Salt Lake Utah Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced

Description

How to fill out Assignment Of Overriding Royalty Interest To Become Effective At Payout, With Payout Based On Volume Of Oil Produced?

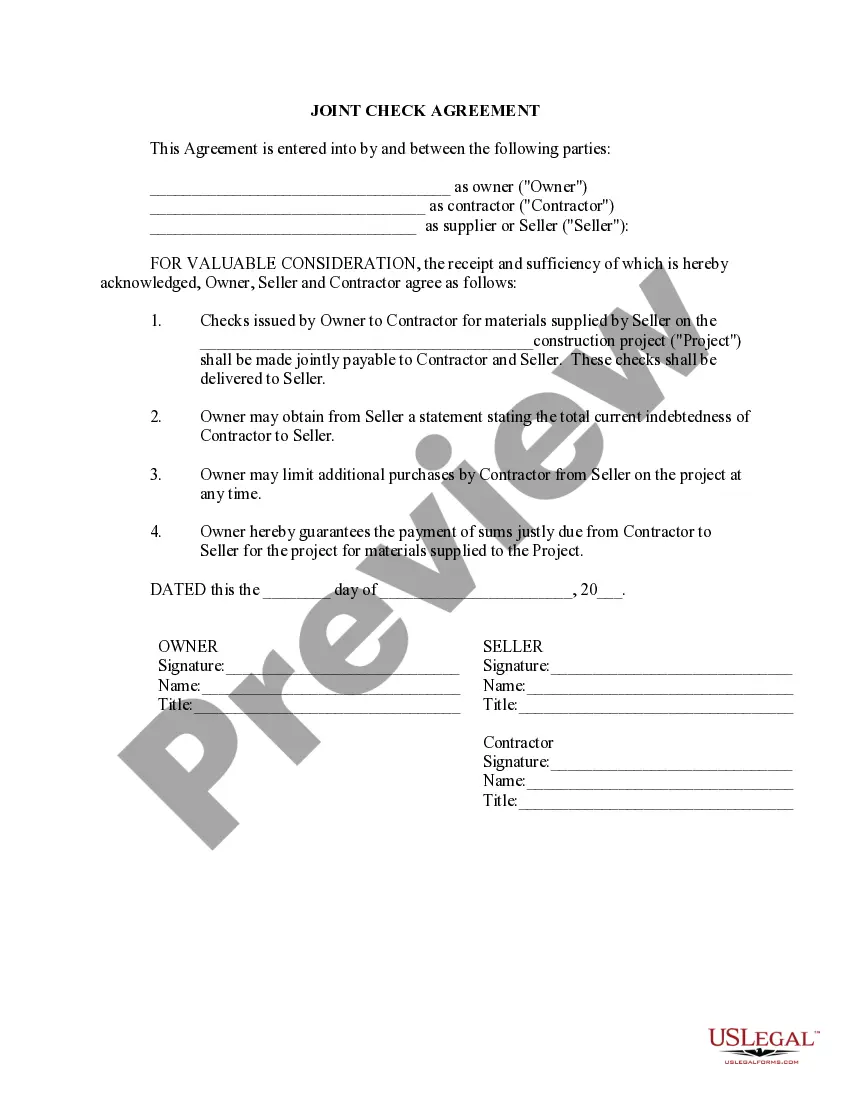

Drafting documentation for the enterprise or individual requests is consistently a significant obligation.

