Anchorage Alaska Basic Lease Guarantor Application

Category:

State:

Multi-State

City:

Anchorage

Control #:

US-RE-A-174589-1

Format:

Word;

Rich Text

Instant download

Description

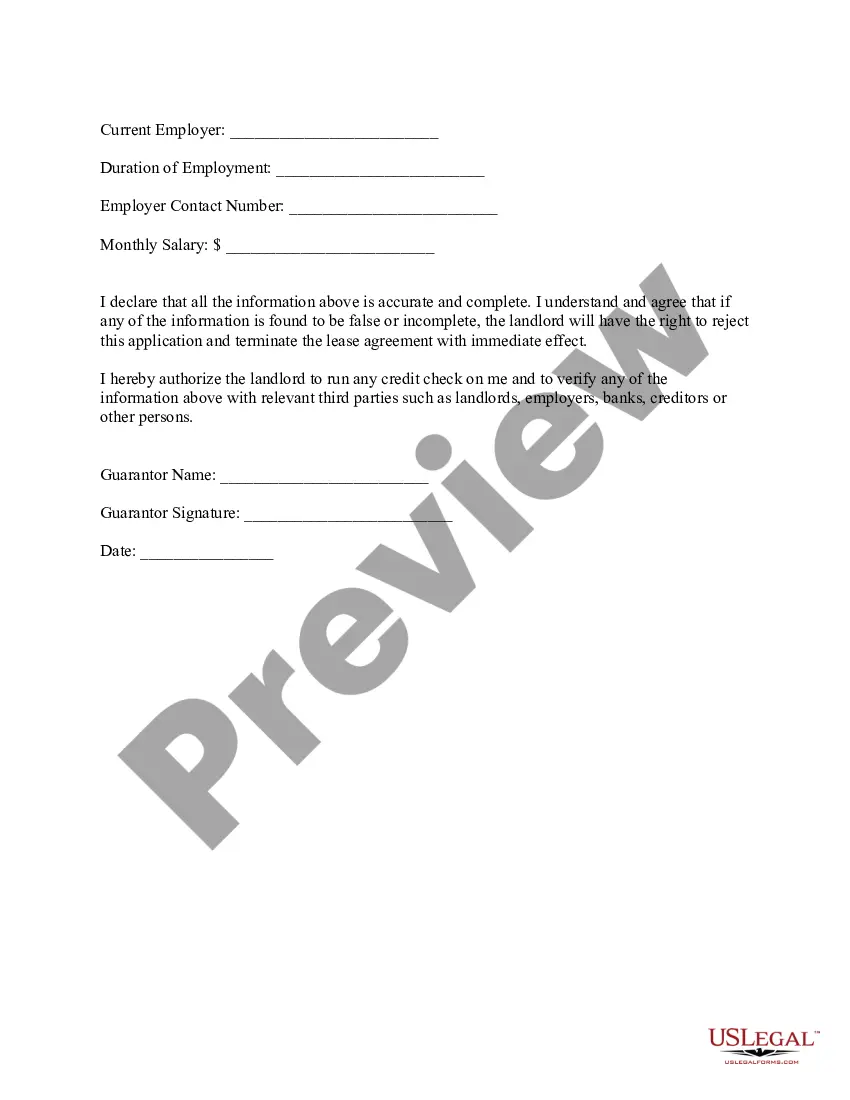

This is a sample Lease Guarantor Application. A guarantor cosigns the lease and assumes financial responsibility for an apartment in the event you can't afford to pay rent. This is a sample application for a guarantor.

Free preview