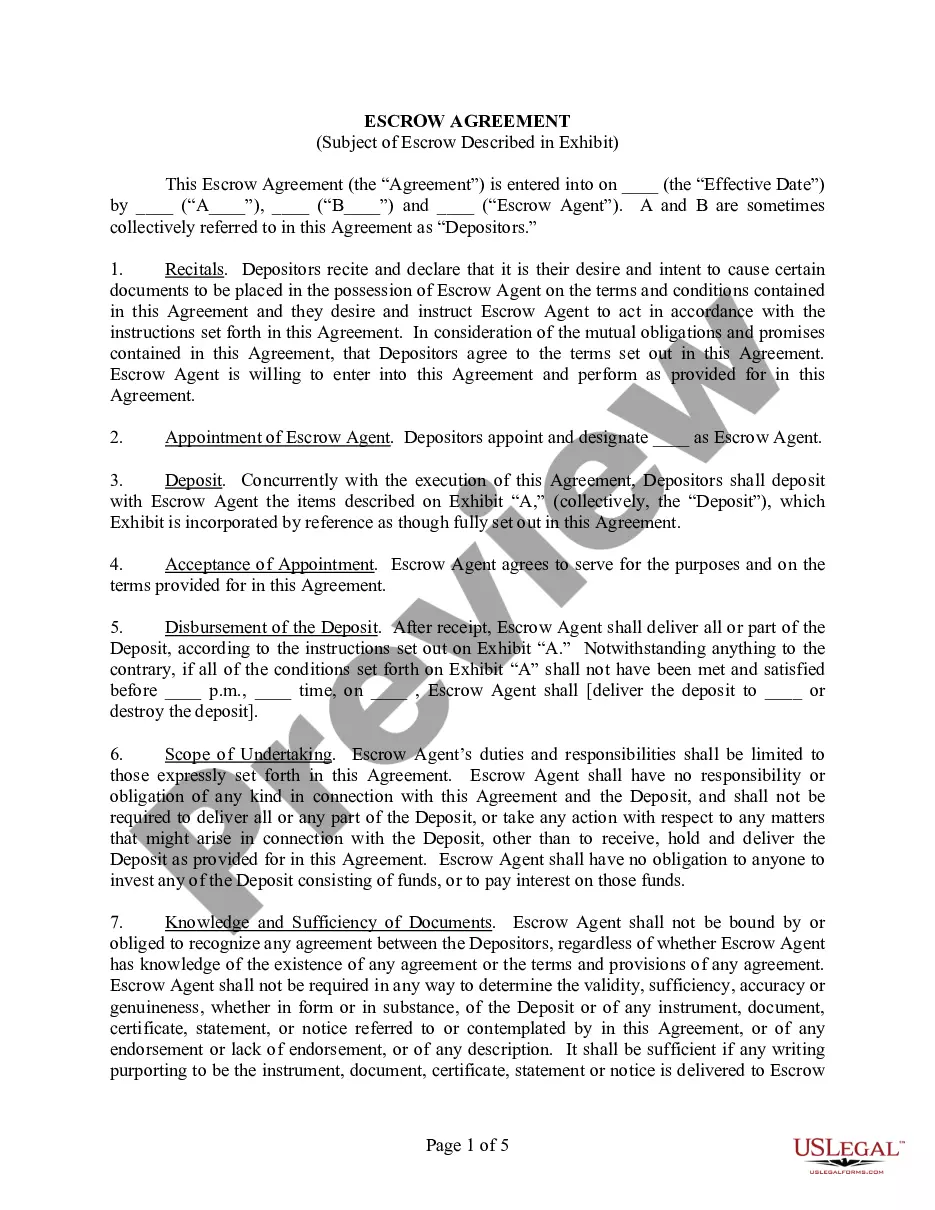

Title: Los Angeles California Escrow Agreement and Instructions: A Comprehensive Guide Introduction: In this article, we will provide a detailed description of Los Angeles California Escrow Agreement and Instructions. Escrow agreements serve as essential legal instruments in various real estate and financial transactions, ensuring secure handling of funds and documentation. We'll delve into the significance, types, and key elements of these agreements in the context of Los Angeles, California. 1. Los Angeles California Escrow Agreement: An Overview An escrow agreement is a legally binding contract established to protect the interests of the parties involved in a transaction. In Los Angeles, California, these agreements are prevalent in real estate purchases, refinancing, lease agreements, business transactions, and other financial dealings. 2. Types of Los Angeles California Escrow Agreements: a) Real Estate Escrow Agreement: This agreement is commonly used in Los Angeles for property transactions, including residential, commercial, and industrial properties. It ensures secure management and distribution of funds, property titles, and associated documents during the purchase or sale process. b) Mortgage Escrow Agreement: In Los Angeles, this agreement is prevalent when borrowers secure a mortgage. It requires borrowers to maintain an escrow account to cover property taxes, insurance premiums, and other related costs. The agreement ensures timely payment and prevents default. c) Business Escrow Agreement: Used in Los Angeles for mergers, acquisitions, stock sales, or large investments, this agreement facilitates the smooth transfer of funds, shares, or assets between parties involved in a business transaction. 3. Key Elements of Los Angeles California Escrow Agreements: a) Parties Involved: The agreement identifies the buyer, seller, agent(s), and escrow officer responsible for executing the terms. b) Escrow Period: Specifies the duration for which escrow will remain open, including any specific events or conditions that may affect the agreement's timeline. c) Deposit and Disbursement: Outlines the amount and conditions under which funds will be deposited into the escrow account and subsequently disbursed upon fulfillment of predetermined conditions. d) Contingency Terms: Describes any contingencies that need to be met before the agreement is fully executed, such as satisfactory home inspections or loan approvals. e) Title Clearance: Addresses the process of clearing any liens, encumbrances, or legal disputes related to the property under consideration. f) Termination Conditions: Outlines the circumstances under which the escrow agreement may be terminated, including default or breach of contract by one of the parties. g) Signatures and Notarization: Requires all parties to the agreement to sign and notarize the document to ensure its legal validity. Conclusion: Los Angeles California Escrow Agreements play a vital role in protecting the rights of buyers, sellers, and investors in a wide range of financial transactions. By providing a secure and neutral platform, these agreements ensure the efficient management and distribution of funds, documents, and assets. Understanding the different types and key elements of escrow agreements is crucial for individuals involved in real estate, business, or financial dealings in Los Angeles, California.

Los Angeles California Escrow Agreement and Instructions

Description

