Queens New York Attorney Fee Contract - Contingency - 33-1/3%

Description

How to fill out Attorney Fee Contract - Contingency - 33-1/3%?

Are you aiming to swiftly create a legally-enforceable Queens Attorney Fee Contract - Contingency - 33-1/3% or perhaps any other document to handle your personal or business affairs? You have two choices: consult a specialist to draft a legitimate document for you or create it entirely on your own.

Fortunately, there's a third option - US Legal Forms. It will assist you in obtaining precisely written legal documents without exorbitant fees for legal services.

If the form isn’t what you were looking for, utilize the search bar in the header to restart your search.

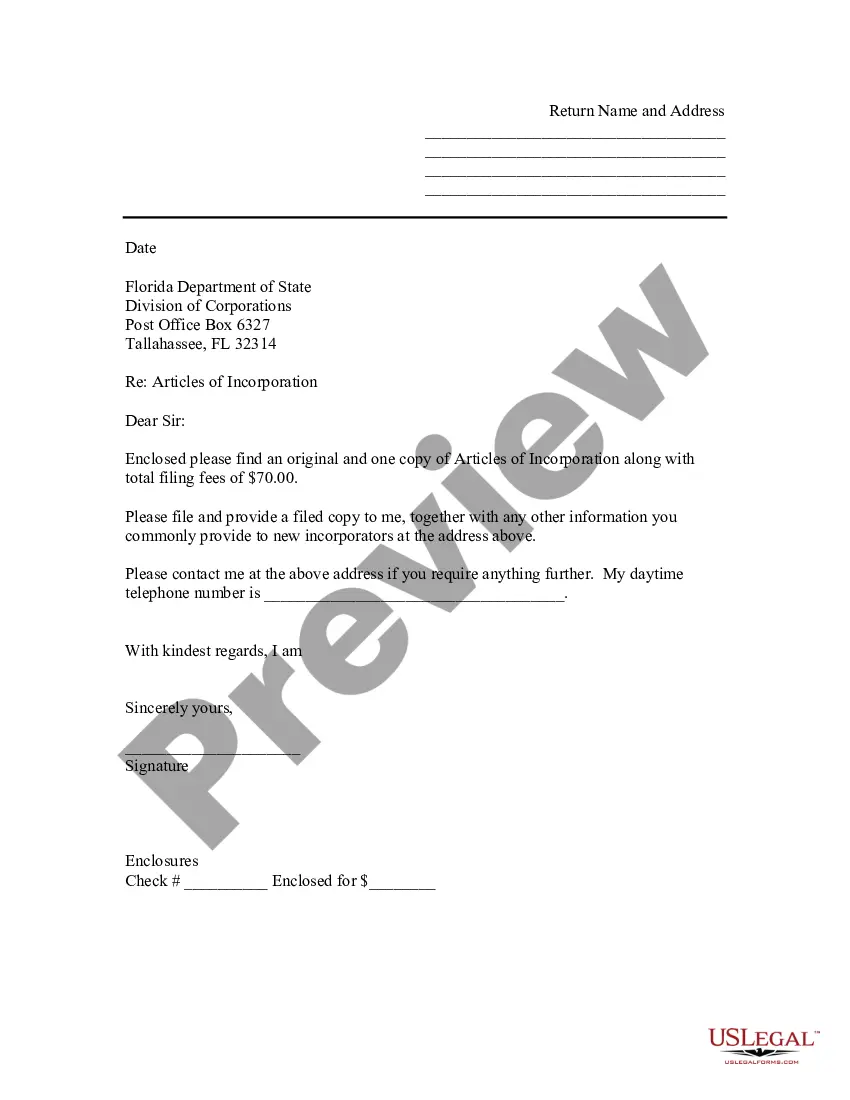

Select the plan that best fits your requirements and proceed to payment. Choose the format you want your form in and download it. Print it, fill it out, and sign where indicated. If you already have an account, you can simply Log In, locate the Queens Attorney Fee Contract - Contingency - 33-1/3% template, and download it. To re-download the form, just navigate to the My documents tab.

