Wake North Carolina Hardware, Locks And Screens Installation And Services Contract - Self-Employed

Description

How to fill out Hardware, Locks And Screens Installation And Services Contract - Self-Employed?

A documentation routine consistently accompanies any legal action you undertake.

Establishing a business, applying for or accepting a job proposal, transferring ownership, and various other life circumstances require you to prepare official paperwork that varies by region.

This is why consolidating everything in one location is extremely advantageous.

US Legal Forms is the most comprehensive online repository of current federal and state-specific legal documents.

This represents the simplest and most reliable approach to obtaining legal documentation. All templates available in our library are professionally crafted and validated for compliance with local laws and regulations. Organize your documentation and manage your legal matters effectively with US Legal Forms!

- Here, you can conveniently locate and obtain a document for any personal or business purpose utilized in your jurisdiction, including the Wake Hardware, Locks And Screens Installation And Services Contract - Self-Employed.

- Finding examples on the platform is remarkably easy.

- If you already possess a subscription to our library, Log In to your account, search for the sample using the search bar, and click Download to save it on your device.

- Subsequently, the Wake Hardware, Locks And Screens Installation And Services Contract - Self-Employed will be available for additional use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, adhere to this straightforward guideline to acquire the Wake Hardware, Locks And Screens Installation And Services Contract - Self-Employed.

- Verify that you have accessed the correct page with your local form.

