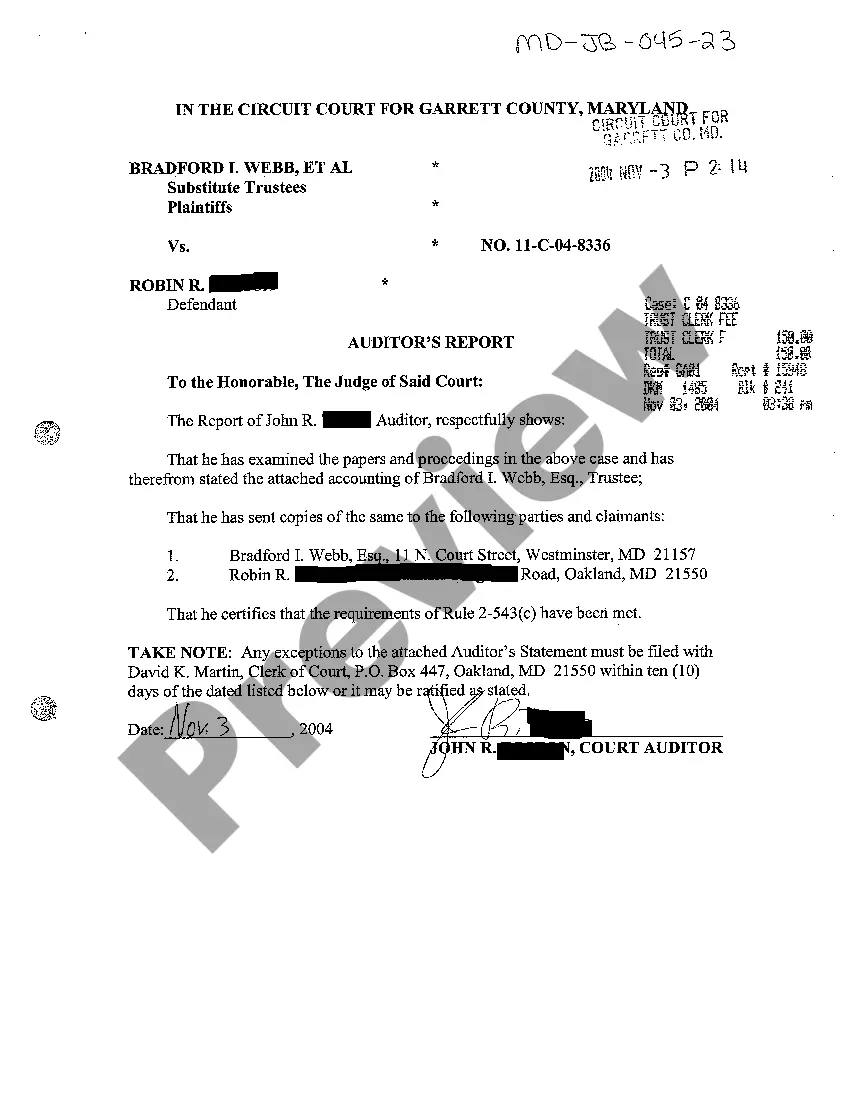

Wayne Michigan Deed and Assignment from individual to A Trust

Description

How to fill out Deed And Assignment From Individual To A Trust?

Legislation and statutes in all areas differ from region to region.

If you are not a lawyer, it can be overwhelming to navigate numerous regulations when it comes to composing legal documents.

To prevent costly legal support while preparing the Wayne Deed and Assignment from an individual to A Trust, you require a validated template that is legitimate for your locality.

This is the easiest and most cost-effective method to obtain current templates for any legal needs. Discover them all with just a few clicks and keep your records organized with the US Legal Forms!

- Take a look at the page content to confirm you have located the correct sample.

- Use the Preview feature or review the form description if available.

- Search for an alternative document if there are discrepancies with any of your requirements.

- Click the Buy Now button to purchase the template once you identify the right one.

- Select one of the subscription plans and Log In or create an account.

- Decide how you want to pay for your subscription (with a credit card or PayPal).

- Choose the format in which you wish to save the document and click Download.

- Complete and sign the template on paper after printing it or do everything electronically.

Form popularity

FAQ

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

You may want to transfer ownership of a property if you are newly married and want your spouse on the title deeds. You can do this through a transfer of equity. This is where a share of equity is transferred to one or multiple people, but the original owner stays on the title deeds.

You cannot simply add someone to the deed in most cases, and it will require a change in the form of the deed on the property. You will have to file a quitclaim deed and then file a new deed with joint ownership.

Comparison of Michigan Warranty Deeds to Other Forms of Michigan Deeds. The full warranty of title provided by a Michigan warranty deed distinguishes that deed form from other deed forms, like quitclaim deeds and covenant deeds. A Michigan quitclaim deed form provides no warranty of title.

Average Title transfer service fee is 20b120,000 for properties within Metro Manila and 20b130,000 for properties outside of Metro Manila.

A general warranty deed is the most beneficial for the home buyer because it provides the greatest amount of protection. It's a guarantee from the current owners (also referred to as grantors) that they have full ownership of the property and have disclosed all encumbrances, liens, easements and judgments.

Warranty Deeds With a warranty deed, the grantor (seller) warrants that they have good title to the property and that they have a right to sell the property to the grantee (buyer). Good title means that there are no liens, conditions, or restrictions on the property.

DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

Documents executed in Michigan which convey or encumber real estate require a notary's acknowledgment. Documents must be on 8.5" x 11" or 8.5" x 14" paper and must have a 2.5" top margin for the first page, and a minimum 0.5" margin on the other three sides of all pages.

Top. If your ex-spouse was supposed to give you a quitclaim deed but did not do it, you have two options. You can file a motion asking the judge to enforce the Judgment of Divorce, and the judge can order your ex-spouse to prepare a quitclaim deed.