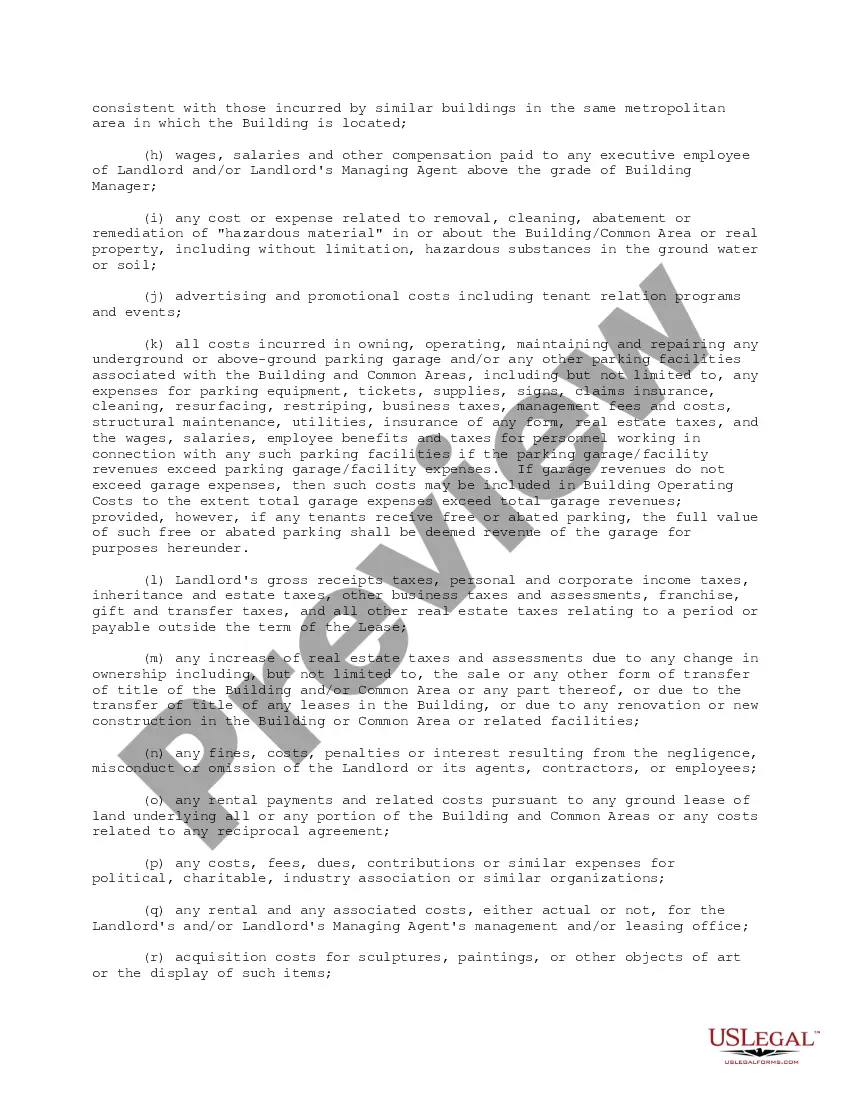

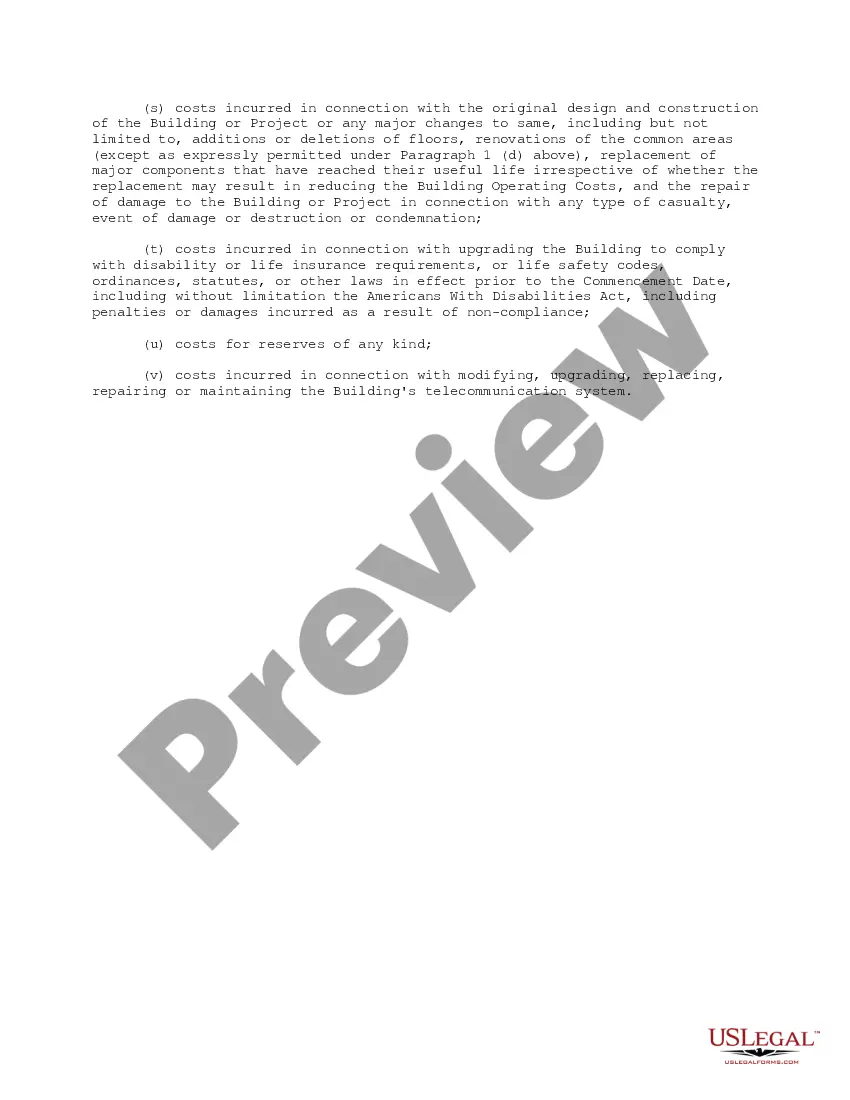

This office lease form is a supplement regarding the building operating expenses which are escalated to the tenant. This form lists items to be excluded from the calculation of building operating costs.

