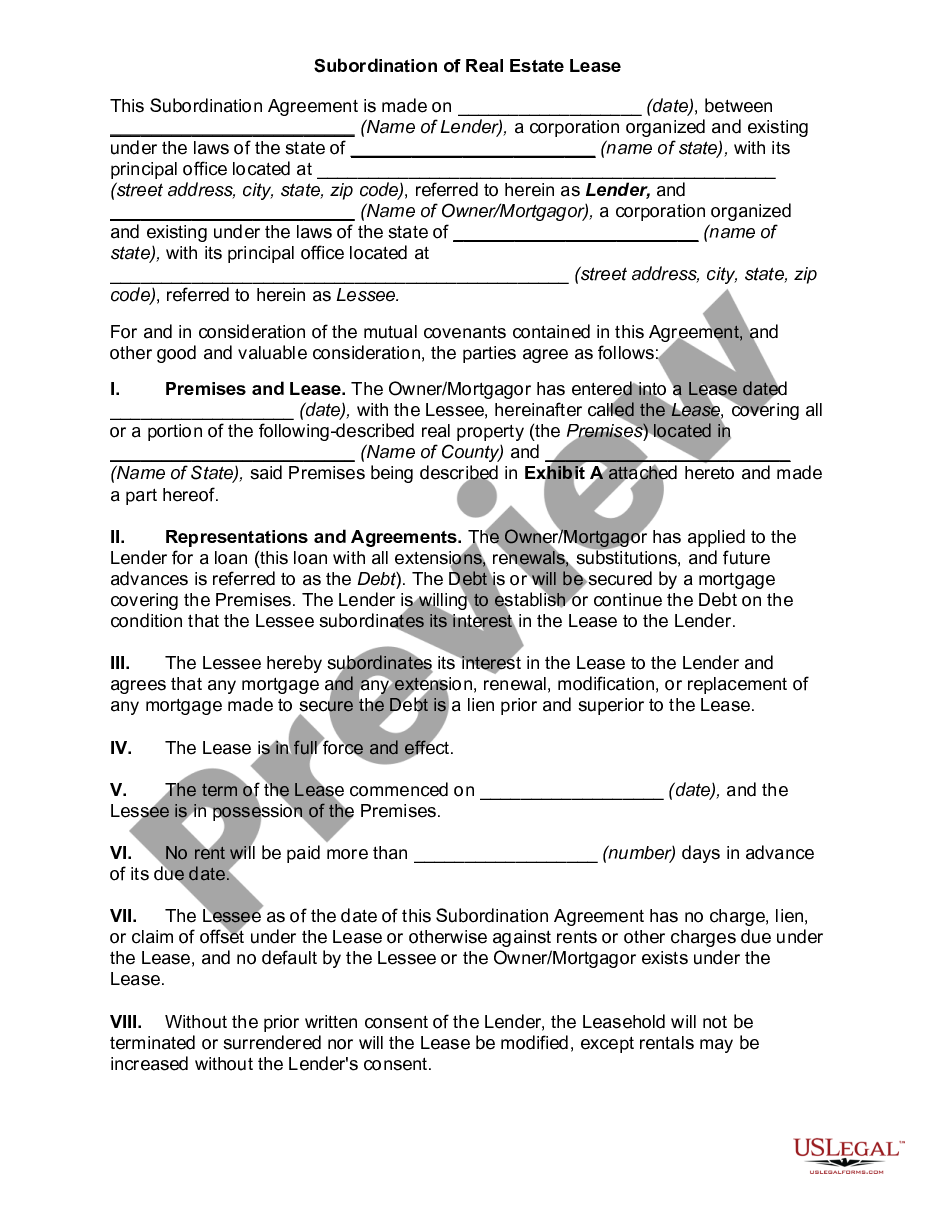

This office lease is subject and subordinate to all ground or underlying leases and to all mortgages which may affect the lease or the real property of which demised premises are a part and to all renewals, modifications, consolidations, replacements and extensions of any such underlying leases and mortgages. This clause shall be self-operative.

Dallas Texas Subordination Provision

Description

How to fill out Subordination Provision?

How long does it generally take you to draft a legal document.

Since each state has its own statutes and regulations for various life situations, finding a Dallas Subordination Provision that satisfies all local standards can be exhausting, and hiring a professional attorney can often be expensive.