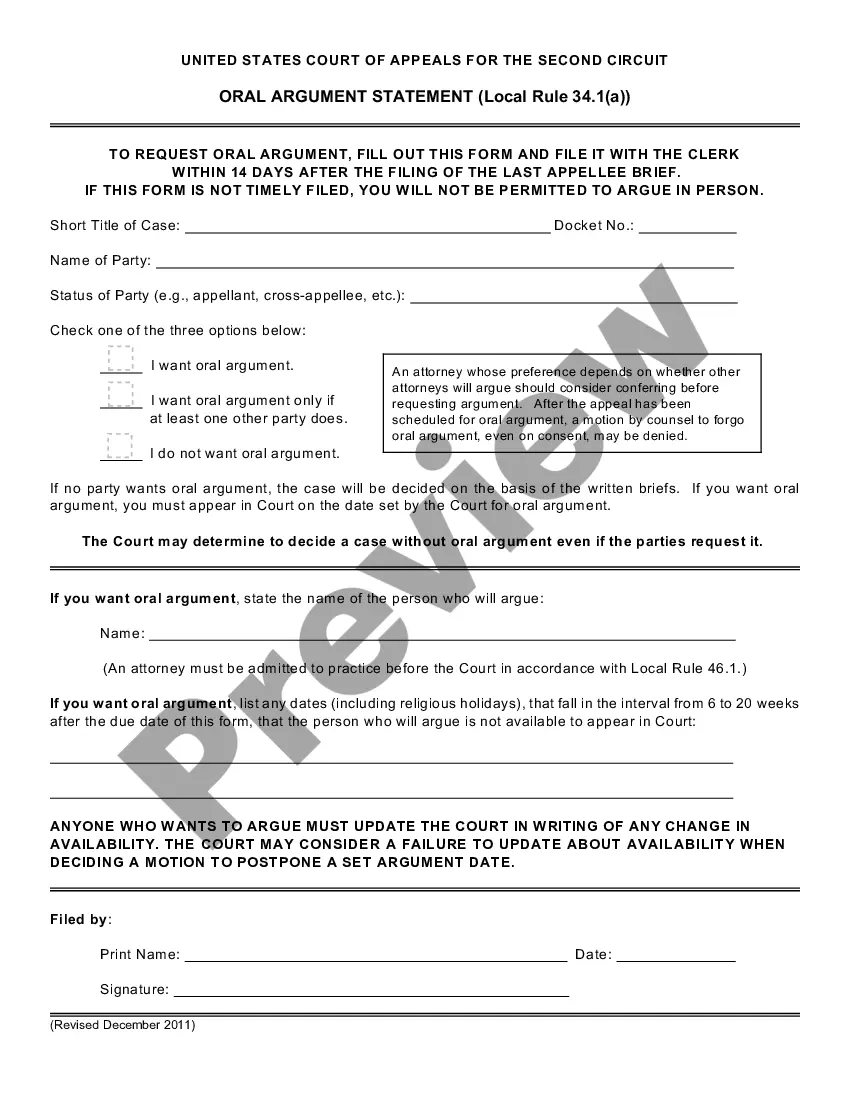

When creating a contract, a public service application, or a power of attorney, it's crucial to contemplate all federal and state statutes and regulations of the specific area.

However, small jurisdictions and even municipalities also possess legislative rules that you must take into account.

