Austin Texas Revocable Trust Agreement when Settlors Are Husband and Wife

Category:

State:

Multi-State

City:

Austin

Control #:

US-OG-104

Format:

Word;

Rich Text

Instant download

Description

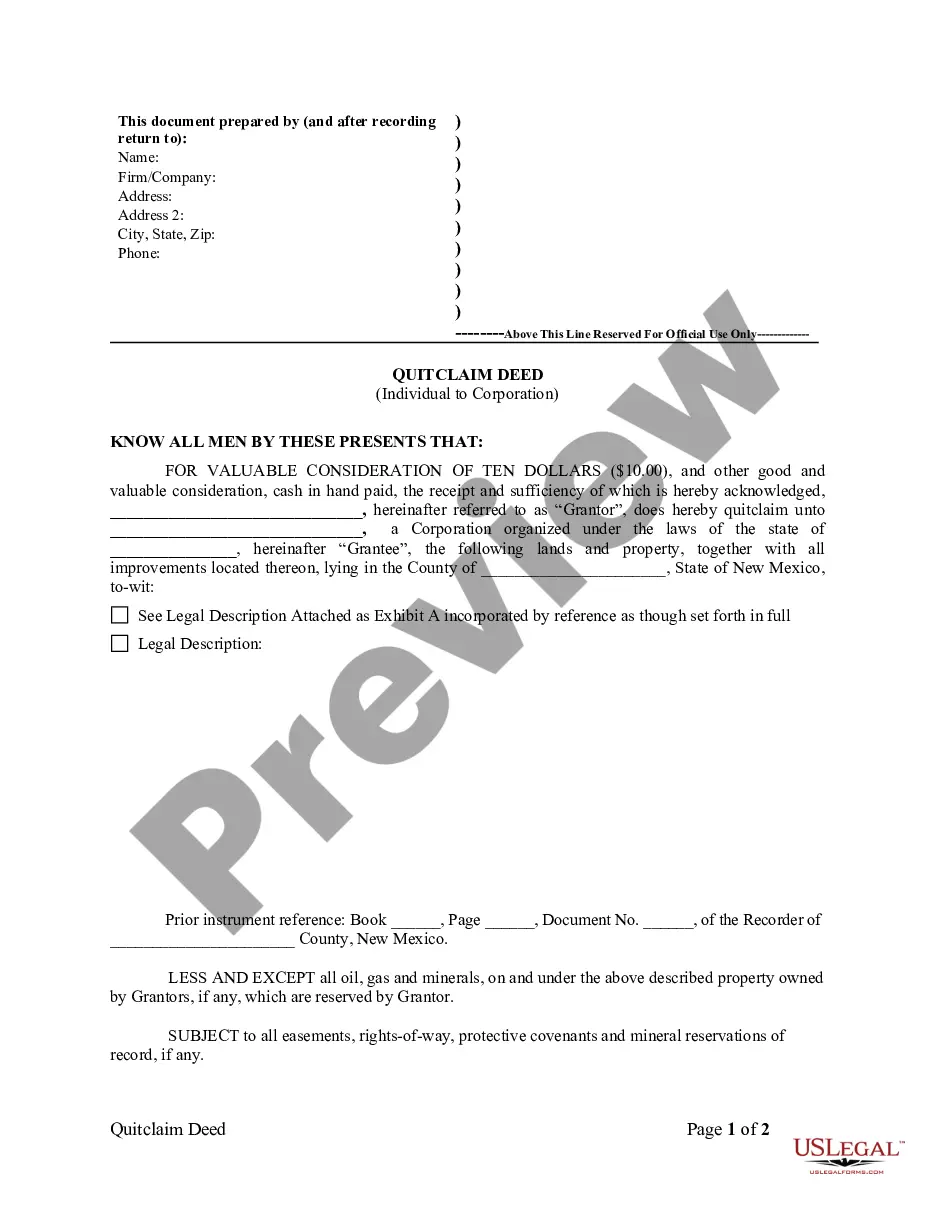

This form provides for the establishment of a trust, specifying the duties and responsibilities of the trustee, and the distribution of the assets to be transferred to the trust. This form of trust is known as a

revocable intervivos trust

. Being a trust does not automatically accomplish the transfer of an owners property into the trust. This must be done by conveying, in deeds or assignments, the property to the Trustee.

Free preview