Tarrant Texas Declaration of Election by Lessor to Convert Royalty Interest to Working Interest

Description

How to fill out Tarrant Texas Declaration Of Election By Lessor To Convert Royalty Interest To Working Interest?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Tarrant Declaration of Election by Lessor to Convert Royalty Interest to Working Interest, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Tarrant Declaration of Election by Lessor to Convert Royalty Interest to Working Interest from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Tarrant Declaration of Election by Lessor to Convert Royalty Interest to Working Interest:

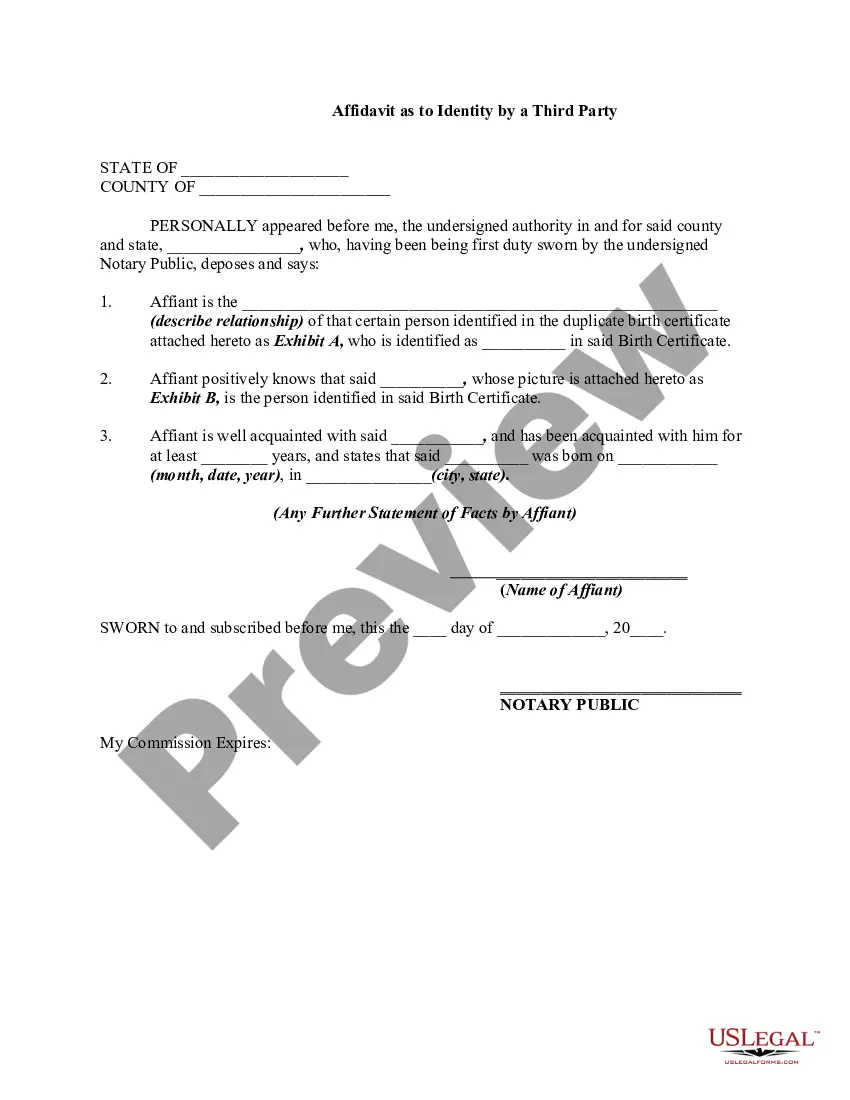

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

Legal Definition of overriding royalty : an interest in and royalty on the oil, gas, or minerals extracted from another's land that is carved out of the producer's working interest and is not tied to production costs compare royalty.

If you have a question about unclaimed royalties or other oil and gas proceeds, you should contact the Texas Comptroller of Public Accounts. The Comptroller operates and maintains the Unclaimed Property Fund. The Comptroller of Public Accounts is located at 111 E. 17th St., Austin, Texas 78701.

A working interest is a type of investment in oil and gas operations. In a working interest, investors are liable for ongoing costs associated with the project but also share in any profits of production. Both the costs and risks of a working interest are extremely high.

Working Interest a percentage of ownership in a mineral lease granting its owner the right to explore, drill, and produce oil and gas from the leased property.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.