King Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor

Description

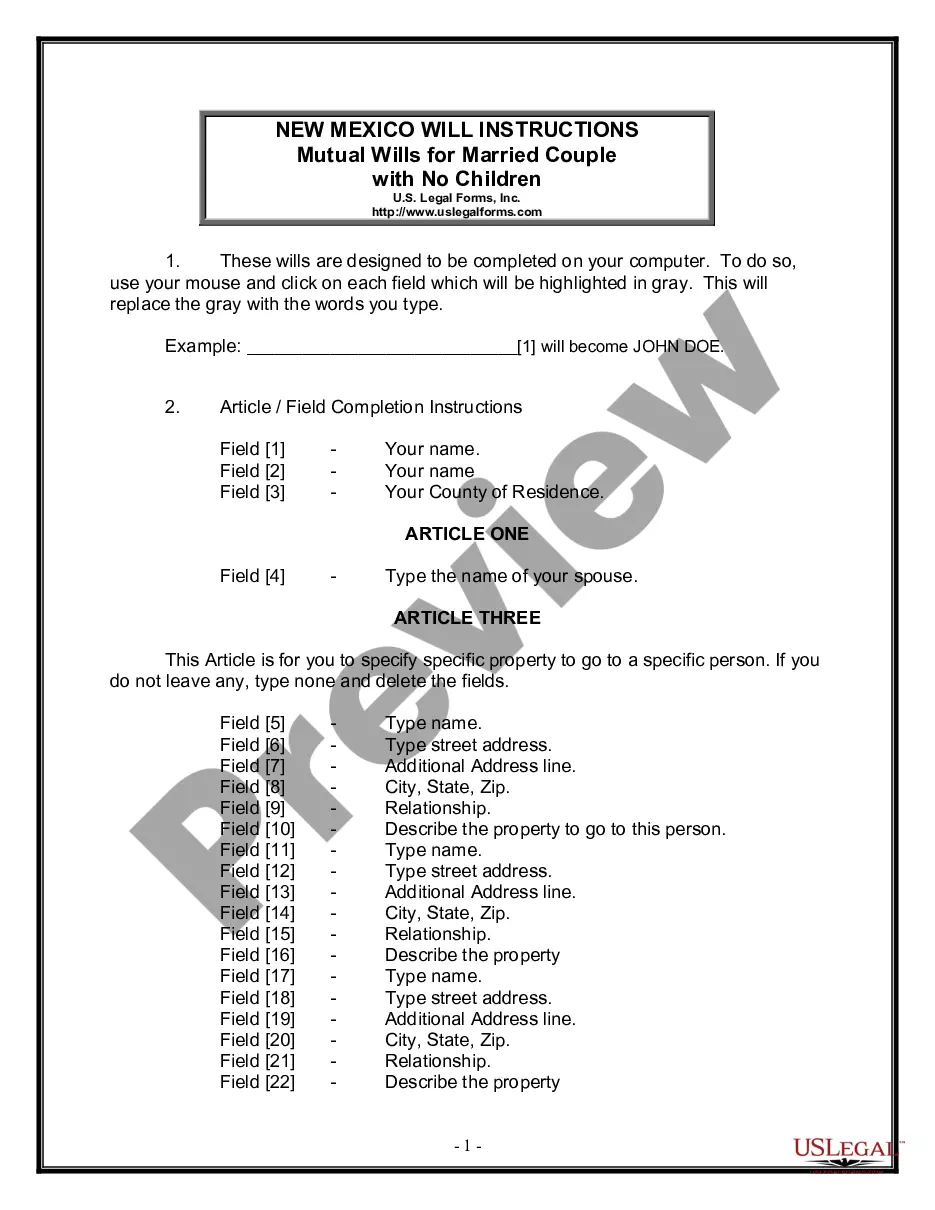

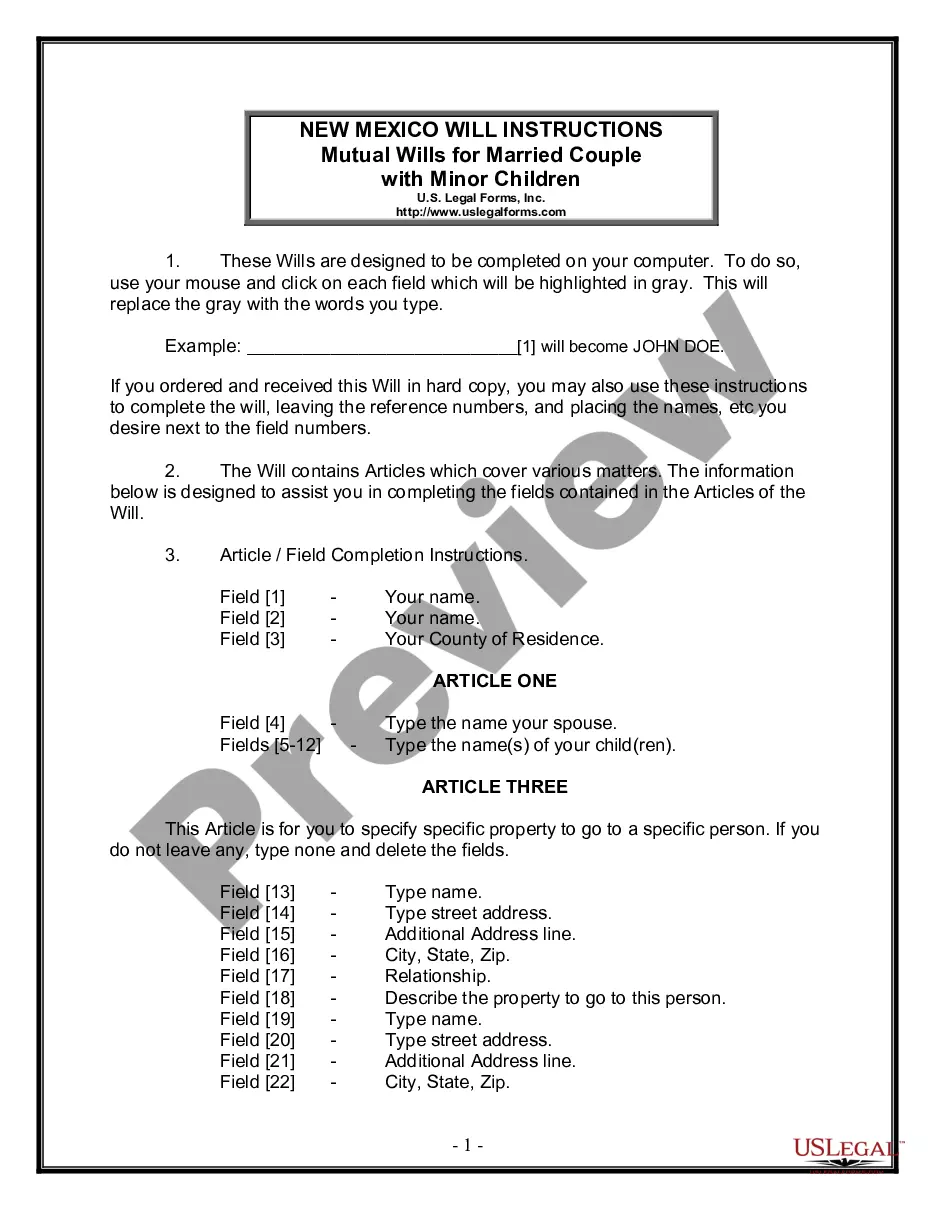

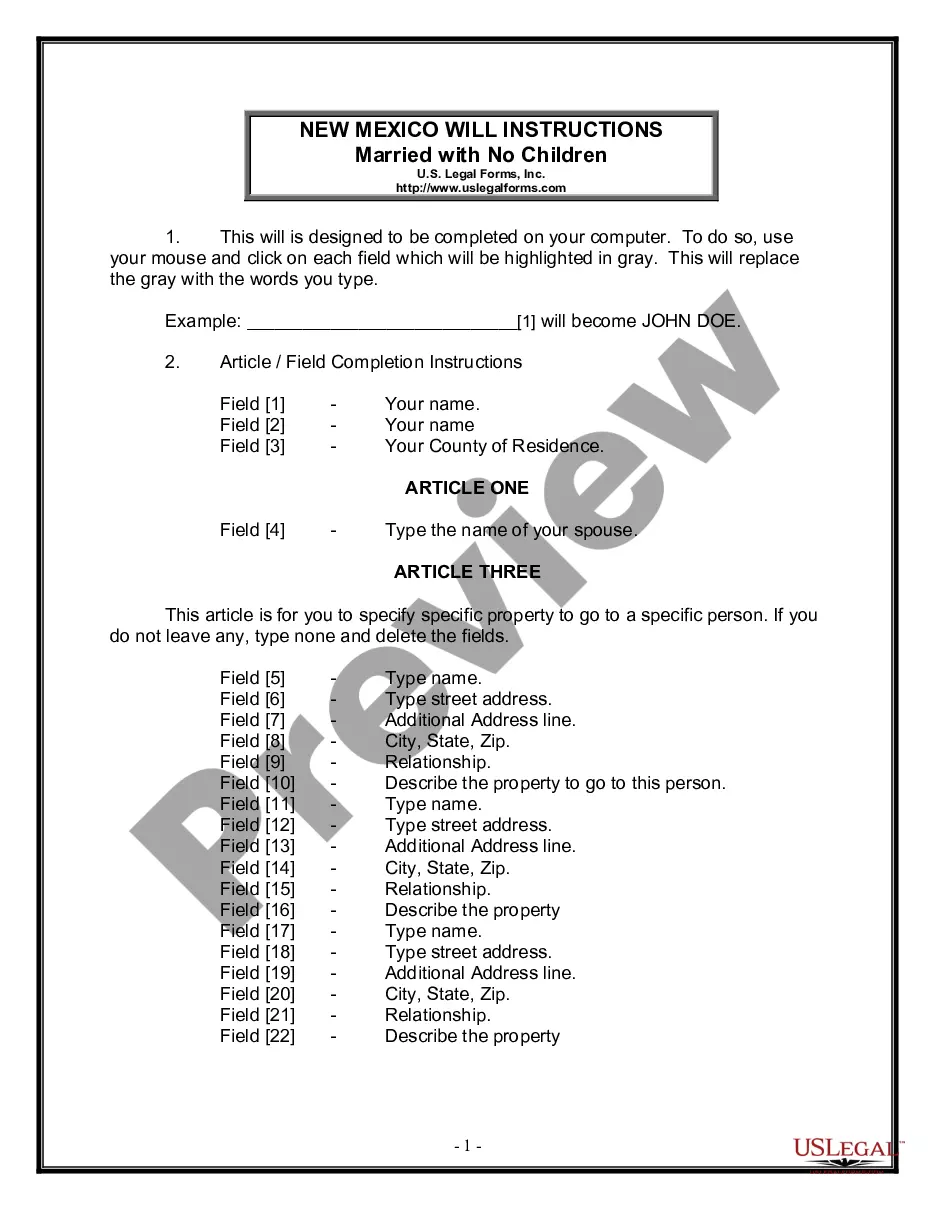

How to fill out Cable Disconnect Service Contract - Self-Employed Independent Contractor?

How long does it typically take you to create a legal document.

Considering that each state has its own laws and regulations for various life scenarios, locating a King Cable Disconnect Service Contract - Self-Employed Independent Contractor that meets all local requirements can be daunting, and procuring it from a qualified attorney is frequently costly.

Many online services provide the most sought-after state-specific templates for download, but utilizing the US Legal Forms library is the most beneficial.