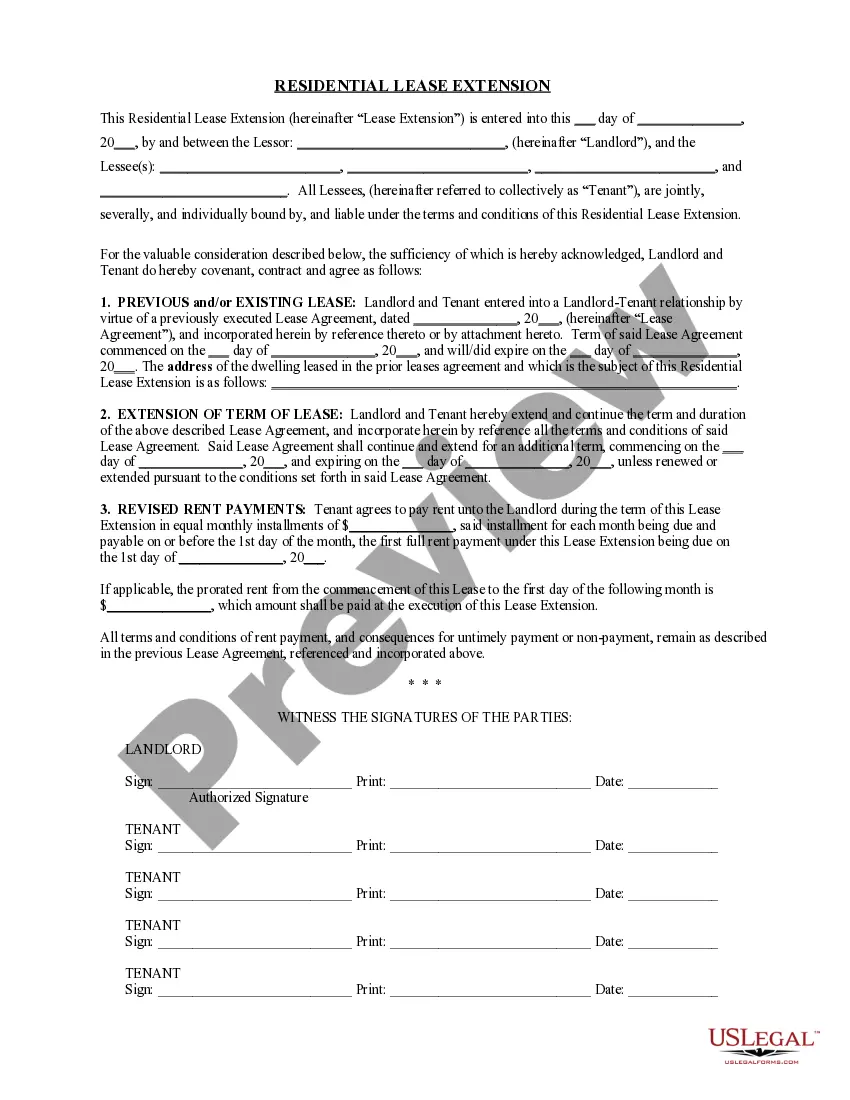

Many online platforms provide the most sought-after state-specific documents for download, but utilizing the US Legal Forms library is the most beneficial.

Give it a try!

- US Legal Forms is the most comprehensive online collection of templates, organized by states and application areas.

- Besides the Dallas Subordination Provision, you can access any specific form to manage your business or personal affairs, adhering to your local standards.

- Professionals validate all templates for their relevance, so you can be assured of preparing your documentation accurately.

- Using the service is quite straightforward.

- If you already possess an account on the platform and your subscription is active, you just need to Log In, select the desired form, and download it.

- You can retrieve the document in your profile at any time later on.

- If you are new to the site, however, you will need to take a few additional steps before obtaining your Dallas Subordination Provision.

- Review the content of the page you are visiting.

- Examine the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now when you are confident in your selected document.

- Select the subscription plan that best fits your needs.

- Register for an account on the platform or Log In to advance to payment methods.

- Complete payment via PayPal or with your credit card.

- Adjust the file format if necessary.

- Click Download to save the Dallas Subordination Provision.

- Print the document or use any preferred online editor to fill it out digitally.

- Regardless of how many times you wish to use the obtained document, you can find all the files you have ever saved in your profile by navigating to the My documents tab.

Form popularity

FAQ

Here's an example of how subordination clauses in mortgage notes work for a better understanding: John decides to buy a house. John's bank agrees to lend him the money to purchase a home on the condition that they take repayment priority. John's bank uses a subordination clause to secure its rights.

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

Subordination clauses are most commonly found in mortgage refinancing agreements. Consider a homeowner with a primary mortgage and a second mortgage. If the homeowner refinances his primary mortgage, this in effect means canceling the first mortgage and reissuing a new one.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

A subordination clause is a clause in an agreement which states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

A subordination clause is a lease provision whereby the tenant subordinates its possessory interest in the leased premises to a third-party lender, usually a bank (the rights of the tenant are thus subject to the rights of the lender).

Subordinate financing is debt financing that is ranked behind that held by secured lenders in terms of the order in which the debt is repaid. "Subordinate" financing implies that the debt ranks behind the first secured lender, and means that the secured lenders will be paid back before subordinate debt holders.