Bexar Texas Lab Worker Employment Contract - Self-Employed

Description

How to fill out Lab Worker Employment Contract - Self-Employed?

Drafting legal documents can be challenging. Moreover, if you choose to hire a lawyer to create a commercial contract, papers for property transfer, prenuptial agreement, divorce documentation, or the Bexar Lab Worker Employment Contract - Self-Employed, it might incur substantial costs.

So what is the optimal way to economize time and funds and produce authentic forms fully aligned with your state and municipal laws? US Legal Forms is an ideal answer, whether you are looking for templates for personal or business purposes.

When completed, you can print it out and fill it in on paper or upload the templates to an online editor for quicker and more convenient completion. US Legal Forms allows you to utilize all the documents you have ever obtained multiple times - you can locate your templates in the My documents tab in your account. Give it a try today!

- US Legal Forms is the most comprehensive online repository of state-specific legal documents, offering users the latest and professionally verified templates for any situation gathered all in one location.

- As a result, if you require the most recent version of the Bexar Lab Worker Employment Contract - Self-Employed, you can effortlessly locate it on our platform.

- Acquiring the documents takes minimal time.

- Those with an existing account should confirm that their subscription is active, Log In, and select the template by clicking on the Download button.

- If you have not subscribed yet, here's how you can obtain the Bexar Lab Worker Employment Contract - Self-Employed.

- Browse the page and ensure there is a template for your area.

