Maricopa Arizona Correction to Mistakes in Prior Conveyance

Description

How to fill out Correction To Mistakes In Prior Conveyance?

Generating documents, such as Maricopa Correction to Errors in Previous Transactions, to handle your legal issues is a difficult and time-intensive endeavor.

Many circumstances necessitate a lawyer’s involvement, which also renders this task costly.

Nevertheless, you might take control of your legal matters and manage them independently.

The onboarding process for new clients is just as straightforward! Here’s what you need to do before obtaining Maricopa Correction to Errors in Previous Transactions: Ensure that your document complies with your state/county since the regulations for crafting legal papers can differ from one state to another. Discover more about the document by previewing it or reviewing a brief description. If the Maricopa Correction to Errors in Previous Transactions isn’t what you were looking for, then utilize the header to find an alternative. Log In or create an account to start using our website and download the document. Everything looks satisfactory on your part? Click the Buy now button and select the subscription option. Choose the payment gateway and enter your payment details. Your document is ready. You can proceed with downloading it. Finding and acquiring the correct document with US Legal Forms is simple. Thousands of companies and individuals are already enjoying the benefits of our extensive library. Subscribe now if you wish to discover what additional advantages you can obtain with US Legal Forms!

- US Legal Forms is here to assist.

- Our site boasts over 85,000 legal documents designed for various situations and life circumstances.

- We guarantee each document adheres to the laws of every state, so you need not worry about any potential legal complications related to compliance.

- If you are already familiar with our services and possess a subscription with US, you understand how simple it is to access the Maricopa Correction to Errors in Previous Transactions template.

- Simply Log In to your account, fetch the document, and customize it to your needs.

- Have you misplaced your document? No need to be concerned. You can retrieve it in the My documents section in your account - on desktop or mobile.

Form popularity

FAQ

After the package receive final approval, the closer will notifies the escrow officer that loan proceeds are available. From the time of your signing, it will usually take 24-48 hours for the lender to fund the loan.

How are my Property Taxes computed? The Assessed Value divided by 100, times the tax rate (set in August of each year) determines property tax billed in September. The County Treasurer bills, collects and distributes the property taxes.

Many people have some confusion on how are property taxes are calculated. Arizona property taxes on owner-occupied residences are levied based on the Assessed Value, not current market value. In Maricopa County the assessment ratio for owner-occupied residential property is 10 percent of Full Cash (market) Value.

An Arizona quitclaim deed (sometimes called a quitclaim deed or a quit claim deed) is used to transfer Arizona real estate with no warranty of title. The person creating the deed (grantor) does not guarantee that he or she owns the property or has the right to convey it to the new owner (grantee).

As the buyer of a property, you are the one responsible for recording the deed. Deeds for real estate need to be filed directly with the municipality or county where the property is located. The documents must be signed, witnessed, and notarized in order to be registered.

The recorder makes a digital image of the deed before returning it to you. It then becomes a matter of public record. After 10 to 15 days, the information from your deed will be searchable using the recorder's online database.

The Maricopa County property tax rate is 0.610% of the assessed home value.

