Fulton Georgia Partial Release of Mortgage / Deed of Trust

Description

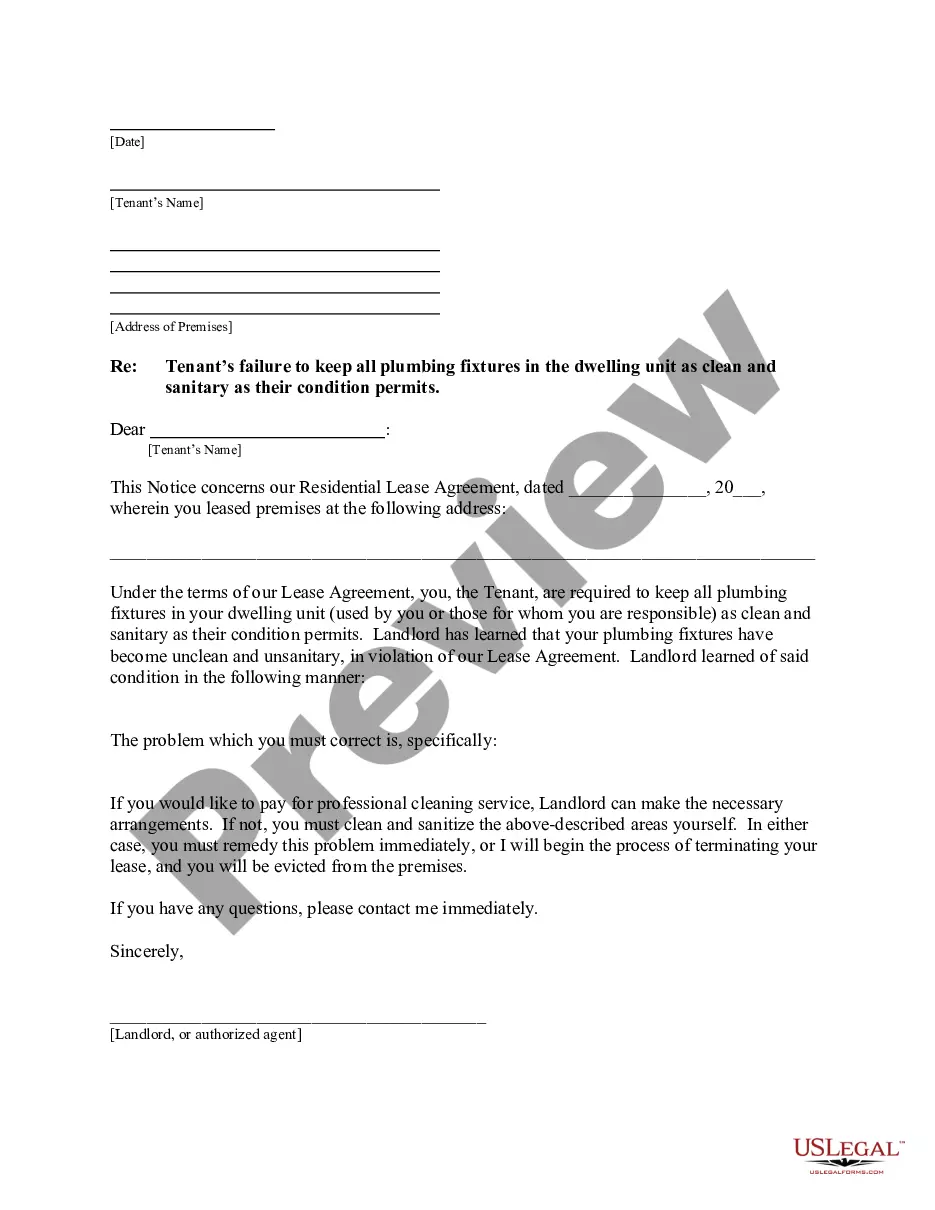

How to fill out Partial Release Of Mortgage / Deed Of Trust?

Producing legal documents is essential in the contemporary world. However, you don't always have to pursue expert help to create some of them from scratch, such as the Fulton Partial Release of Mortgage / Deed of Trust, utilizing a service like US Legal Forms.

US Legal Forms offers more than 85,000 templates to select from across various categories, including living wills, real estate documents, and divorce papers. All documents are organized according to their valid state, simplifying the search process.

Additionally, you can find informational resources and guides on the site to facilitate any tasks related to completing paperwork.

If you’re already registered with US Legal Forms, you can find the appropriate Fulton Partial Release of Mortgage / Deed of Trust, Log In to your account, and download it. It’s important to mention that our website cannot fully substitute for a lawyer. If you are handling a particularly complex matter, we recommend employing the services of an attorney to review your document before signing and filing it.

With over 25 years in the industry, US Legal Forms has established itself as a preferred platform for a variety of legal documents for millions of users. Join them today and easily obtain your state-specific forms!

- Review the document's preview and outline (if available) to understand what you’ll receive after acquiring the document.

- Confirm that the template you select is suited to your state/county/region, as state regulations can influence the legality of certain records.

- Examine the related document templates or restart the search to find the correct file.

- Click Buy now and set up your account. If you already possess one, choose to Log In.

- Select the pricing option, then the desired payment method, and purchase the Fulton Partial Release of Mortgage / Deed of Trust.

- Choose to save the form template in any supported file format.

- Visit the My documents section to re-download the document.

Form popularity

FAQ

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

A deed of trust, or security deed, as it is known in some jurisdictions, is a form of mortgage. A borrower of money signs a promissory note demonstrating the debt owed to the lender. The promissory note will generally recite the purpose of the loan and indicate that it is secured by real property.

Most consumer debt is made up of fully amortized loans, but partially amortized loans also exist. This is just as it sounds: The borrower pays off a portion of the debt with regular monthly payments, then makes a "balloon payment"a large lump sumon the loan maturity date.

Cancellation of Deed to Secure Debt. (GA) This cancellation of deed to secure debt may be used in Georgia to satisfy and cancel a security instrument where the original deed to secure debt has been lost, stolen, or otherwise mislaid.

Partial Discharge occurs where more than one Land Title is used to secure a loan, and one or more (but not all) of those Land Titles is released as security (e.g. for property developments). Partial Discharge occurs where a fraction of Proprietors or Mortgagees in a Tenancy are removed from a Mortgage.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

In the State of Georgia, the instrument used to secure a debt on property is called a "Deed to Secure Debt" or "Security Deed." Under Georgia law, the lender is deeded the property, but in a lesser form of a deed that becomes activated if the borrower defaults in some way.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

The Carrier Release Program allows senders of parcels to authorize carriers to leave parcels in a safe location protected from weather if no one is available at the location to receive it or when the addressee has filed a written order to allow a carrier to leave the parcel.

Key Takeaways. A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.