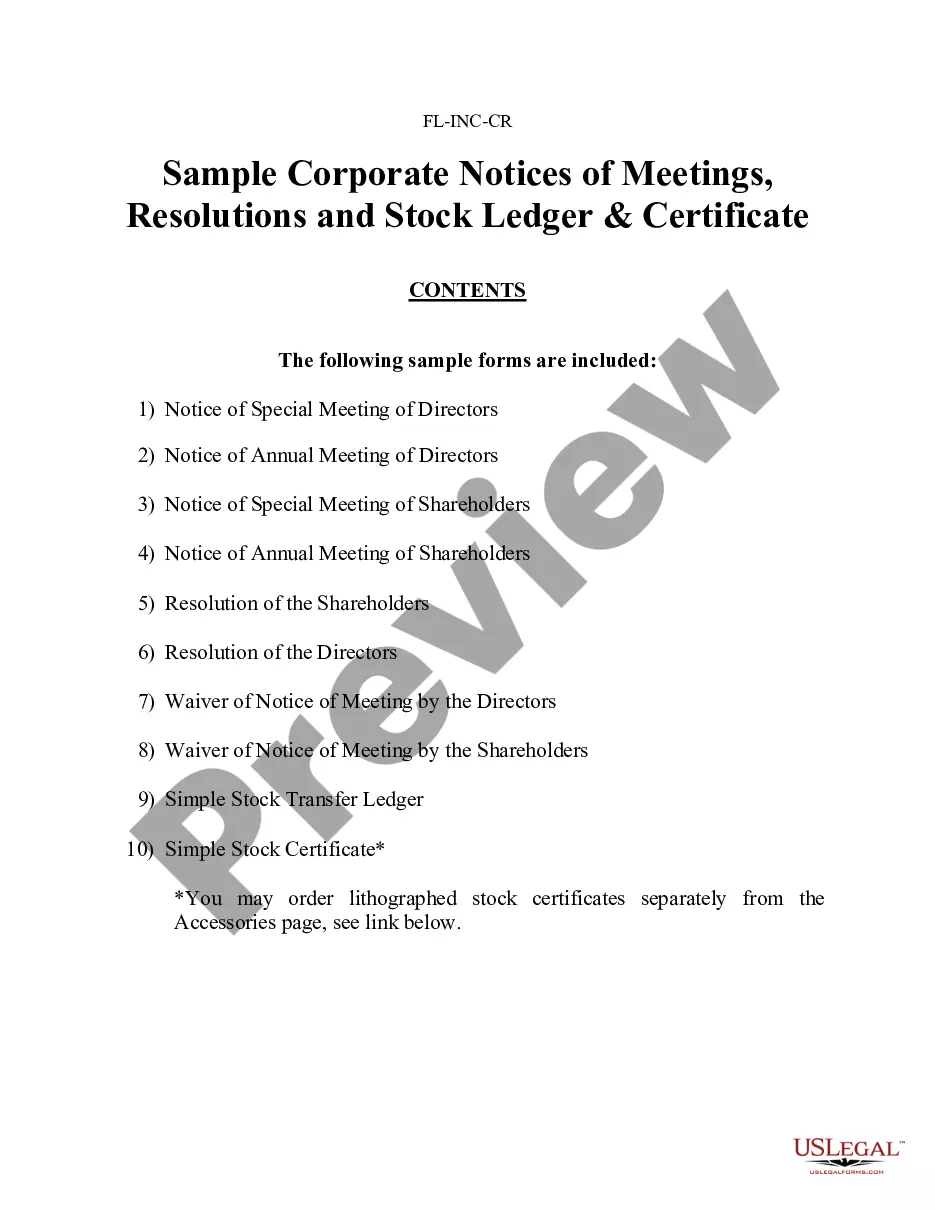

- US Legal Forms offers an extensive collection of over 85,000 state-compliant document templates, including Queens Attorney Fee Contract - Contingency - 33-1/3% and form packages.

- We supply documents for various purposes: from divorce filings to real estate document templates.

- We've been in the business for over 25 years and have established a solid reputation among our clients.

- Here's how you can join them and acquire the desired template effortlessly.

- First and foremost, ensure that the Queens Attorney Fee Contract - Contingency - 33-1/3% aligns with your state's or county's regulations.

- If the document has a description, be sure to confirm its applicability.

Form popularity

FAQ

US AICPA Solely for purposes of this rule, fees are not regarded as being contingent if fixed by courts or other public authorities, or, in tax matters, if determined based on the results of judicial proceedings or the findings of governmental agencies.

A contingent fee agreement is a legal agreement that allows you to hire a lawyer for your case without having to pay any out-of-pocket upfront fees unlike a retainer fee. The lawyer getting payment is contingent on you winning your case. If you do not win your case, you don't have to pay your contingency lawyer.

Victorian law does not currently allow you to bill your client a 'contingency fee'. This is where your fees are calculated based on how much money you might get for your client from a payout or a settlement.

Under a contingency fee arrangement, a fee is only charged if the litigation is successful. Historically, lawyers in Australia have been prohibited from entering into a costs agreement with a client which allows contingency fees to be charged.

Though contingent commissions are not as popular as they once were, they are legal to use and are considered ethical if brokers are upfront about the agreement they have with an insurer or reinsurer.

A contingent fee (also known as a contingency fee in the United States or a conditional fee in England and Wales) is any fee for services provided where the fee is payable only if there is a favourable result.

Victorian law does not currently allow you to bill your client a 'contingency fee'. This is where your fees are calculated based on how much money you might get for your client from a payout or a settlement.

A contingency fee agreement means that you will only pay us your fees if we achieve a pre-agreed result in your claim (usually this is the payment of a certain amount of damages). If we achieve this result, our fees are then paid as an agreed percentage of those damages.

Definition of contingency fee : a fee for services (as of a lawyer) paid upon successful completion of the services and usually calculated as a percentage of the gain realized for the client. called also contingent fee.

In Australia there has been a statutory prohibition preventing lawyers from charging a contingency fee on damages obtained by a successful party. An inherent conflict was recognised to exist between the lawyer's own interests and those of the client, which may affect the advice provided.