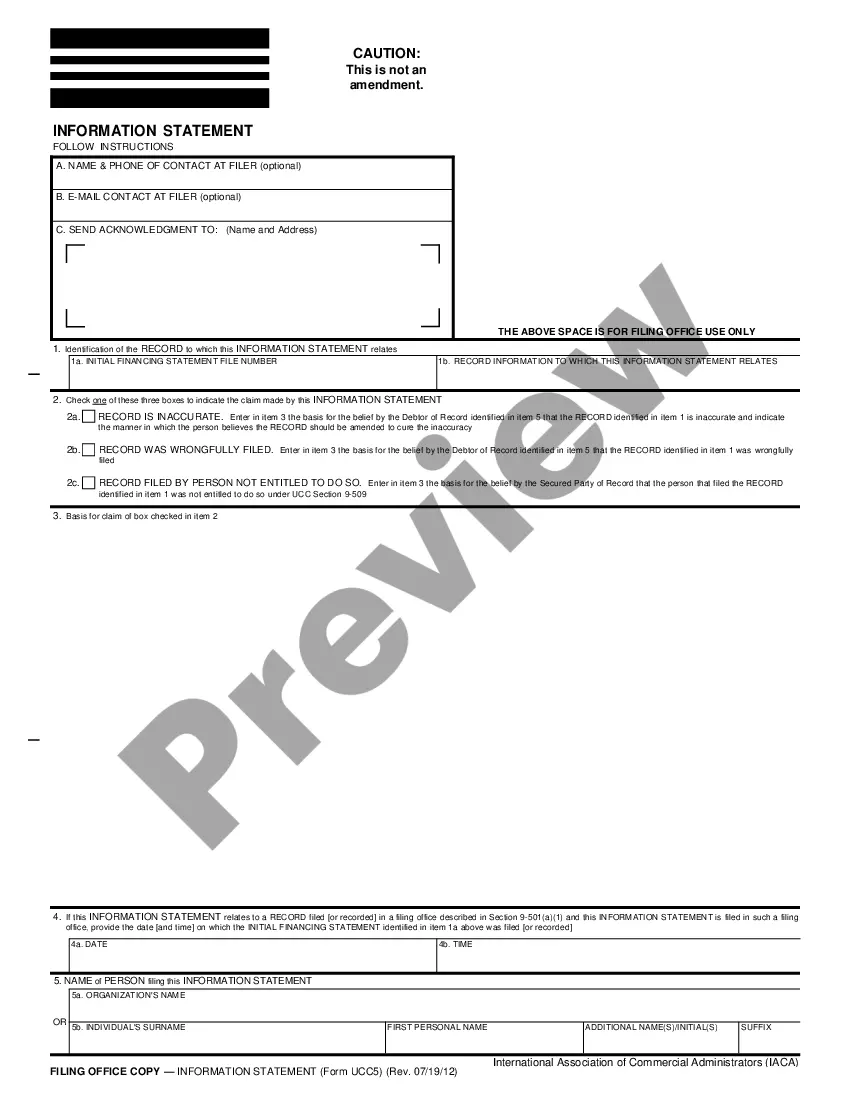

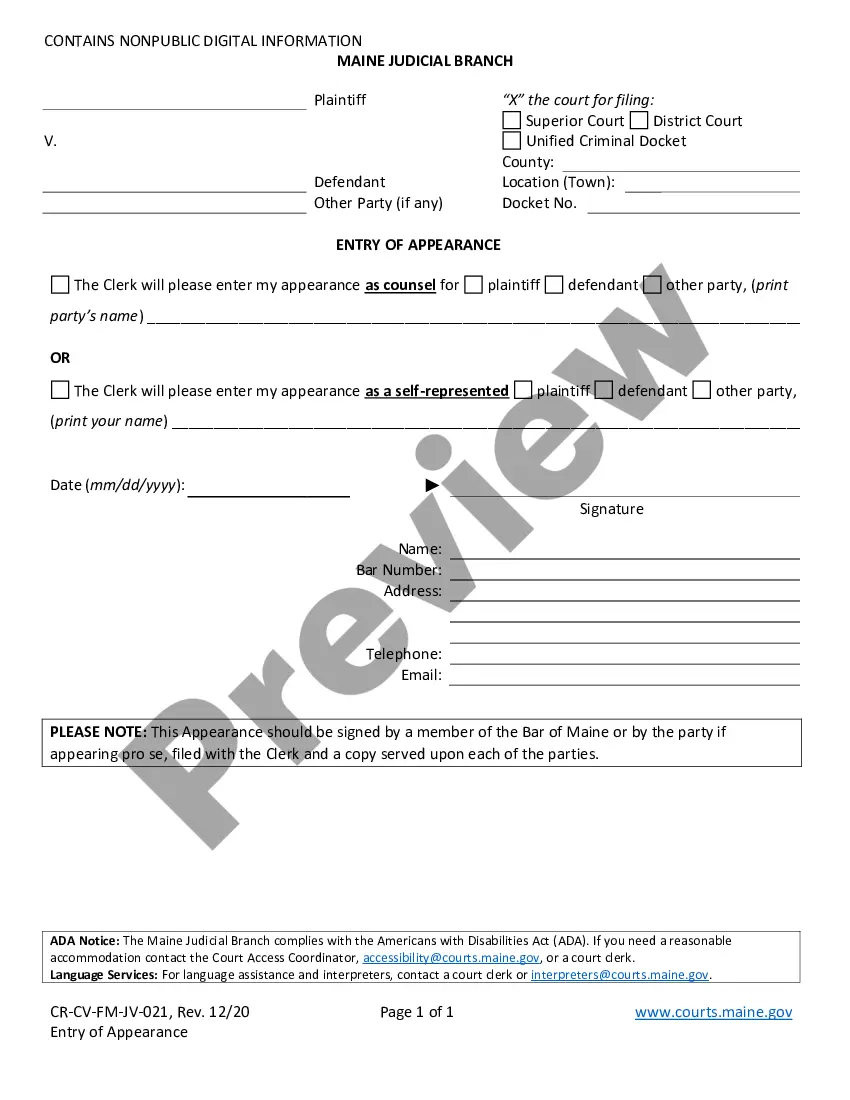

- Utilize the Preview mode (if applicable) and scroll through the sample.

- Examine the description (if any) to confirm the template fulfills your requirements.

- Search for another document via the search bar if the sample does not suit you.

- Click Buy Now upon finding the necessary template.

Form popularity

FAQ

An independent contractor agreement is a document outlining the business relationship between a hiring company and a contractor. These legally binding written documents establish clear expectations, protect both parties, and avoid employment misclassification.

Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied.

This part of your independent contractor contract agreement may say something like: Your Name is an independent contractor and is not an employee of Name of Client. You may also want to specify that you have the sole discretion of how, when, and where you fulfill the terms of your independent contractor agreement

When you produce a 1099-NEC, you provide copies of the form to different recipients: Submit Copy A to the IRS with Form 1096, which reports all 1099 forms issued to contractors and the total dollar amount of payments. Send Copy 1 to your state's department of revenue. Provide Copy B to the recipient (the contractor).

1099 Worker Defined A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

Address. Start date of contract (if no contract, date payments equal $600 or more)...Reporting Requirements Federal Employer Identification Number (FEIN) California employer payroll tax account number (if applicable) Social Security number (SSN) Service-recipient name/business name, address, and phone number.

An Independent Contractor Agreement is a written contract that outlines the terms and conditions of the working arrangement between an independent contractor and client, including: A description of the services provided. Terms and length of the project or service.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What tax forms are needed for an independent contractor to be hired? IRS Tax Form W-9. A W-9 form is used by a company to request a contractor's taxpayer identification number (TIN).IRS Tax Form 1099-NEC.IRS Tax Form 1096.