Kings New York Disability Services Contract - Self-Employed

Description

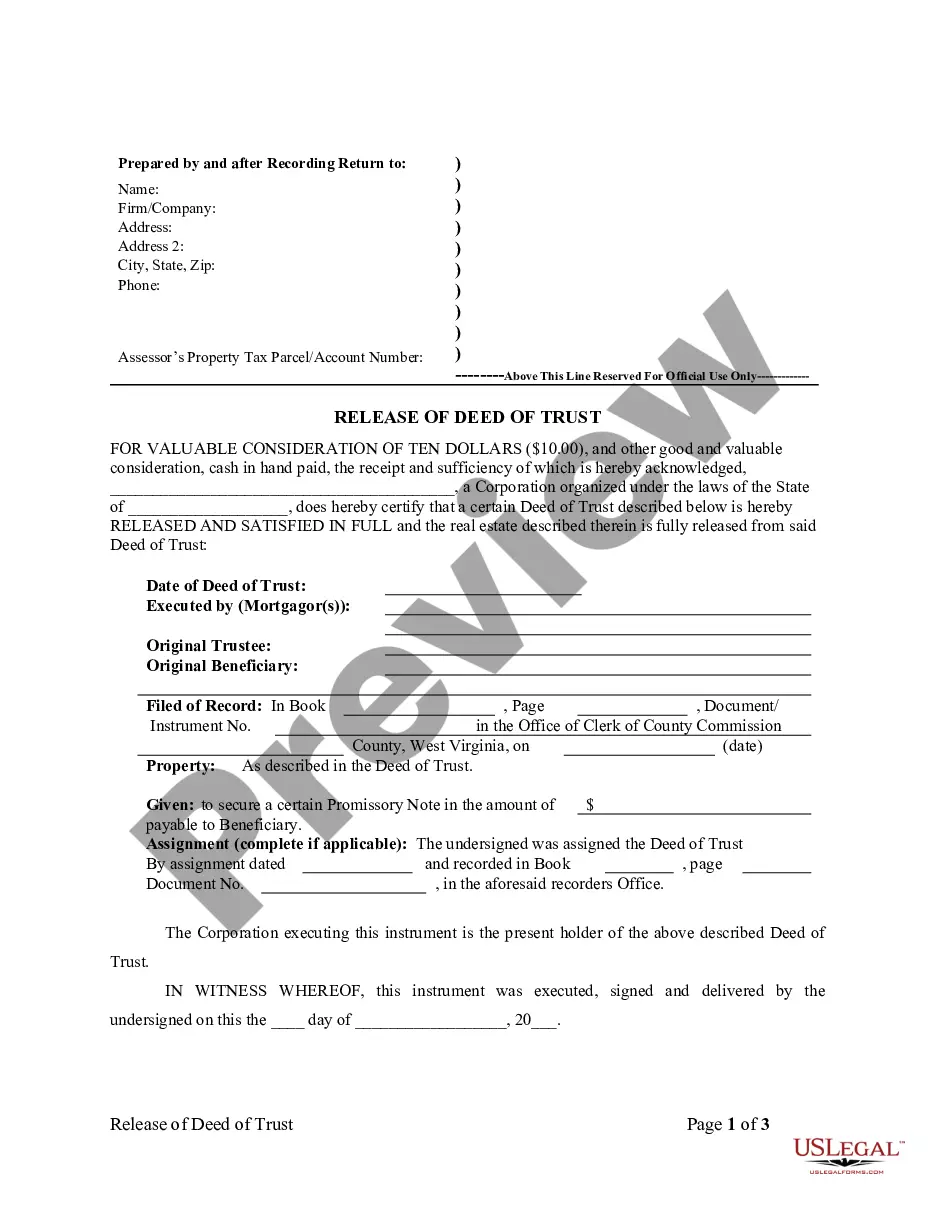

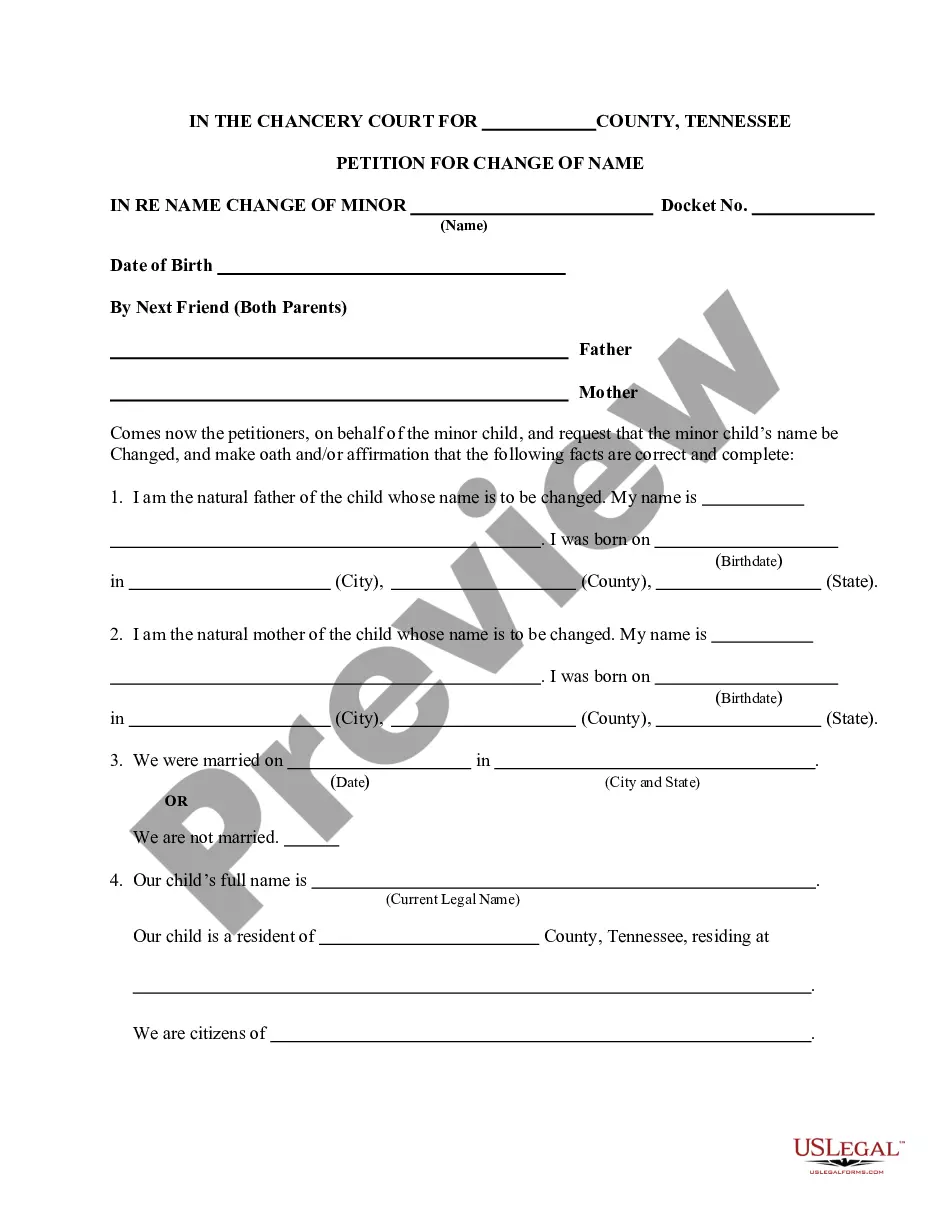

How to fill out Disability Services Contract - Self-Employed?

Drafting paperwork for the company or individual requirements is consistently a significant obligation.

When formulating a contract, a public service inquiry, or a power of attorney, it's vital to consider all federal and state statutes and regulations of the specific area.

Nevertheless, minor counties and even towns possess legislative measures that you need to acknowledge.

Join the platform and swiftly acquire verified legal forms for any situation with just a few clicks!

- All these elements make it daunting and lengthy to create Kings Disability Services Contract - Self-Employed without expert assistance.

- It's achievable to prevent squandering funds on attorneys preparing your documents and establish a legally binding Kings Disability Services Contract - Self-Employed yourself, utilizing the US Legal Forms online library.

- It is the top online catalog of state-specific legal templates that are professionally verified, granting you confidence in their legitimacy when choosing a template for your region.

- Previously registered users only need to Log In to their accounts to access the desired document.

- If you haven't subscribed yet, adhere to the step-by-step guide below to acquire the Kings Disability Services Contract - Self-Employed.

- Browse the page you've accessed and check if it features the template you need.

- To do this, utilize the form description and preview if these features are available.

Form popularity

FAQ

Schedule SE is one of many schedules of Form 1040, the form you use to file your individual income tax return. You use it to calculate your total self-employment tax, which you must report on another schedule of Form 1040Schedule 4 (line 57).

