Travis Texas Dissolution of Pooled Unit

Description

How to fill out Travis Texas Dissolution Of Pooled Unit?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, finding a Travis Dissolution of Pooled Unit meeting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. Apart from the Travis Dissolution of Pooled Unit, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Travis Dissolution of Pooled Unit:

- Check the content of the page you’re on.

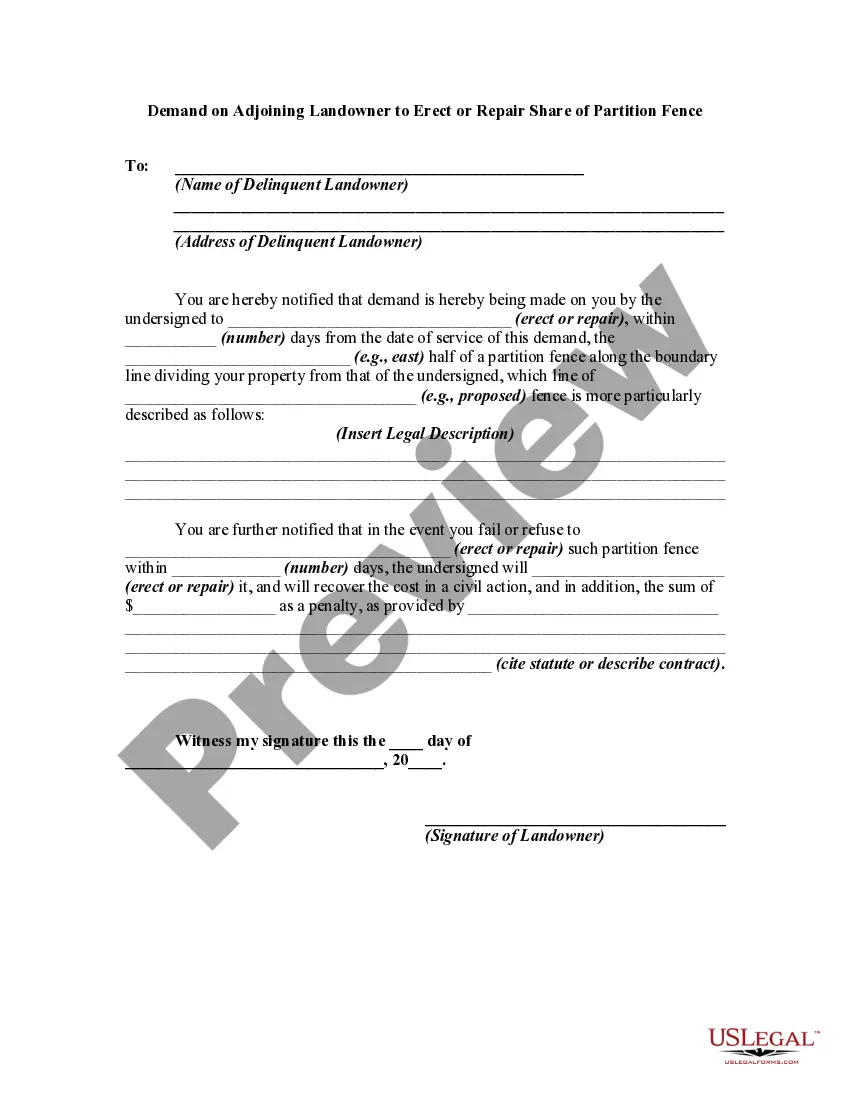

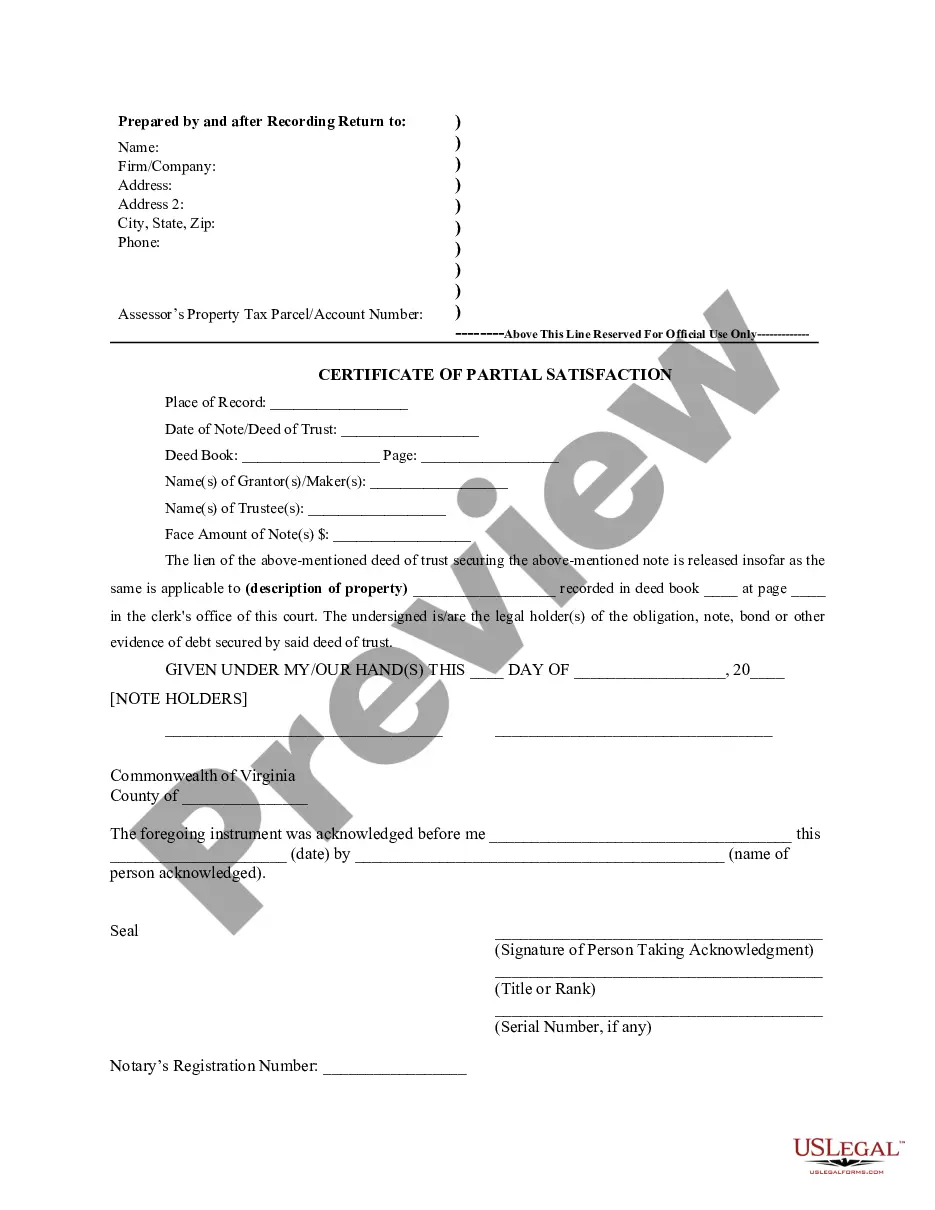

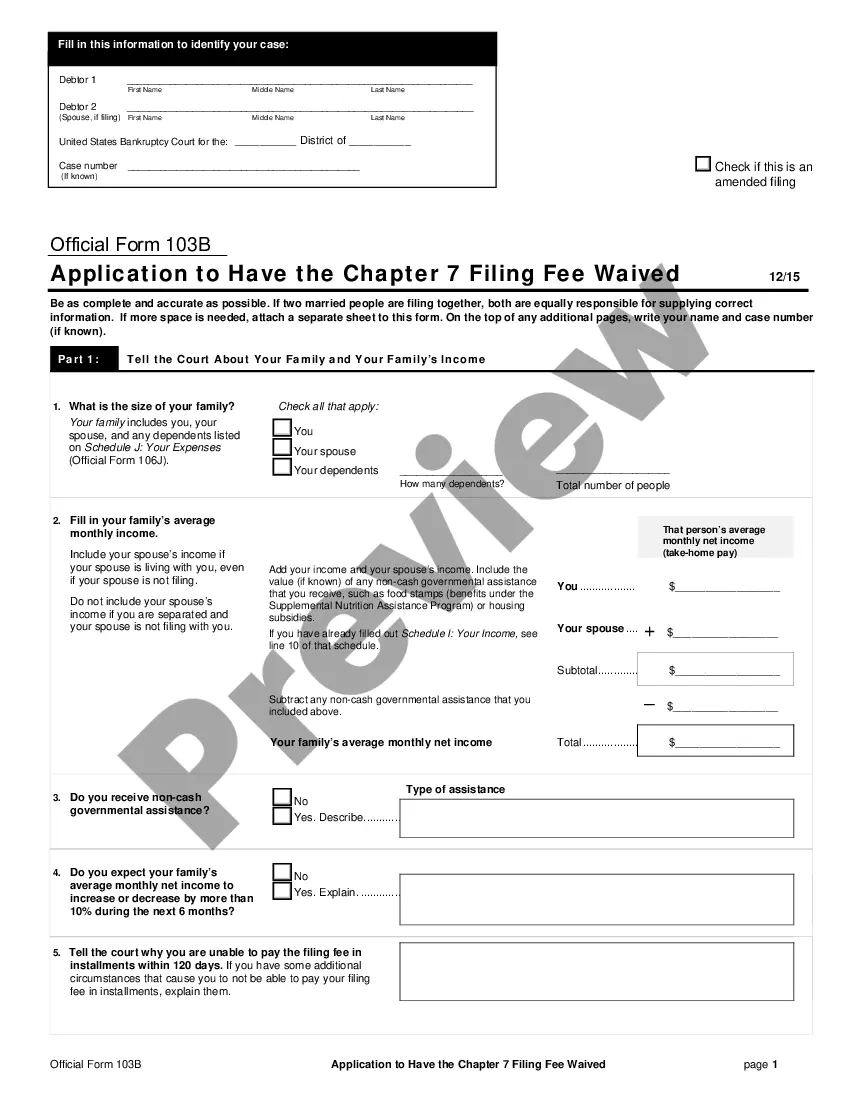

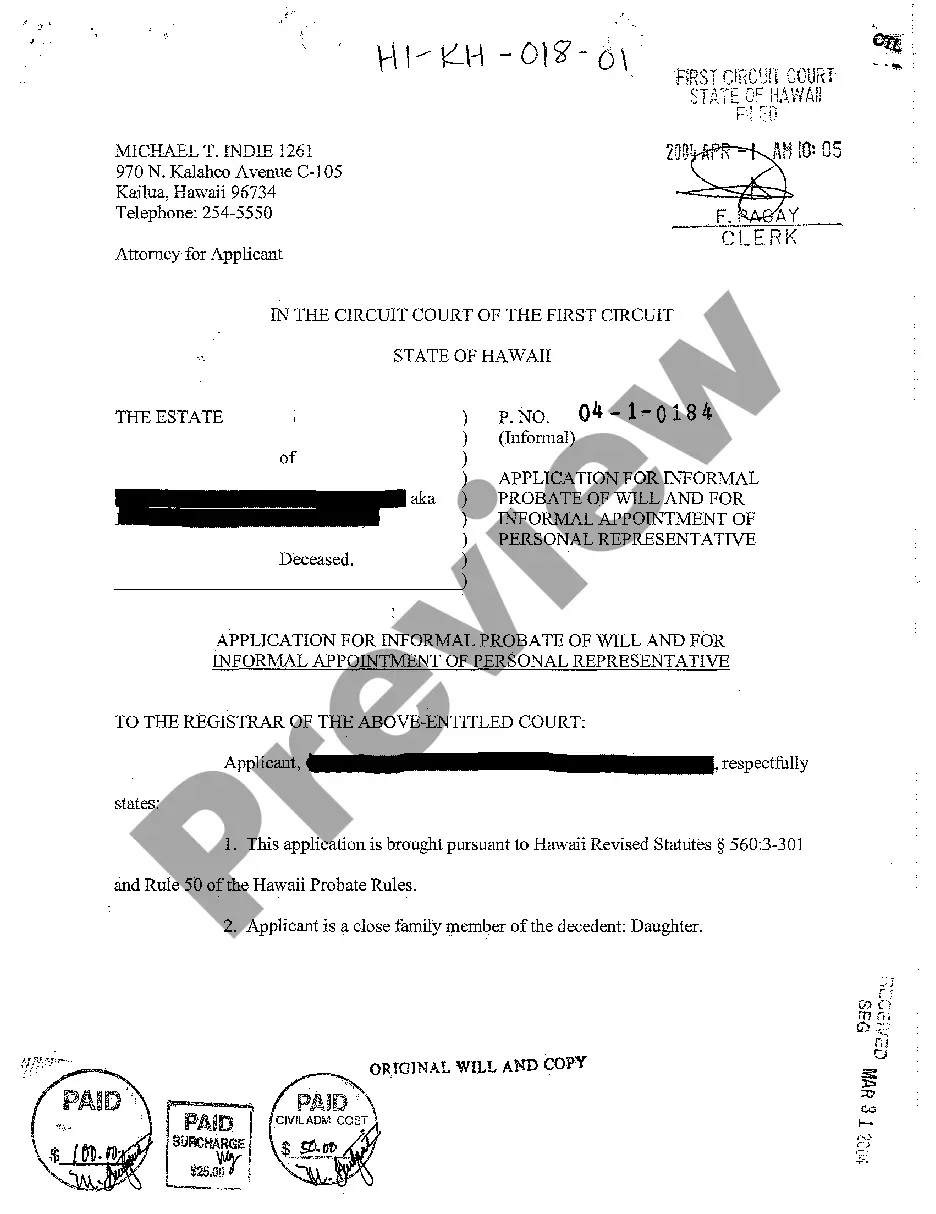

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Travis Dissolution of Pooled Unit.