Cook Illinois Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) is a legal document that establishes the transfer of overriding royalty interest to Cook Illinois, a party that does not actively participate in the production of oil, gas, or mineral reserves. This particular assignment focuses on a single lease and reserves the right to pool. "Assignment of Overriding Royalty Interest" refers to the transfer of a percentage of proceeds from the production of oil, gas, or minerals to a third party, known as the assignee or Cook Illinois in this case. This assignment is specifically for a non-producing lease, meaning that Cook Illinois does not bear the risk or costs of drilling, exploration, or extraction activities. Instead, they will receive a share of the revenue generated by the production. The assignment pertains to a single lease, which indicates that the overriding royalty interest applies to a specific lease agreement between the lessor and the lessee. Cook Illinois, as the assignee, will benefit from the production of the designated lease. This arrangement typically grants Cook Illinois the right to receive a fixed percentage of the production revenues. Furthermore, this assignment reserves the right to pool. Pooling refers to the consolidation or combining of multiple leases or tracts of land to enhance efficiency and profitability in drilling operations. By reserving this right, Cook Illinois retains the option to integrate the subject lease with other leases or tracts for increased operational performance. Types of Cook Illinois Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) may include variations based on the percentage of overriding royalty interest assigned, specific lease agreements, or the jurisdiction in which the lease is located. For example, there might be assignments with different percentages of overriding royalty interest, such as 1%, 2%, or 5%. Each assignment could pertain to a distinct lease agreement in various regions or states.

Cook Illinois Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

Description

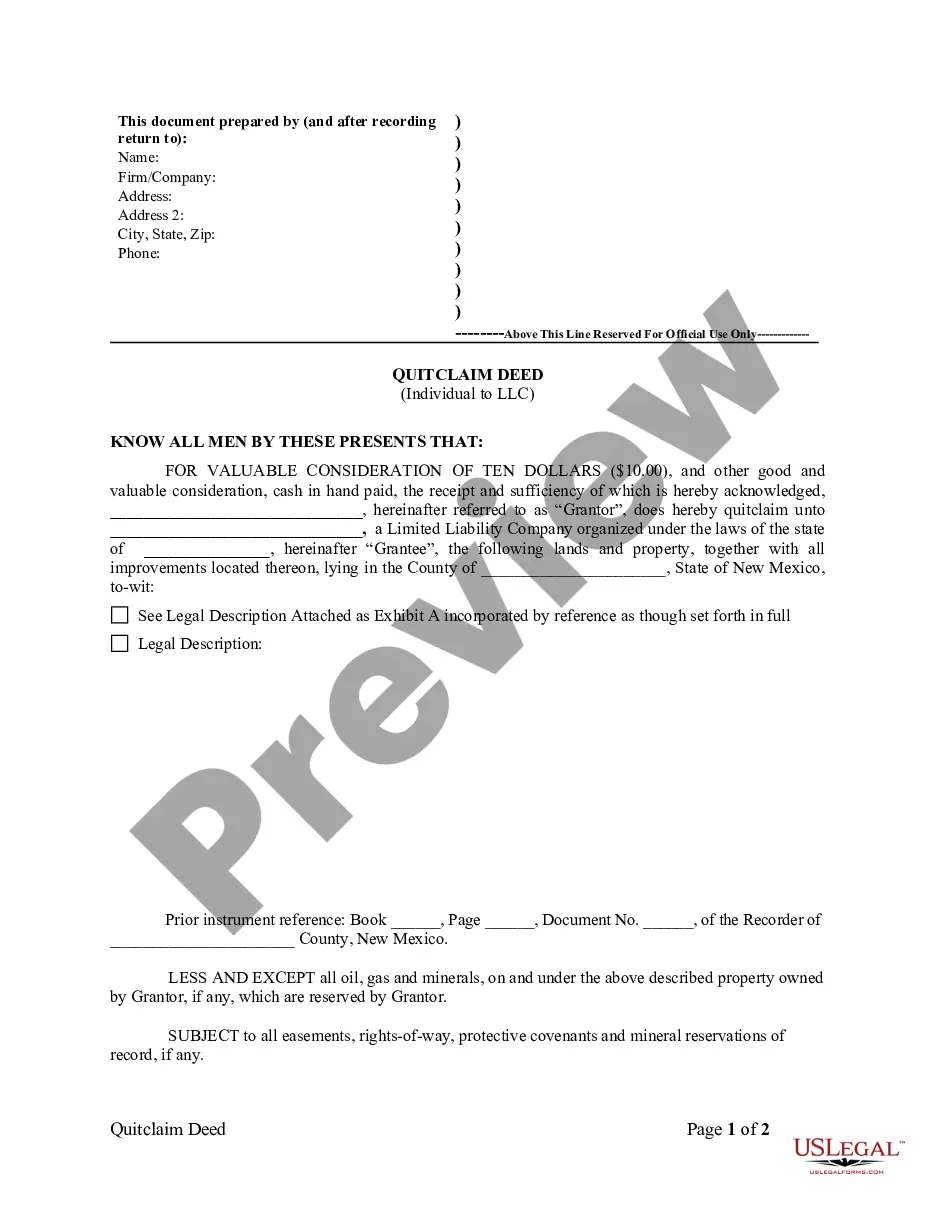

How to fill out Cook Illinois Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

Do you need to quickly draft a legally-binding Cook Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) or probably any other document to take control of your own or business affairs? You can select one of the two options: contact a professional to write a valid paper for you or create it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you get professionally written legal documents without having to pay sky-high prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant document templates, including Cook Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) and form packages. We offer templates for an array of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, double-check if the Cook Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Cook Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our services. Moreover, the paperwork we provide are reviewed by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

The Bankruptcy Code defines a production payment as a type of term overriding royalty or an interest in liquid or gaseous hydrocarbons in place or to be produced from particular real property that entitles the owner thereof to a share of production, or the value thereof, for a term limited by time, quantity, or