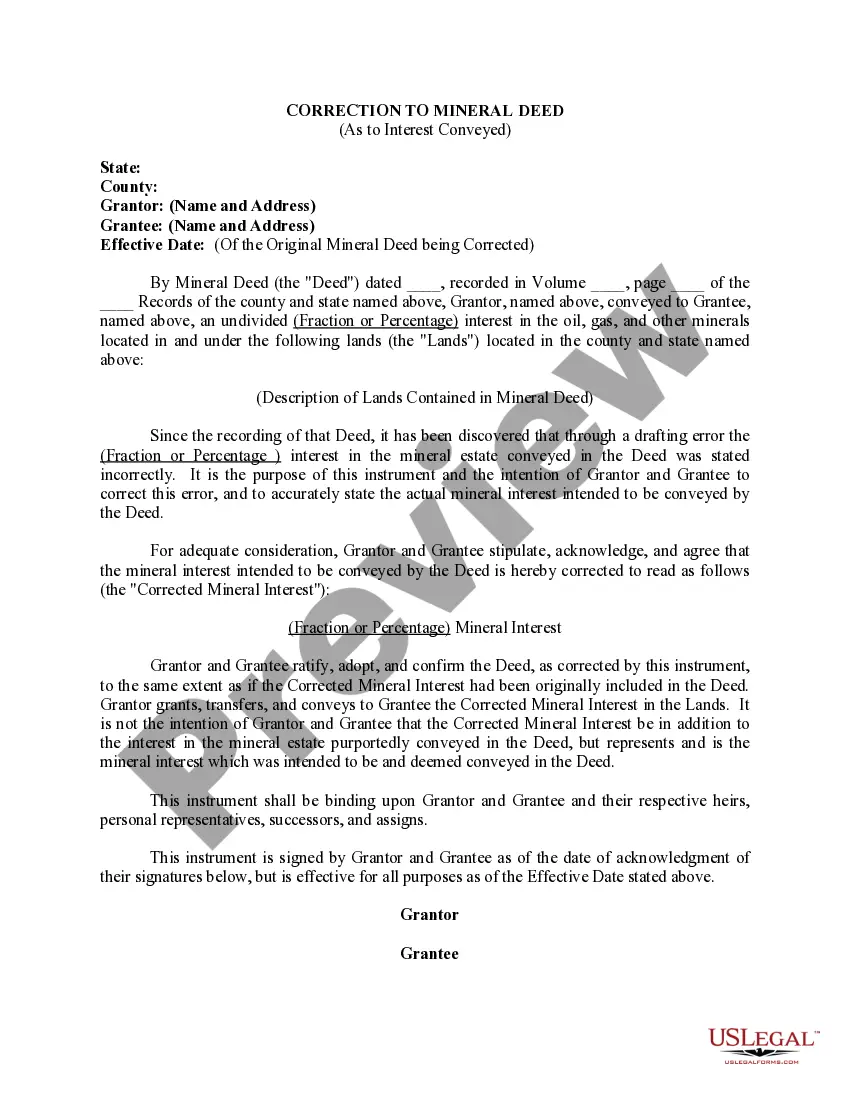

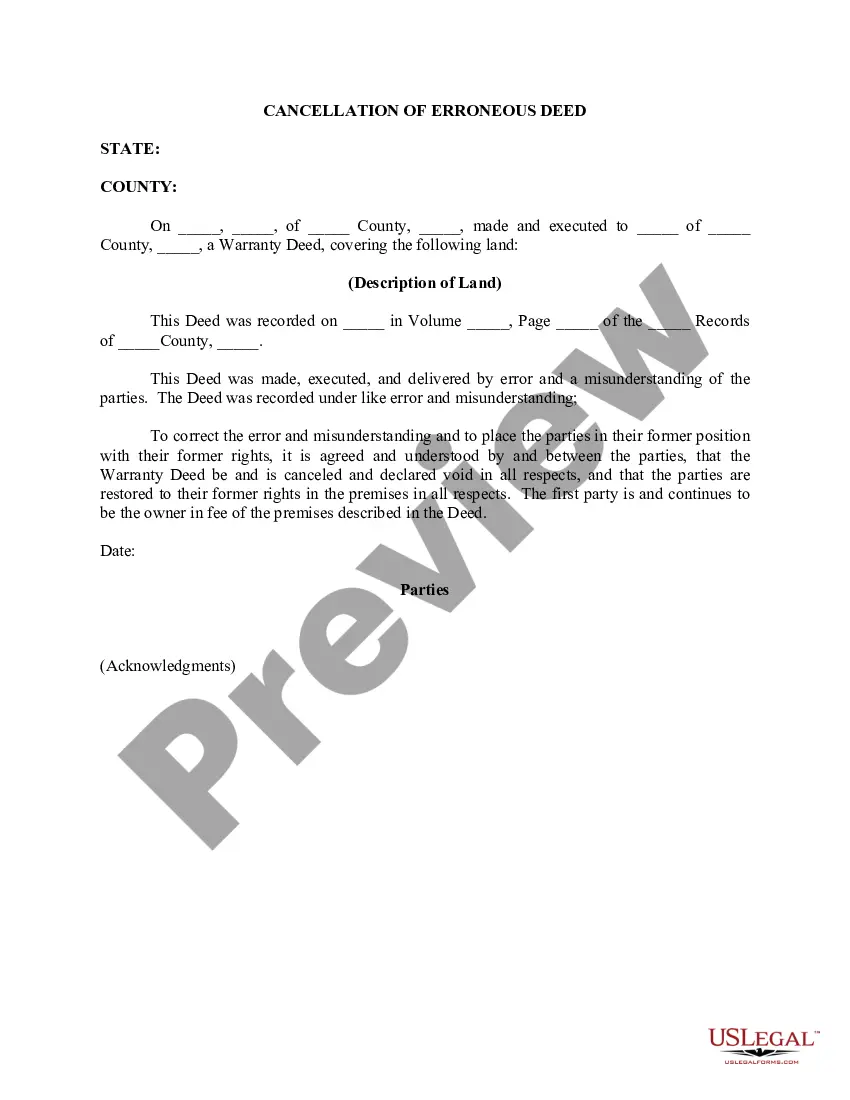

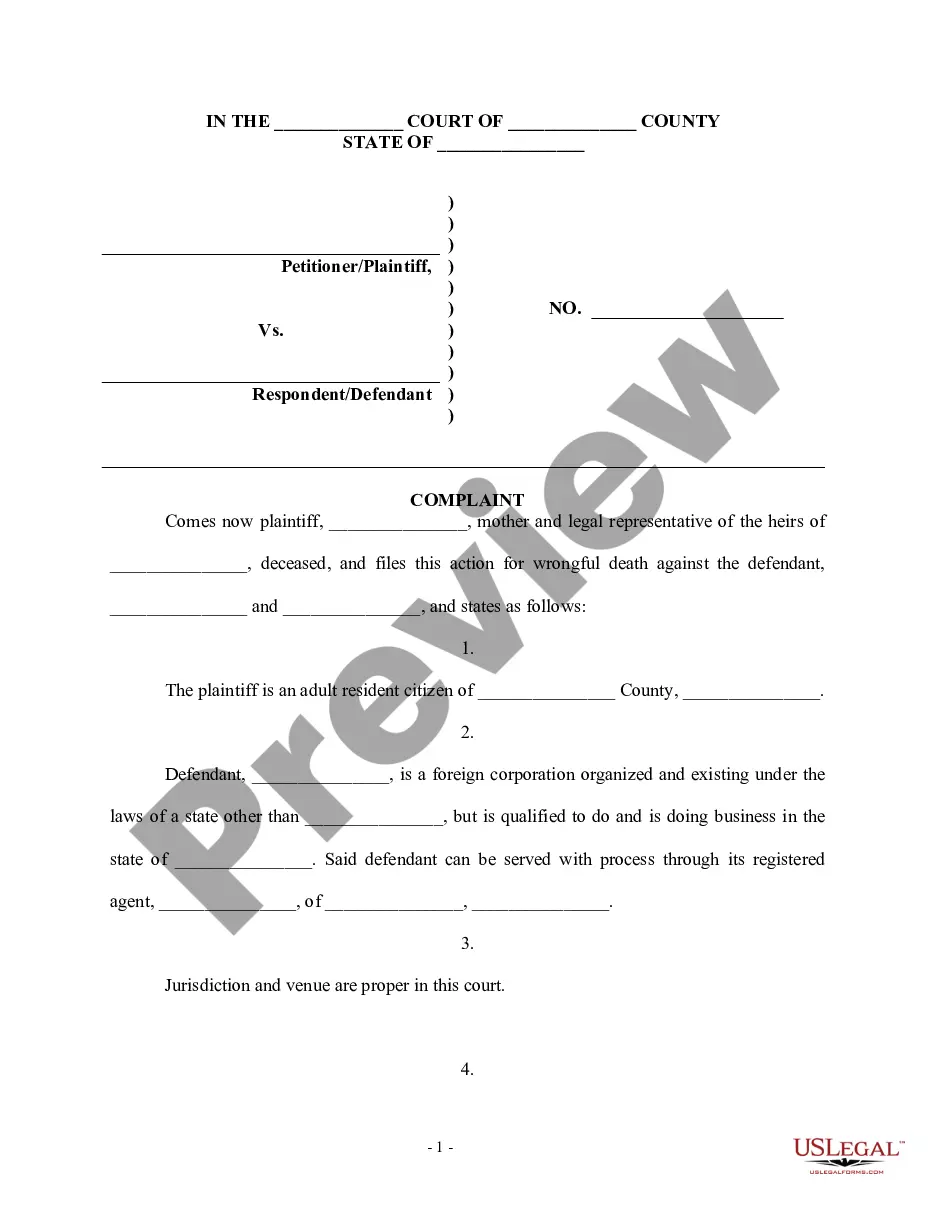

What can you do to fix it? One option may be filing a corrective deed. A corrective deed is an instrument used to correct a small error in a deed that has been recorded at an earlier date. Corrections can only be made to non-material errors, causing no actual change in the substance of the deed.

Arizona Revised Statutes § 33-401 lays out the formal requirements for conveyance of property. All transfers of property in Arizona must be in writing. The deed must be signed by the grantor and notarized by an authority granted those duties in the state.

The fee to record a document in County Recorder offices throughout Arizona will become $30.00 for each complete document. Documents received on or after July 1st will be returned if accompanied by insufficient payment. Postmarked recordings submitted without the $30.00 flat recording fee will be rejected.