Suffolk New York Building Operating Cost Addendum

Description

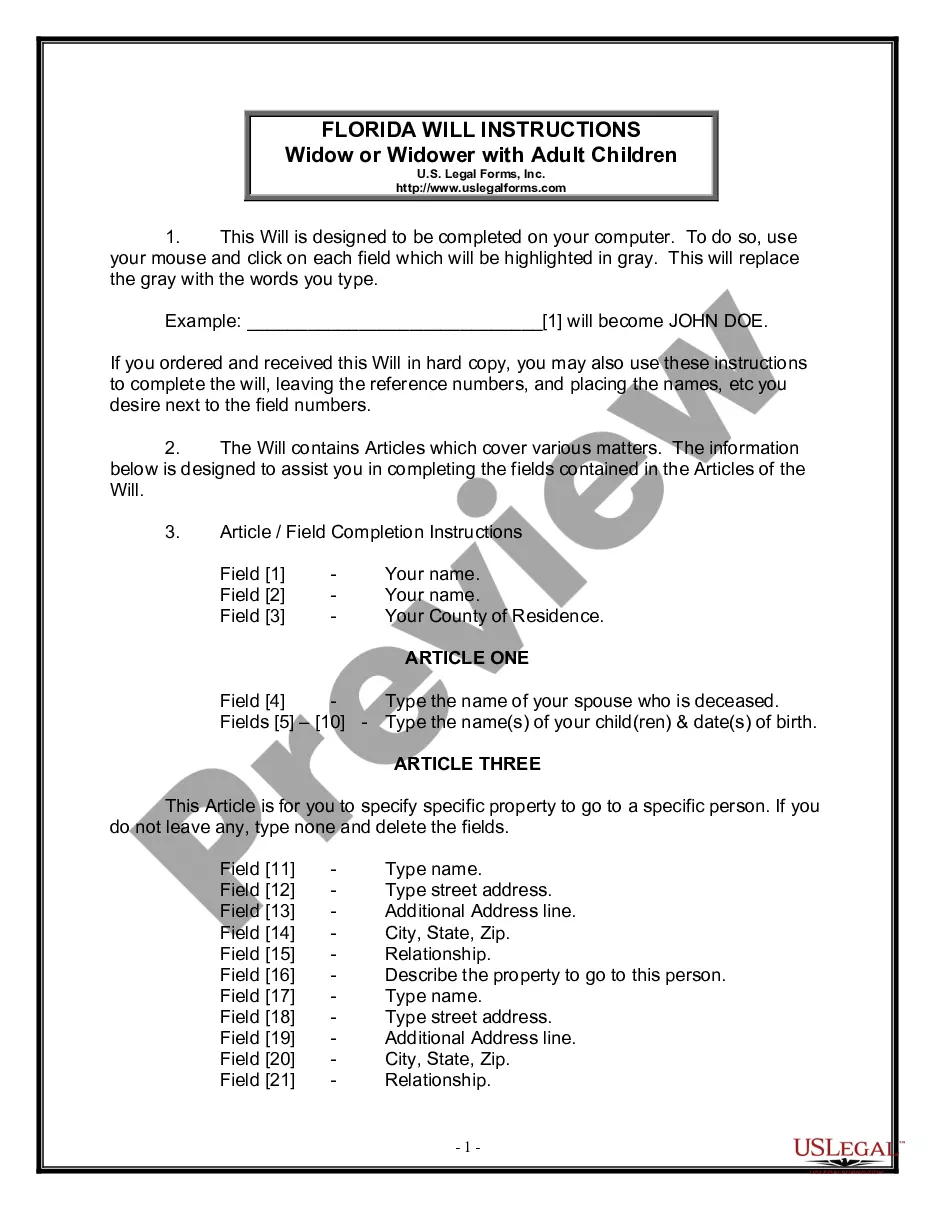

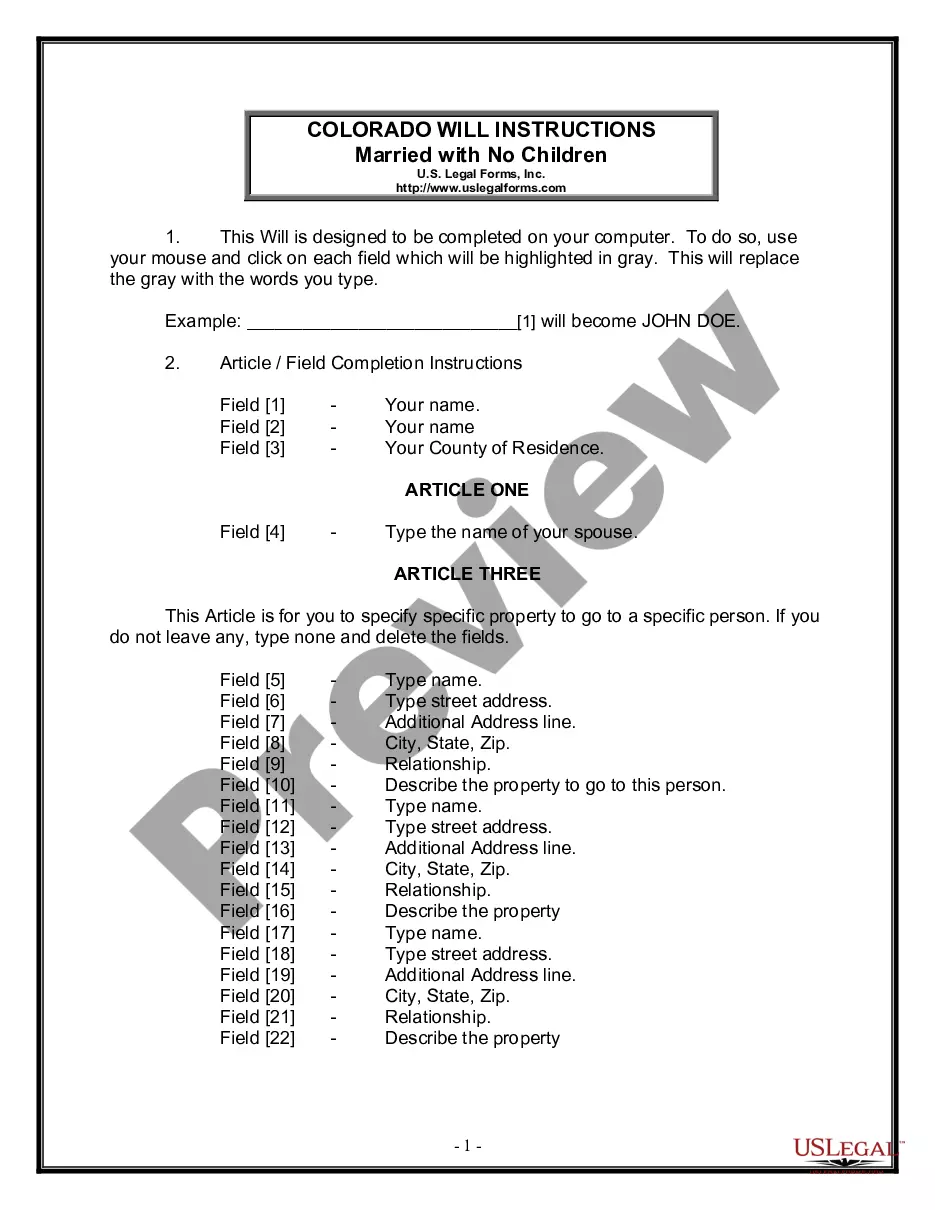

How to fill out Suffolk New York Building Operating Cost Addendum?

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Suffolk Building Operating Cost Addendum is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Suffolk Building Operating Cost Addendum. Follow the instructions below:

- Make certain the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Building Operating Cost Addendum in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Frequently referred to as OPEX, operating expenses are all of the costs that go into running a building. These include utilities, repairs and maintenance, exterior work, insurance, management, and property tax.

As such, a gross lease rental rate is inclusive of rent and the first year's operating expenses. Tenants, however, are still responsible for in-suite electricity costs. As the tenant, you will still be responsible for your proportionate share of increases over the base year amount.

The main advantage of leasing a business facility is that your initial outlay of cash to gain the use of an asset is generally less for leasing than it is for purchasing.

7. Gross Leases Require You to Only Pay for Your Space. Another thing that tenants often like about gross leases is that they are only responsible for paying for utilities, maintenance and other costs associated with the space that they are occupying. Costs for the rest of the building are covered by the landlord.

An operating expense is an expense a business incurs through its normal business operations. Often abbreviated as OPEX, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development.

A common method for determining percentage rent is to use a natural breakpoint. A natural breakpoint is calculated by dividing the base rent by an agreed percentage. The percentage rent payable by a tenant will then be equal to this percentage multiplied by the amount by which gross sales exceeds the breakpoint.

If the lease agreement uses an artificial break-even point, the tenant and landlord simply agree on a flat amount, above which a percentage of any income will be given to the landlord as additional rent. For example, they might agree any amount of gross sales over $500,000 is subject to percentage rent.

A triple net lease (triple-net or NNN) is a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. These expenses are in addition to the cost of rent and utilities.

With a modified gross lease, the tenant takes over expenses directly related to his or her unit, including unit maintenance and repairs, utilities, and janitorial costs, while the owner/landlord continues to pay for the other operating expenses.

A net lease is a real estate lease in which a tenant pays one or more additional expenses. In a single net lease, the tenant pays a lower base rent in addition to property taxes. Double net leases include property taxes and insurance premiums, in addition to the base rent.