Alameda California Self-Employed Plumbing Services Contract

Description

How to fill out Self-Employed Plumbing Services Contract?

Laws and statutes across various domains differ throughout the nation. If you're not an attorney, it can be challenging to navigate the numerous rules when it comes to creating legal documents.

To steer clear of expensive legal fees while preparing the Alameda Self-Employed Plumbing Services Agreement, you require a validated template suitable for your area. This is where the US Legal Forms platform becomes extremely advantageous.

US Legal Forms is a reliable online repository trusted by millions, containing over 85,000 state-specific legal documents. It serves as an excellent option for both professionals and individuals looking for DIY templates for various personal and business situations. All documents can be reused: after purchasing a template, it remains accessible in your account for future use.

This is the simplest and most cost-effective method to obtain current templates for any legal purposes. Find everything in just a few clicks and maintain your documents in order with US Legal Forms!

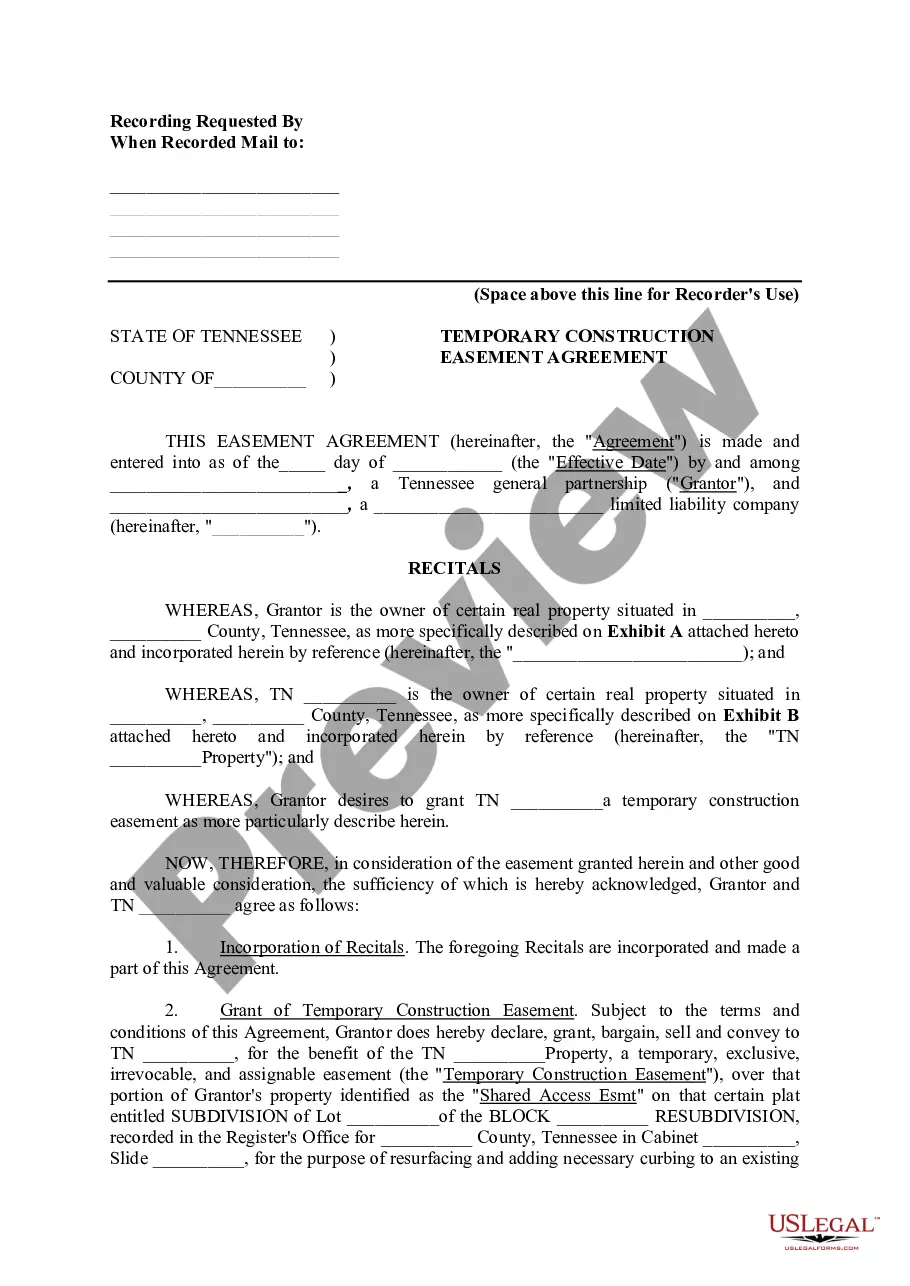

- Review the page details to confirm you have located the correct template.

- Utilize the Preview feature or examine the form description if it exists.

- Search for another document if there are discrepancies with any of your criteria.

- Press the Buy Now button to acquire the template once you identify the suitable one.

- Choose from the subscription plans and log in or set up a new account.

- Decide how you wish to pay for your subscription (via credit card or PayPal).

- Select the format in which you wish to save the file and hit Download.

- Complete and sign the template on paper after printing it or do everything digitally.

Form popularity

FAQ

Yes, independent contractors in California are considered self-employed. This classification means they are responsible for their business operations, taxes, and any benefits they choose to provide for themselves. Understanding this relationship is essential when entering into an Alameda California Self-Employed Plumbing Services Contract.

The majority of states have a mandatory requirement that a business take a fictitious name to register at the county clerk's office in the county where the company is located. You might also need to publish a notice of intent in order to use the name in your local newspaper.

Though California does not require all businesses to obtain a business license, many types of businesses are required at a city or county level. LLCs are a type of legal entity and will still be required to obtain any appropriate business licensing depending on the type of work conducted.

Many California counties require businesses to obtain a business operating license before doing business in the county. This requirement applies to all businesses, including one-person, home-based operations. Many cities require a business license in addition to the county license.

You must obtain a business license from Alameda County only if you are conducting any type of business, including leasing residential and commercial property, or your business is based in an unincorporated area of Alameda County. DO NOT APPLY TO ALAMEDA COUNTY IF YOU OPERATE A BUSINESS WITHIN CITY LIMITS.

To obtain a Business License, contact the City of Alameda Finance Department at (510) 747-4881 or . Obtain all appropriate City of Alameda Permits and approvals. A Certificate of Occupancy is required for all businesses.

During the review process, whether design review, building or other review, City staff may ask for clarifications and or corrections to the submitted plans. Every effort is made to get the initial review of most applications complete within 15 working days of submittal.

A person who is an employee and whose compensation is reported on a Federal W-2 is not in business and is not required to obtain a business license.

If you don't have your paperwork yet, the Alameda County Clerk Recorder is the place to begin. They supply forms for Fictitious Business Names, and they will stamp your form and assign a file number to your application.

Business entity filing is not necessary for sole proprietors, but if you intend to form a corporation, limited liability company or partnership, you must file with the California Secretary of State(SOS). All businesses are required to file state income tax with the Franchise Tax Board(FTB).