Philadelphia Pennsylvania Data Entry Employment Contract - Self-Employed Independent Contractor

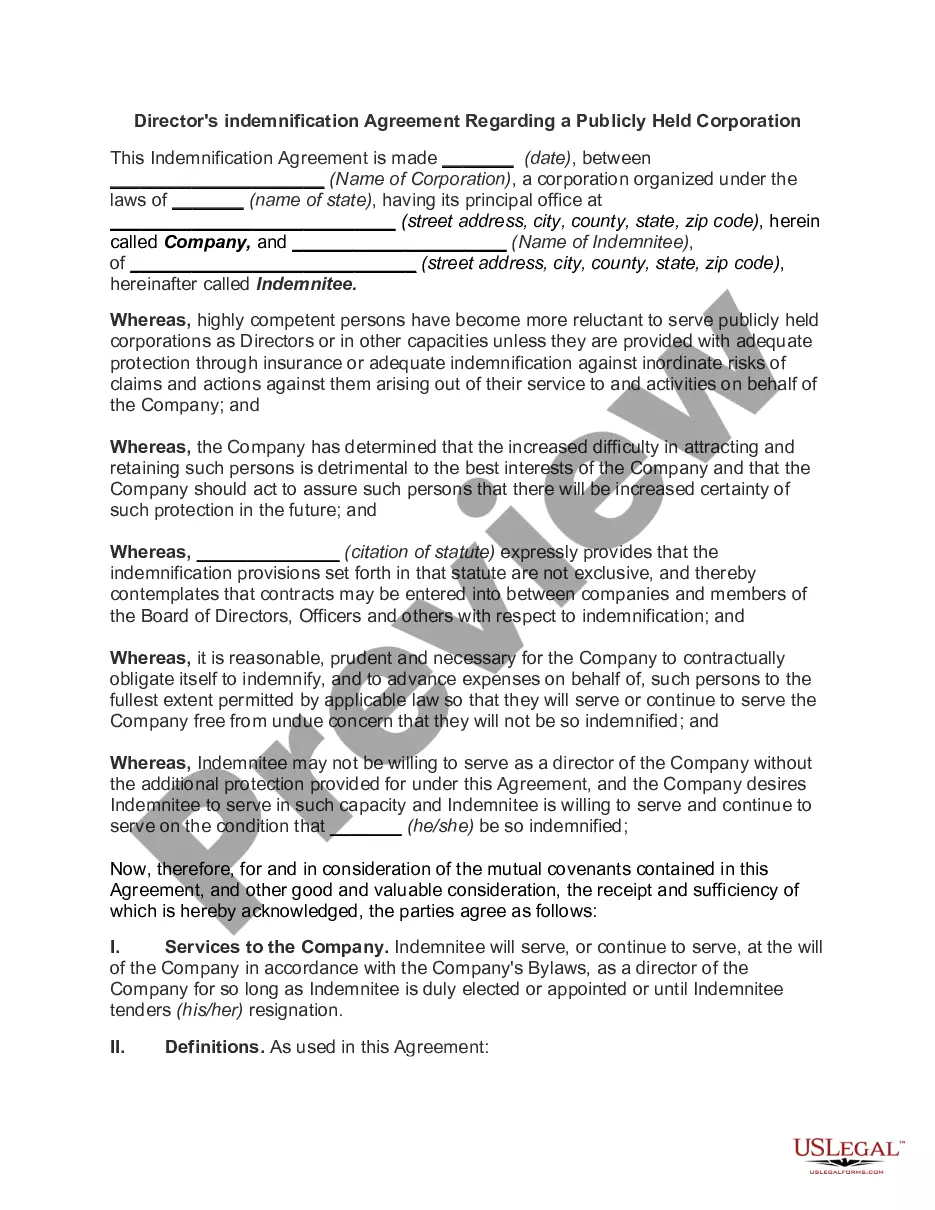

Description

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

Whether you intend to launch your enterprise, engage in a transaction, submit your identification renewal request, or address family-related legal matters, you need to organize specific documentation that complies with your regional laws and regulations.

Locating the appropriate documents may require considerable time and effort unless you utilize the US Legal Forms collection.

The platform offers users access to over 85,000 expertly crafted and verified legal documents for any personal or business scenario. All files are categorized by state and purpose, making it quick and straightforward to select a copy like Philadelphia Data Entry Employment Agreement - Self-Employed Independent Contractor.

Documents available in our library are reusable. With an active subscription, you can access all your previously acquired paperwork at any time in the My documents section of your profile. Stop wasting time on an endless search for current formal documentation. Register for the US Legal Forms platform and maintain your paperwork organized with the most extensive online form library!

- Ensure the sample meets your personal needs and state law specifications.

- Examine the form description and review the Preview if available on the page.

- Utilize the search function providing your state above to find another template.

- Click Buy Now to acquire the file when you identify the correct one.

- Select the subscription plan that fits you best to continue.

- Log in to your account and pay the service using a credit card or PayPal.

- Download the Philadelphia Data Entry Employment Agreement - Self-Employed Independent Contractor in your desired file format.

- Print the document or complete it and sign it electronically via an online editor to save time.

Form popularity

FAQ

The Net Profits Tax (NPT) is imposed on the net profits from the operation of a trade, business, profession, enterprise, or other activity by: Philadelphia residents, even if their business is conducted outside of Philadelphia.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

If you don't have Wage Tax withheld You are a resident of Philadelphia or a non-resident who works in Philadelphia, and. Your employer is not required to withhold the Wage Tax.

Every individual, partnership, association, limited liability company (LLC), and corporation engaged in a business, profession, or other activity for profit within the City of Philadelphia must fb01le a Business Income & Receipts Tax (BIRT) return.

The Earnings Tax is a tax on salaries, wages, commissions, and other compensation paid to a person who works or lives in Philadelphia. You must pay the Earnings Tax if you are a: Philadelphia resident with taxable income who doesn't have the City Wage Tax withheld from your paycheck.

Business Income and Receipts Tax (BIRT) and Net Profits Tax (NPT) The BIRT is a net income and gross receipts tax imposed on individuals, partnerships, limited liability companies, and corporations engaged in business within the City of Philadelphia.

The application for the Commercial Activity License (CAL) and Business Tax Account number (BIRT) is a combination application. You can apply online or in person in the basement of the Municipal Services building. If you apply online, it will take time for the city to process your application.

All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax. Effective July 1, 2021, the rate for residents is 3.8398 percent, and the rate for non-residents is 3.4481 percent.

The application for the Commercial Activity License (CAL) and Business Tax Account number (BIRT) is a combination application. You can apply online or in person in the basement of the Municipal Services building. If you apply online, it will take time for the city to process your application.