Palm Beach Florida Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

Description

How to fill out Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

Generating documentation for business or personal obligations is consistently a significant duty.

When formulating a contract, a civic service application, or a power of attorney, it's essential to consider all federal and state regulations of the specific locality.

Nevertheless, smaller counties and even municipalities also have legislative protocols that you must factor in.

The remarkable aspect of the US Legal Forms library is that all the documents you've ever procured are never lost - you can reach them in your account under the My documents tab anytime. Enroll in the platform and effortlessly acquire verified legal templates for any situation with just a few clicks!

- All these factors contribute to the stress and laboriousness of drafting the Palm Beach Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) without expert help.

- It's simple to prevent unnecessary expenses on attorneys drafting your documents and create a legally acceptable Palm Beach Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) by yourself, utilizing the US Legal Forms online repository.

- It is the largest online catalog of jurisdiction-specific legal documentation that is professionally verified, so you can be confident in their accuracy when selecting a specimen for your region.

- Previously registered users only need to Log In to their accounts to obtain the needed document.

- If you haven't subscribed yet, follow the step-by-step instructions below to acquire the Palm Beach Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool).

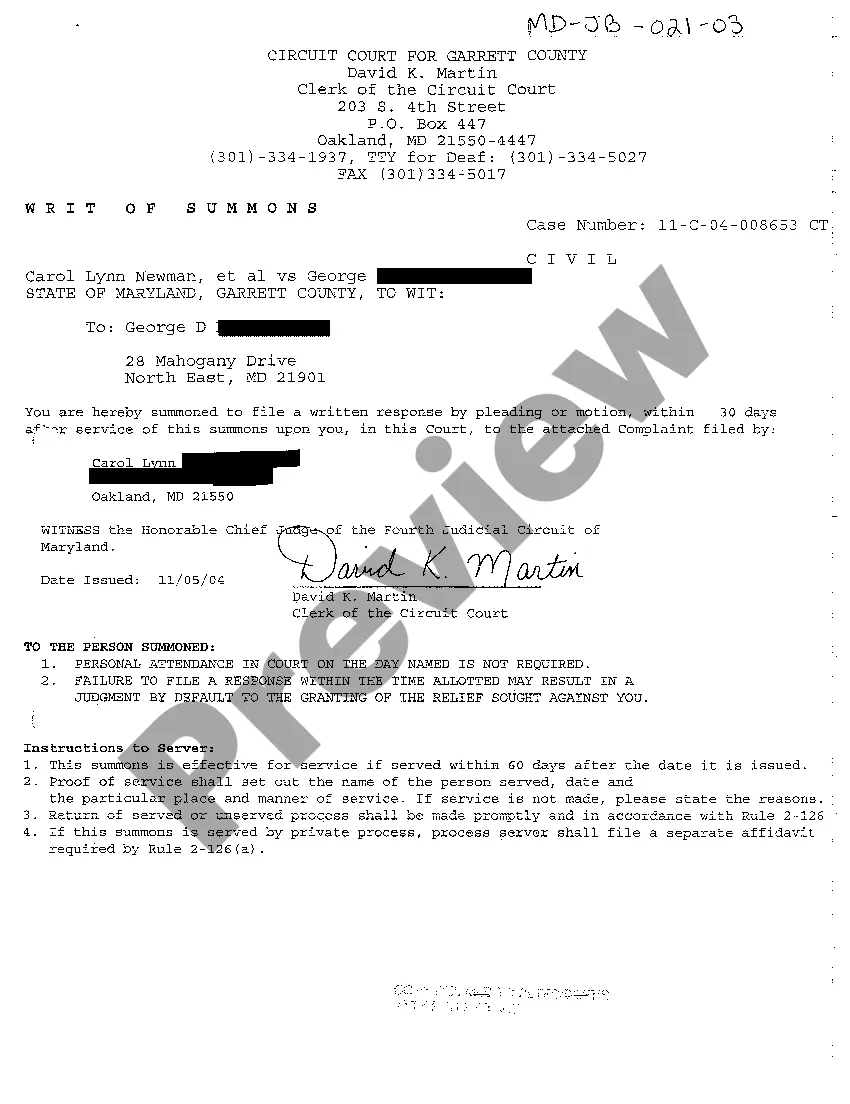

- Review the page you’ve opened and verify if it contains the sample you are looking for.

- To accomplish this, utilize the form description and preview if these features are offered.

Form popularity

FAQ

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.