Broward Florida Schedule of Fees

Description

How to fill out Schedule Of Fees?

Whether you plan to launch your enterprise, enter into an agreement, request an update for your identification, or address family-related legal matters, it is essential to prepare specific documentation that complies with your local laws and regulations.

Finding the appropriate documents can consume a considerable amount of time and effort unless you utilize the US Legal Forms library.

The platform offers users access to over 85,000 professionally crafted and verified legal templates suitable for any personal or business circumstance.

Acquire the Broward Schedule of Fees in your preferred file format. Print the document or fill it out and sign it electronically using an online editor to save time. The documents available on our website are reusable. With an active subscription, you can retrieve all of your previously purchased documents at any time from the My documents section of your account. Stop expending time on a never-ending quest for current formal documents. Register for the US Legal Forms platform and organize your paperwork with the most comprehensive online form library!

- All documents are organized by state and area of application, making it easy and quick to select a document such as the Broward Schedule of Fees.

- US Legal Forms website users simply need to Log In to their account and click the Download button adjacent to the desired template.

- If you are a new user, it will require a few extra steps to acquire the Broward Schedule of Fees. Follow the guidelines below.

- Ensure the sample aligns with your personal requirements and state legal standards.

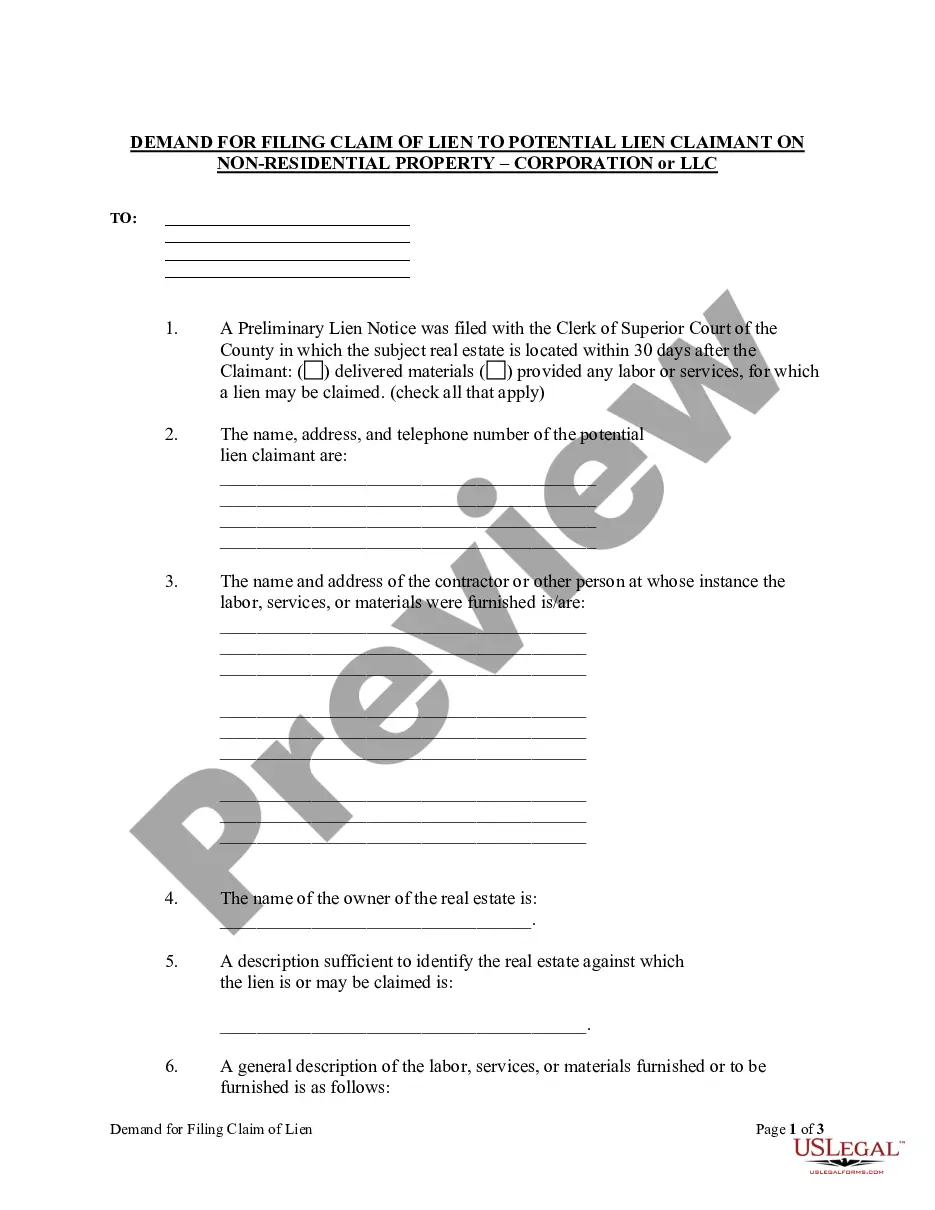

- Review the form description and check the Preview if it is available on the page.

- Employ the search bar specifying your state above to find another template.

- Click Buy Now to obtain the document when you identify the correct one.

- Choose the subscription plan that best fits your needs to advance.

- Log in to your account and pay for the service using a credit card or PayPal.

Form popularity

FAQ

If you missed your court date and wish to schedule a new court date for a Civil Traffic case, you must contact the Clerk's Office in person or in writing, and will be required to fill out a "Civil Traffic Court Defendant's Request Form". This request will be forwarded to the presiding Hearing Officer for review.

Admission is charged to enter regional parks on weekends and holidays only. There is no fee to enter Boaters Park, nature centers, natural areas, and specialty parks.

Court Case Payments Pay court case fines and fees online securely by credit card (Visa, MasterCard, AMEX or Discover) or debit card via MyFloridaCounty.com CourtPay. Receive confirmation of payment after successfully completing the payment process.

Documentary stamp tax is due on a mortgage, lien, or other evidence of indebtedness filed or recorded in Florida. The tax rate is $. 35 per $100 (or portion thereof) and is based on the amount of the indebtedness or obligation secured, even if the indebtedness is contingent.

Recording charges are $10.00 for the first page and $8.50 for each additional page of the same document.

Transaction total between $. 01 to $76.66 will be $1.95. Transaction totals between $76.67 and above will be charged at 2.55%. Acceptable Payment Methods include: Cash, Checks, Money Orders, Master Card, VISA, American Express, Discover Card and (with e-recording) ACH Debit.

VALID FORMS OF PAYMENT Cash, Cashier's Check, Bank Official Check, Money Order, Attorney Trust Account check, or American Express, MasterCard or Visa credit cards. (Proper identification is required when paying in person by credit card.) NO PERSONAL CHECKS ARE ACCEPTED.

Documentary Stamps on Deed - calculated at $7.00/$1,000.00 on the sale price. Title Abstract - $175.00 - $250.00 - This cost can be a buyer cost - However, most Broward County Real Estate Contracts have the Seller paying these costs - See Real Estate Contract.

The only fees should be recording fees and document stamps (usually around $10.00/deed).

The Broward County Records, Taxes and Treasury Division can provide certified copies of documents recorded, including all documents pertaining to ownership of real estate in Broward County, since 1883.