Fairfax Virginia Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

How to fill out Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

Preparing documents for personal or business requirements is always a significant obligation.

When forming an agreement, a public service application, or a power of attorney, it is crucial to take into account all federal and state statutes relevant to the particular area.

Nonetheless, small counties and even municipalities also have legislative regulations that you must consider.

To find the document that meets your requirements, employ the search tab in the header of the page.

- All these factors contribute to the anxiety and time required to produce a Fairfax Deed (Including Acceptance of Community Property with Right of Survivorship) without expert help.

- It's simple to prevent unnecessary expenses on lawyers drafting your documentation and create a legally enforceable Fairfax Deed (Including Acceptance of Community Property with Right of Survivorship) independently, using the US Legal Forms online repository.

- It is the largest online compilation of state-specific legal templates that are professionally verified, ensuring their legitimacy when selecting a sample for your county.

- Previously registered users only need to Log In to their accounts to retrieve the necessary document.

- If you do not yet have a subscription, follow the step-by-step instructions below to obtain the Fairfax Deed (Including Acceptance of Community Property with Right of Survivorship).

- Review the page you’ve opened and verify whether it contains the sample you need.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

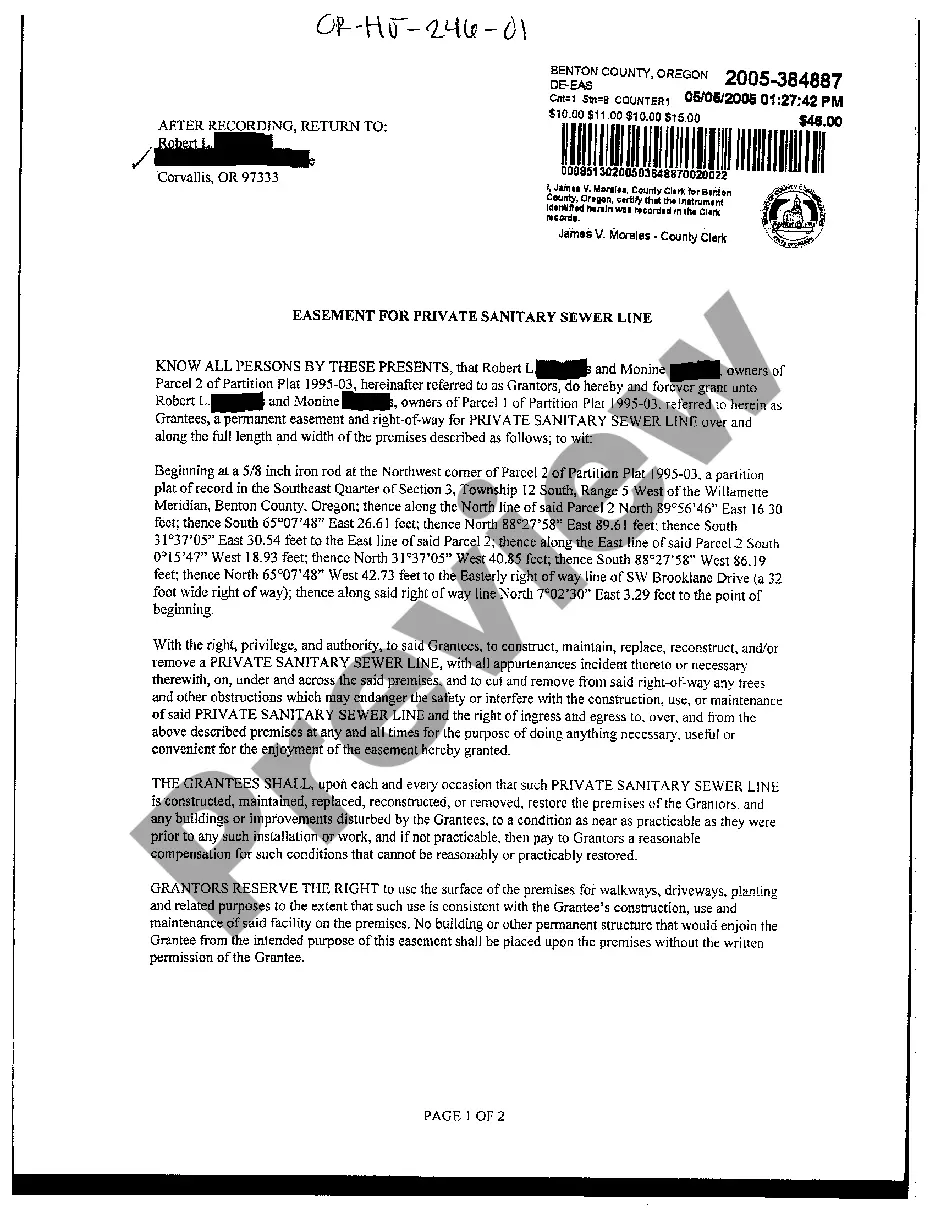

Many couples own homes as joint tenants with right of survivorship, perhaps because community property with right of survivorship did not become an official option in California until July 1, 2001. To change the title, you must record a new California grant deed or quitclaim deed at your county recorder's office.

The right of survivorship is a right granted to joint property owners that ensures the transfer of one owner's stake to the remaining property owner(s) in the case of his or her death.

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.

Property owned in joint tenancy automatically passes to the surviving owners when one owner dies. No probate is necessary. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts or other valuable property together.

Joint tenants with rights of survivorship (JTWROS) is ownership by two or more individuals who have equal rights to the property while alive and survivorship rights at death. Rights of survivorship means that when one owner dies the entire ownership interest transfers to the surviving owners.

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.

The main difference between joint tenants vs community property with right of survivorship lies in how the property is taxed after the death of a spouse. In joint tenant agreements, the proceeds from the sale of a property (after the death of a spouse) would be subject to the capital gains tax.

With community property, the step-up basis applies to the whole property; with joint tenancy, only the deceased tenant's half receives the step-up basis. This can have serious tax implications if and when the surviving tenant sells the property.

Joint ownership, also known as joint tenancy with rights of survivorship (JTWROS), specifies that tenants hold equal ownership rights. This holds true even if only one person paid for the property anyone listed on the deed has ownership of the complete property.

If you live in a community property state such as California, you and your spouse (or registered domestic partner) can likely avoid probate by taking title to property as community property with Right of Survivorship.