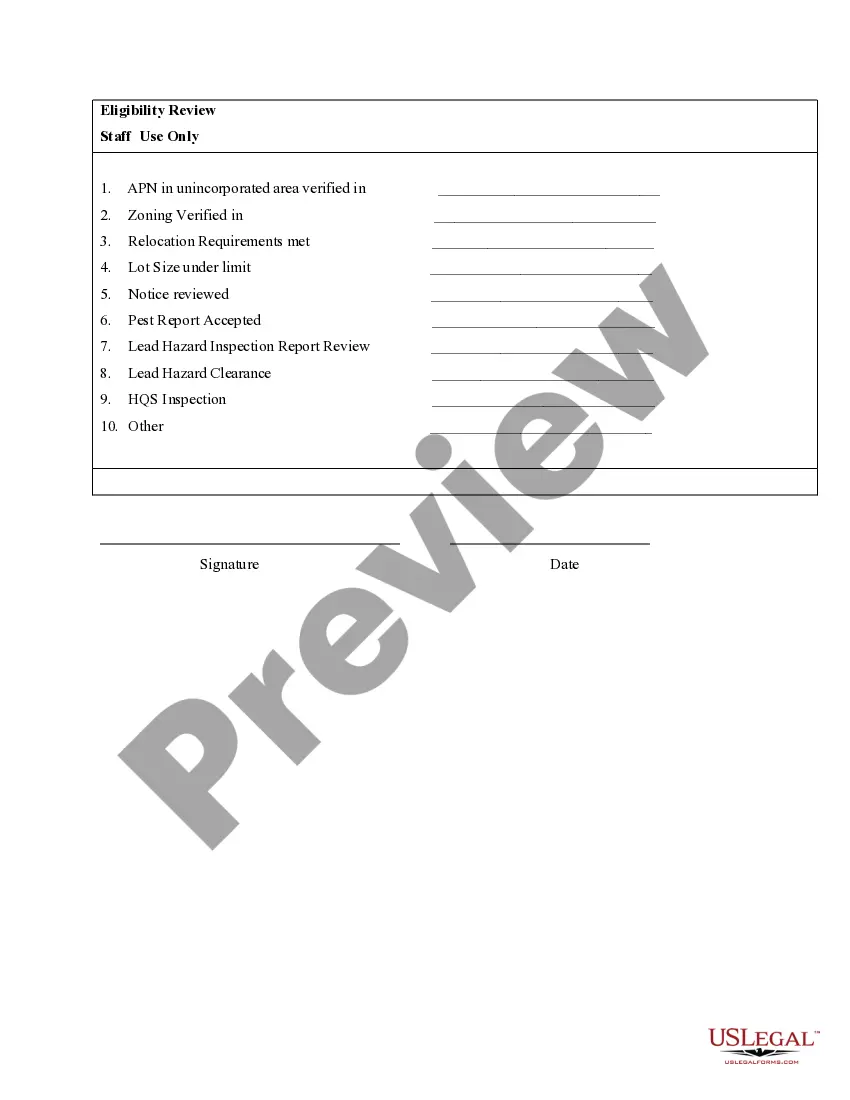

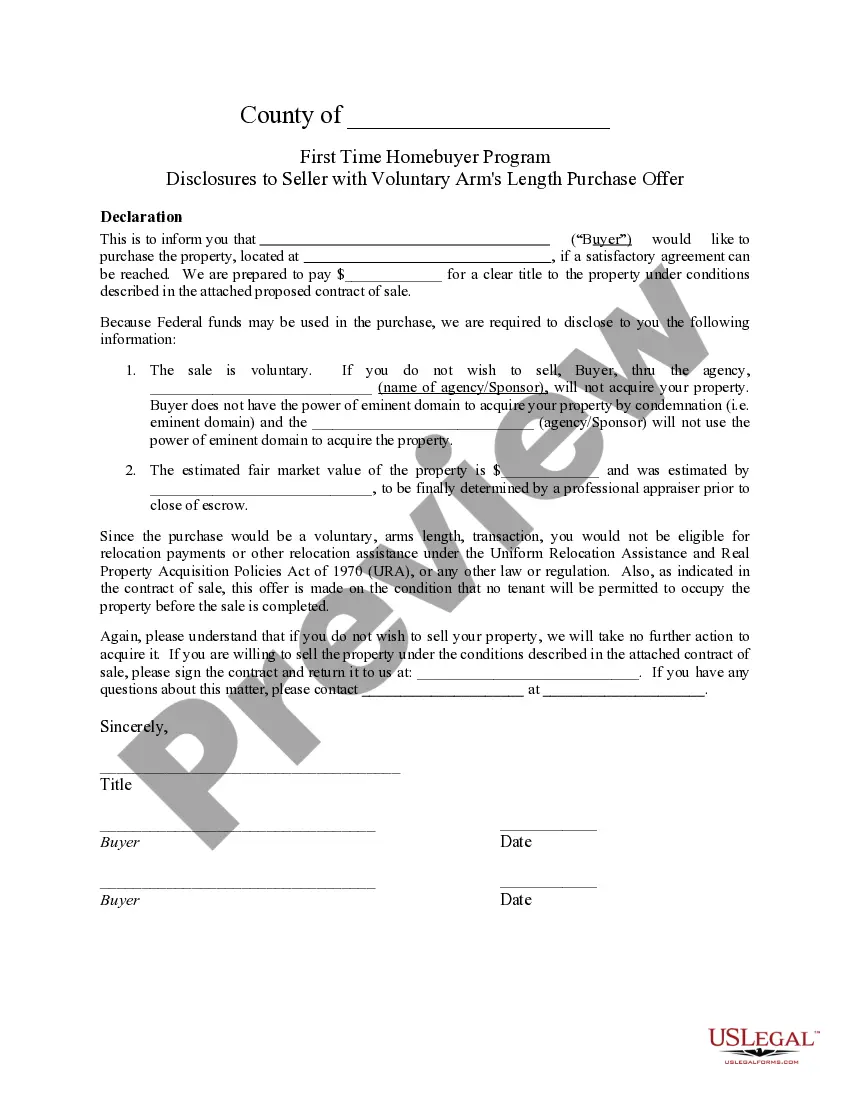

Sample First Time Homebuyer Program Realtor Packet: Includes Realtor Summary, Lending Guidelines, Loan Processing Summary, Property Selection and Eligibility Checklist, Disclosure to Seller with Voluntary Arm's Length, Purchase Offer and Seller's Occupancy Certification

Free preview