The net income information on Schedule C is used to determine the amount of self-employment tax you owe (for Social Security and Medicare taxes). Schedule SE is used to calculate the self-employment tax amount.

As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly. Self-employed individuals generally must pay self-employment (SE) tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

How to Fill out Schedule SE (IRS Form 1040) - YouTube YouTube Start of suggested clip End of suggested clip On what type of business entity. And what type of earnings. You have if you have a soleMoreOn what type of business entity. And what type of earnings. You have if you have a sole proprietorship. Or a single-member LLC. You'll refer to line 31 of Schedule C if.

You calculate your self-employment tax on Schedule SE and report that amount in the "Other Taxes" section of Form 1040. In this way, the IRS differentiates the SE tax from the income tax.

Report your self-employment income on separate lines for each source by entering your gross income and net income in lines 13500 to 14300 of your income tax and benefit return.

Schedule C (line 31) If you run a sole proprietorship or performed work as an independent contractor, you'll use Schedule C to calculate your total self-employment income (or loss). On Schedule C, total self-employment income is recorded on line 31.

Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program.

You must pay SE tax if you had net earnings of $400 or more as a self-employed person. If you are in business (farm or nonfarm) for yourself, you are self-employed.

You usually must pay self-employment tax if you had net earnings from self-employment of $400 or more. Generally, the amount subject to self-employment tax is 92.35% of your net earnings from self-employment.