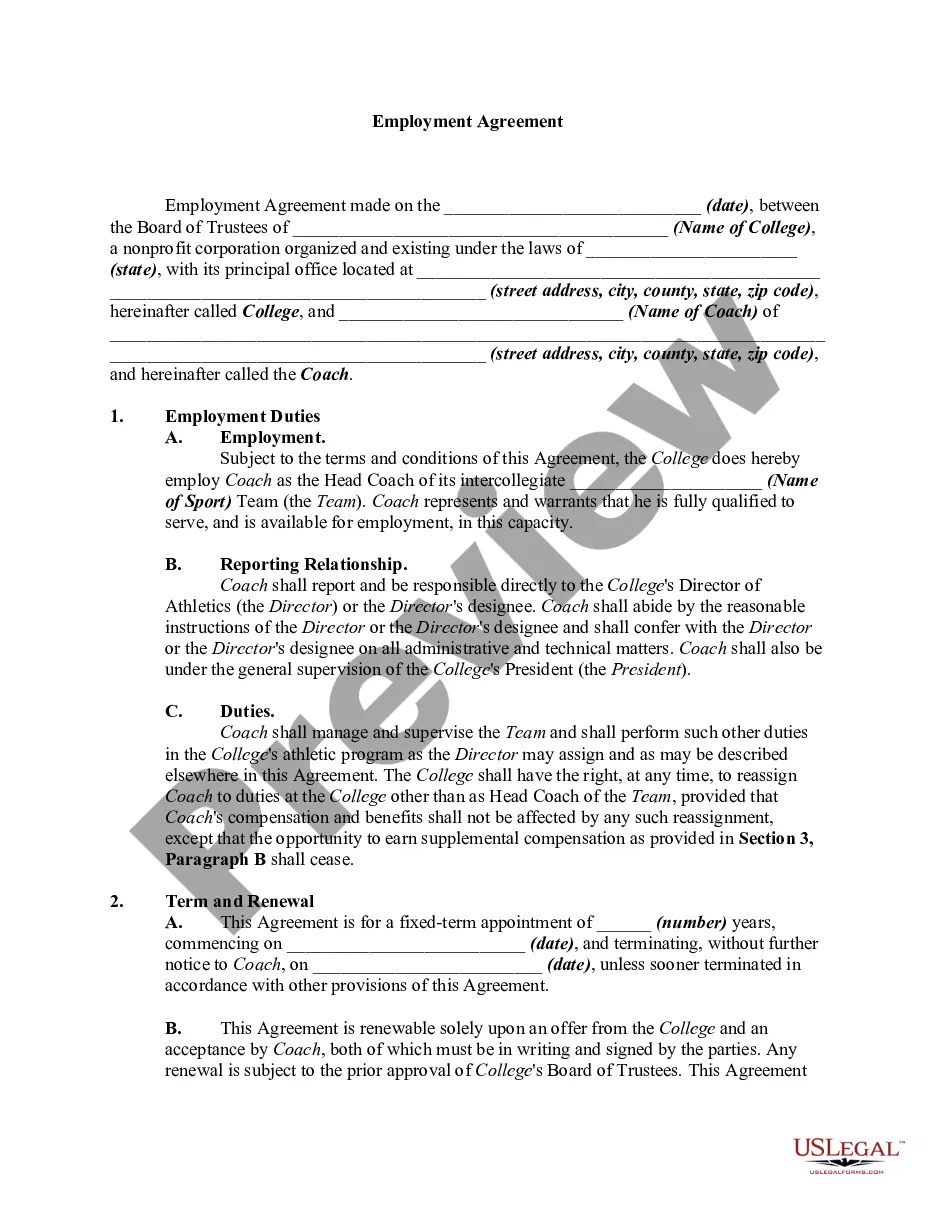

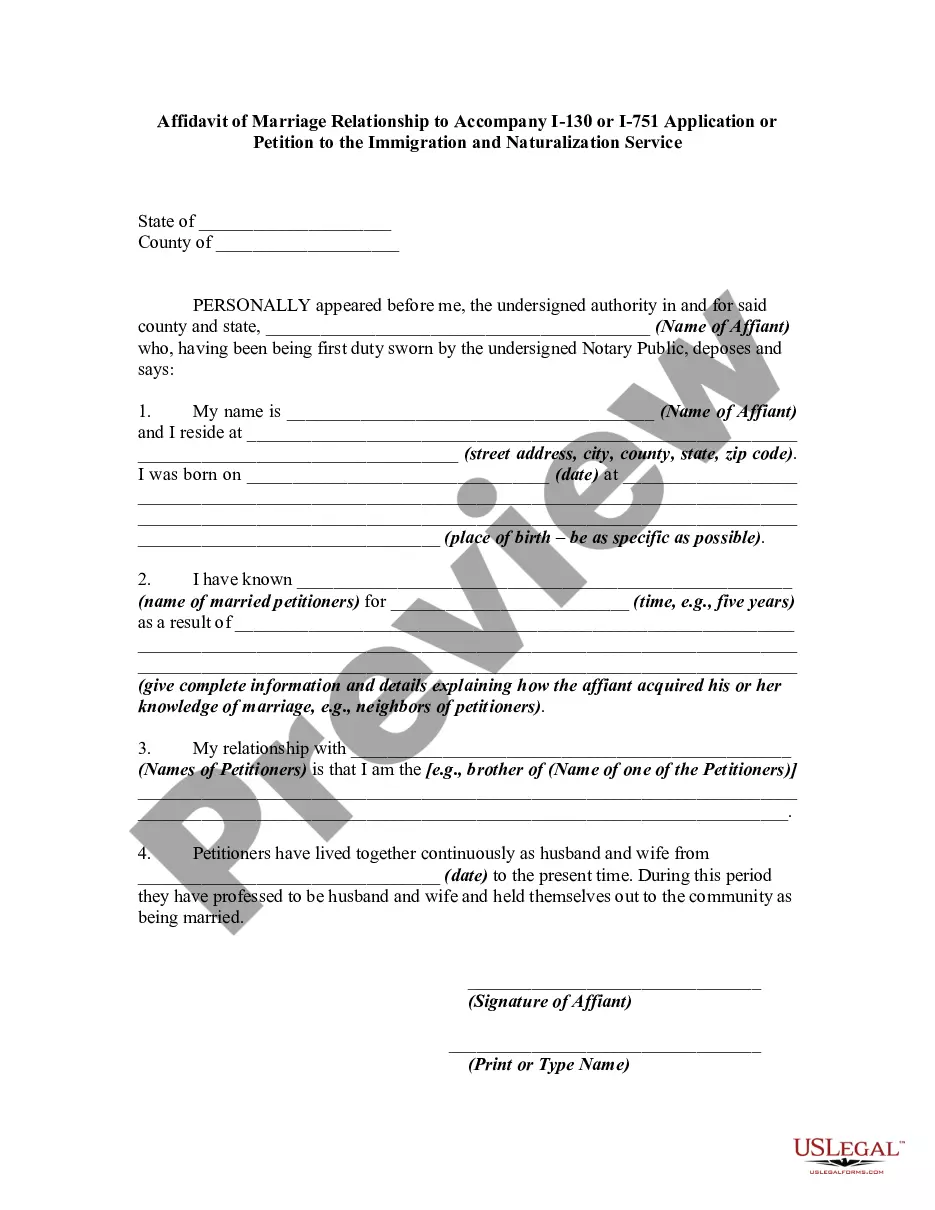

- Review the form description and utilize the Preview option, if available, to confirm it's the template you require.

- Do not fret if the form does not meet your specifications - search for the appropriate one in the header.

- Click Buy Now once you find the needed template and select the most suitable subscription.

- Log in or register for an account to process the payment for your subscription.

- Make a payment using a credit card or via PayPal.

- Select the document format for your Bexar Lab Worker Employment Contract - Self-Employed and save it.

Form popularity

FAQ

An independent contractor is self-employed, bears responsibility for his or her own taxes and expenses, and is not subject to an employer's direction and control.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

An auto mechanic who has a station license, a resale license, buys the parts necessary for the repairs, sets his or her own prices, collects from the customer, sets his or her own hours and days of work, and owns or rents the shop from a third party is an example of an independent contractor.

If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor. You don't necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed (an independent contractor), see our Self-Employed Individuals Tax Center.

Generally, you are self-employed if any of the following apply to you. You carry on a trade or business as a sole proprietor or an independent contractor. You are a member of a partnership that carries on a trade or business.

Whether you're looking for additional income or want to stop working to earn someone else money, here's how to become an independent contractor: Step 1) Name Your Business.Step 2) Register Your Business Entity.Step 3) Obtain a Contractor's License.Step 4) Open Your Business Bank Account.Step 5) Start Marketing.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work for?or provide services to?another entity as a non-employee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Texas doesn't require you to obtain a state-wide Texas business license. But, just like all other states, it does have license and/or certification requirements for business activities and occupations that require extensive training or expose consumers to potential hazards, including: Medical professionals.