Tarrant Texas Affidavit of Heirship for the Owner of the Property

Description

How to fill out Affidavit Of Heirship For The Owner Of The Property?

A document procedure consistently accompanies any legal action you undertake.

Establishing a business, applying for or accepting a job offer, transferring property ownership, and numerous other life situations require you to prepare formal documentation that varies by state.

This is why having everything gathered in one location is so advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal templates.

- Here, you can effortlessly find and download a document for any personal or business need in your county, including the Tarrant Affidavit of Heirship for the Owner of the Property.

- Locating forms on the platform is very straightforward.

- If you already have a subscription to our service, Log In to your account, use the search field to find the sample, and click Download to save it on your device.

- After that, the Tarrant Affidavit of Heirship for the Owner of the Property will be accessible for further use in the My documents section of your profile.

- If you are utilizing US Legal Forms for the first time, follow this straightforward guide to obtain the Tarrant Affidavit of Heirship for the Owner of the Property.

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your requirements.

Form popularity

FAQ

An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).

There are several methods of settling an estate of someone who dies without a valid will in Texas: Small Estate Affidavit.Affidavit of Heirship.Determination of Heirship.

Can I file an Affidavit of Heirship with the Probate courts? No, these documents should be filed in the County Clerk Official Public Records Office located in room B20 at 100 W. Weatherford, Fort Worth, Texas.

The surviving spouse automatically receives all community property. Separate personal property also goes completely to the surviving spouse, while separate real property is split down the middle between the surviving spouse and the deceased's parents, siblings or siblings' descendants, in that order.

A spouse and parents: spouse inherits all community property, all separate personal property, and ½ of separate real estate; parents inherit everything else. One parent and siblings, but no spouse: parent inherits ½ of property; siblings equally share ½ of remaining property.

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

If the deceased doesn't leave a will (intestate proceeding), the estate will have no free portion and will be divided equally among the surviving spouse and legitimate children. If there are illegitimate children, they are entitled to the equivalent of ½ the share of the legitimate children.

If a you are single and die without a will in Texas, your property will be distributed as follows: Your estate will pass equally to your parents if both are living. If one parent has died, and you don't have any siblings, then your estate will pass to your surviving parent.

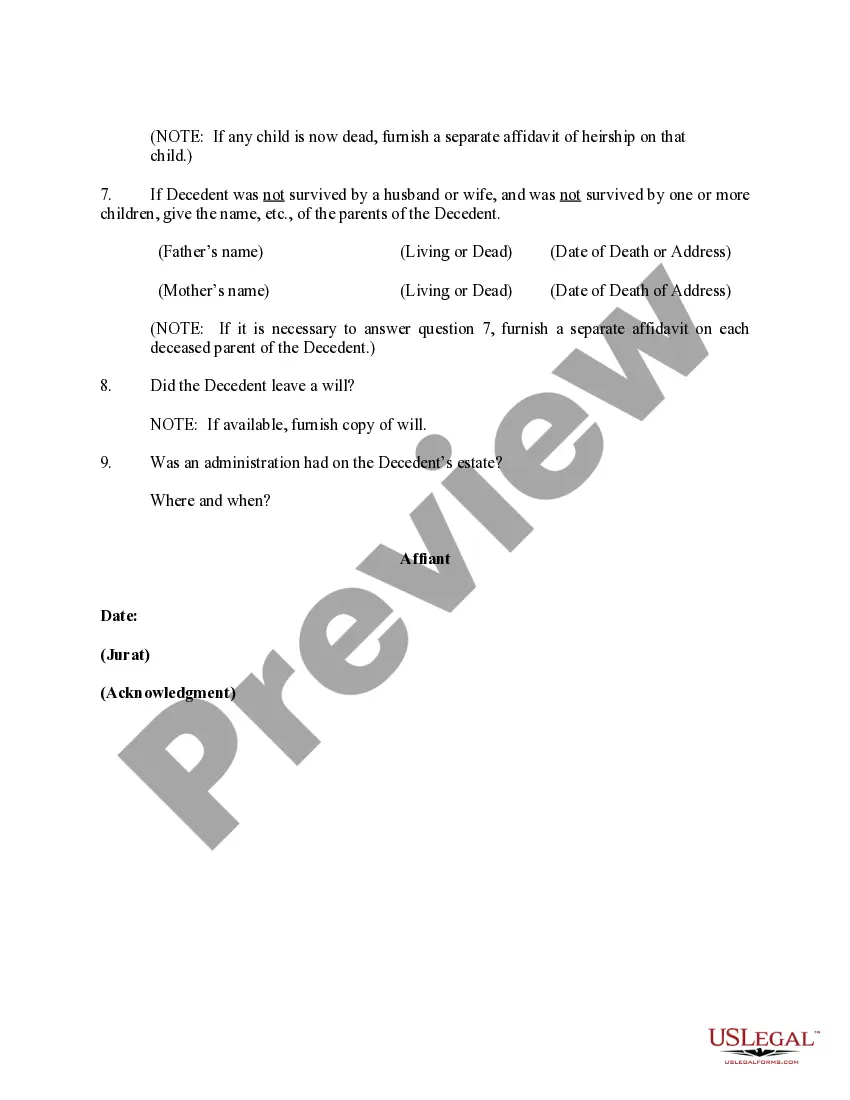

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so. At that point, the deed most commonly used to transfer the property is a General Warranty Deed.