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Forced Pooling in Texas - the Texas forced pooling statute is similar to the statutes of most states. The Texas Railroad Commission has authority to issue forced pooling orders. A mineral interest owner who is force pooled in Texas has essentially the same options as mineral owners in other states.

Generally, a pooling clause will allow the leased premises to be combined with other lands to form a drilling unit, wherein proceeds from production anywhere on the drilling unit are allocated according to the percentage of the acreage of each tract divided by the total acreage of the drilling unit.

Pooling is the combination of all or portions of multiple oil and gas leases to form a unit for the drilling of a single oil and/or gas well. The unit is generally one or a combination of government survey quarter-quarter sections.

Unitization is the agreement to jointly operate an entire producing reservoir or a prospectively productive area of oil and/or gas. The entire unit area is operated as a single entity, without regard to lease boundaries, and allows for the maximum recovery of production from the reservoir.

It also records a "Declaration of Pooling" or similarly named document in the land records office at the local Courthouse. The declaration shows the boundaries of the pooling unit and identifies all the landowners and amount of property each landowner actually has in the unit.

Pooling refers to joining together enough acreage to allow issuance of a drilling permit for a single well. Unitization refers to joining together large areas such as an entire reservoir or field to optimize operations, introduce efficiencies, and reduce costs. Both pooling and unitization can be voluntary or forced.

The basic royalty calculation is: the landowner's acreage in the unit / (divided by) total number of acres in the unit x (multiplied by) royalty rate x (multiplied by) production = (equals the) gross royalty. An example may be helpful.

For a producing well, royalties could easily be 10 to 20 times the bonus payment in the first year of production alone. Private landowners are normally offered the standard royalty of 1/8 share of production.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.