How to fill out Los Angeles California Escrow Agreement And Instructions?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, finding a Los Angeles Escrow Agreement and Instructions suiting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the Los Angeles Escrow Agreement and Instructions, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Los Angeles Escrow Agreement and Instructions:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Los Angeles Escrow Agreement and Instructions.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Escrow instructions are typically included in the Los Angeles California Escrow Agreement. You can easily find them through trusted legal platforms like US Legal Forms that provide comprehensive templates and guidance for creating your escrow agreement. Additionally, local escrow companies often have specific instructions tailored to their processes. By utilizing these resources, you can ensure that you follow the correct procedures.

The escrow agent typically provides the escrow instructions for handling and disbursing funds as specified in a Los Angeles California Escrow Agreement and Instructions. This agent is responsible for ensuring that the terms of the agreement are carried out correctly. It's advisable to clearly outline all instructions to avoid any misunderstandings during the transaction.

Authority to change escrow instructions in a Los Angeles California Escrow Agreement and Instructions rests primarily with the parties who signed the agreement. Both the buyer and seller, along with their authorized agents, can request changes. It is crucial that all changes are documented and agreed upon to prevent any confusion later.

Escrow instructions are typically drawn from the details outlined in the Los Angeles California Escrow Agreement and Instructions. They capture specific agreements between parties regarding how funds and documents should be managed during the transaction. It is important to ensure that these instructions align with the overall terms of your agreement.

Escrow instructions must be signed by the parties involved in a Los Angeles California Escrow Agreement and Instructions. Generally, this includes the buyer, the seller, and sometimes their agents or attorneys. Signing these instructions is crucial as it indicates agreement to the terms outlined within the document.

In the context of a Los Angeles California Escrow Agreement and Instructions, typically, only the parties involved in the agreement can initiate changes to escrow instructions. This generally includes the buyer, seller, and any involved agents. Ensure that any modifications are documented in writing to maintain clarity and prevent disputes.

To create a Los Angeles California Escrow Agreement and Instructions, you should start by gathering the necessary details about the transaction, including all parties involved and the specific terms of the agreement. Next, you can use templates available on platforms like USLegalForms which offer state-specific documents. Once you draft the agreement, ensure all signatories review and understand their obligations before signing.

Escrow instructions in California are written guidelines that outline the obligations and expectations of all parties involved in a transaction. They ensure that the escrow agent follows the contractual obligations set forth by the buyer and seller. When using the Los Angeles California Escrow Agreement and Instructions, these guidelines play a pivotal role in achieving a successful closing.

For an escrow to be valid, there must be a contract, mutual consent, and the presence of a neutral third party, typically the escrow agent. These elements ensure that the transaction proceeds smoothly and fairly. Understanding these requirements is vital in the context of the Los Angeles California Escrow Agreement and Instructions to ensure compliance and avoid issues.

Lenders' escrow instructions specify the conditions under which the lender will release funds to the seller. These instructions protect both the lender's and the buyer's interests. In the context of the Los Angeles California Escrow Agreement and Instructions, adhering to these guidelines helps facilitate a smooth transaction.