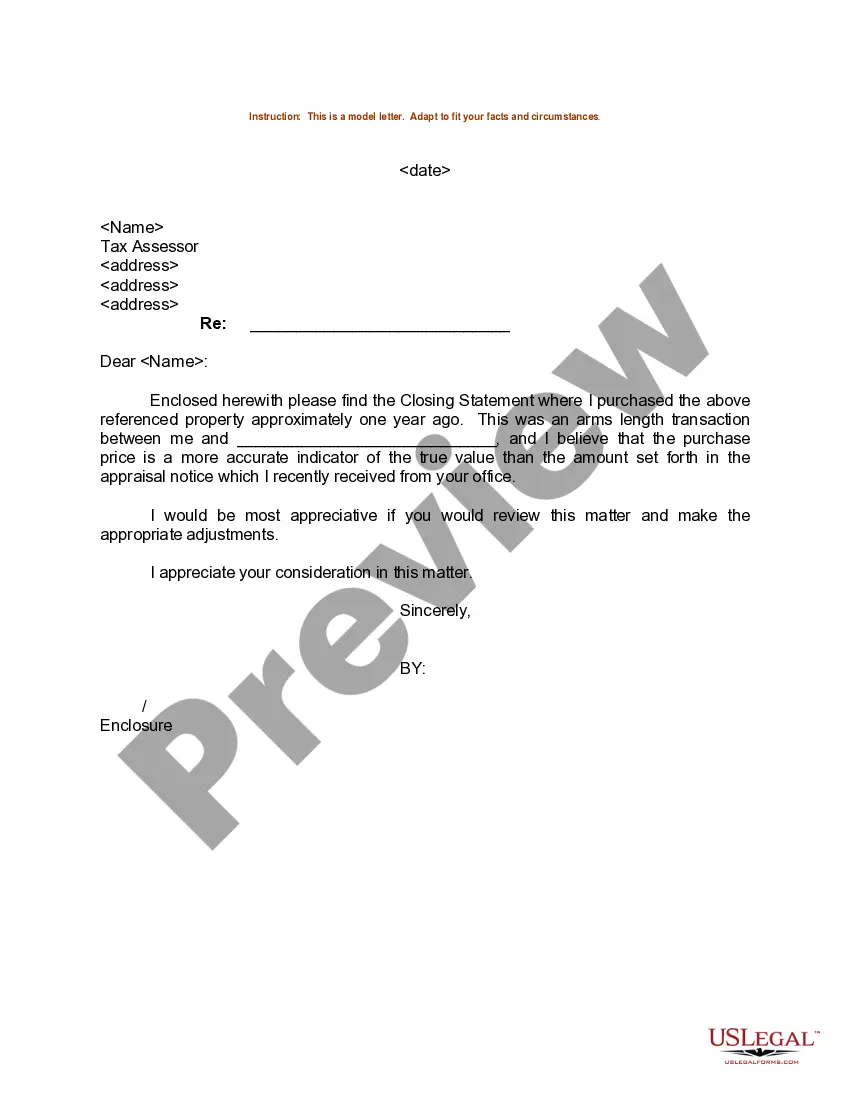

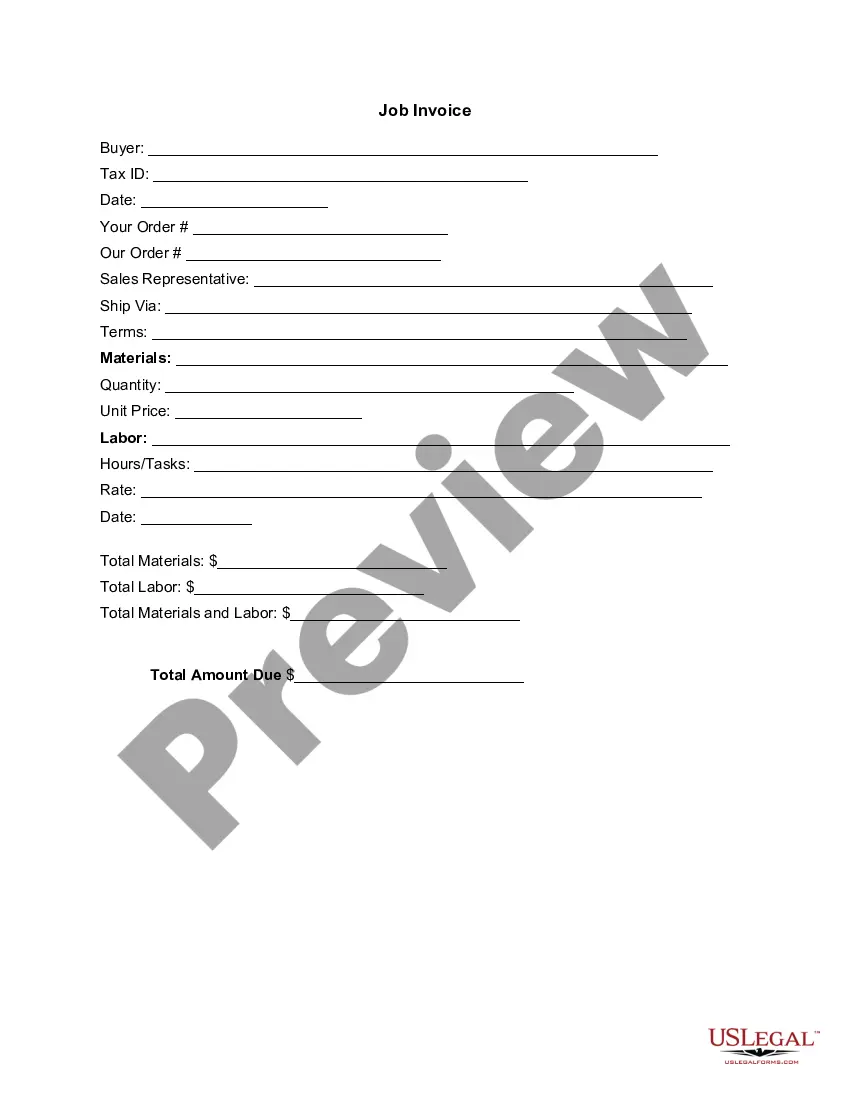

To accomplish this, employ the form description and preview if these features are available.

- All these factors render it challenging and lengthy to compose Salt Lake Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced without professional assistance.

- It's simple to refrain from incurring expenses on attorneys drafting your documentation and produce a legally binding Salt Lake Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced by yourself, utilizing the US Legal Forms web archive.

- It is the most comprehensive online collection of state-specific legal documents that are expertly verified, allowing you to be confident in their legitimacy when selecting a sample for your county.

- Previously registered users simply need to Log In to their accounts to retrieve the necessary form.

- If you do not have a subscription yet, adhere to the step-by-step instructions below to acquire the Salt Lake Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced.

- Browse the page you've accessed and confirm if it contains the document you need.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding royalty interests are an important financing tool for oil and gas companies involved in the exploration and development of oil gas and mineral interests. For investors, they provide an opportunity to participate in mineral production without incurring the costs.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.