Anchorage Alaska Basic Life Estate Deed

Category:

State:

Multi-State

City:

Anchorage

Control #:

US-RE-D-LE-1931-1

Format:

Word;

Rich Text

Instant download

Description

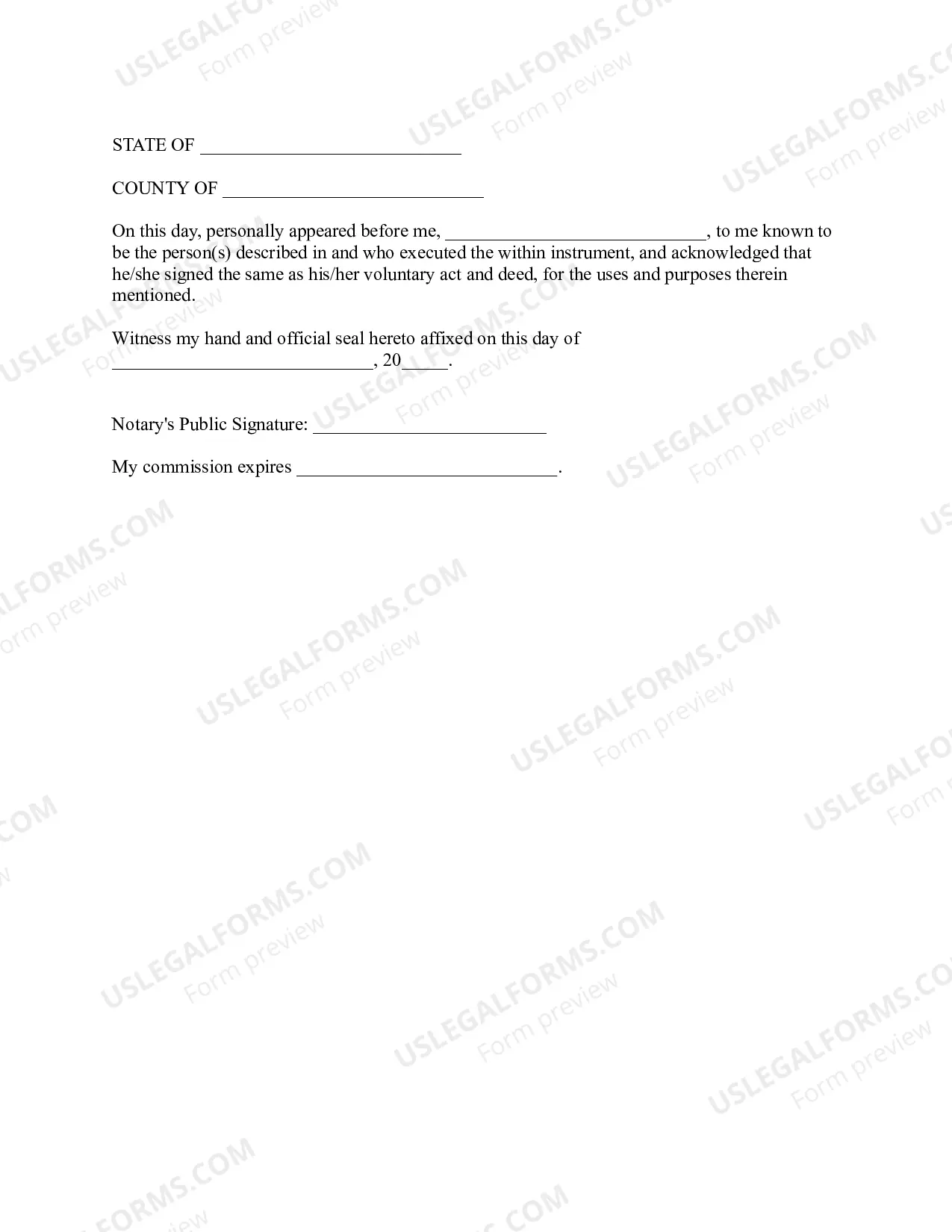

This is a Basic Life Estate Deed. A life estate has exclusive rights to the use and enjoyment of the land, including the right to live there, and all income rights from the property, as. long as the life estate owner has a pulse. The “remainder” interest of the. property is what remains at the death of the life tenant.

Free preview