Establish an account on the platform or Log In to continue to payment options. Pay via PayPal or with your credit card. Change the file format if desired. Click Download to save the King Cable Disconnect Service Contract - Self-Employed Independent Contractor. Print the template or utilize any preferred online editor to complete it digitally. Regardless of how often you need to use the acquired document, you can find all the templates you’ve ever saved in your account by accessing the My documents tab. Give it a try!

- US Legal Forms is the most extensive online directory of templates, organized by states and areas of application.

- In addition to the King Cable Disconnect Service Contract - Self-Employed Independent Contractor, here you can discover any particular form to manage your business or personal matters, adhering to your local regulations.

- Professionals validate all templates for their accuracy, so you can be assured of preparing your documents correctly.

- Utilizing the service is exceedingly straightforward.

- If you already possess an account on the platform and your subscription is active, you only need to Log In, select the necessary template, and download it.

- You can keep the file in your account at any time in the future.

- Alternatively, if you are new to the site, there will be additional steps to follow before you can acquire your King Cable Disconnect Service Contract - Self-Employed Independent Contractor.

- Review the content of the page you’re visiting.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you are confident in your selected document.

- Choose the subscription plan that best fits your needs.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How to Fill Out a 1099-MISC Form Enter your information in the 'payer' section.Fill in your tax ID number.As a business owner, enter the contractor's tax ID number which is found on their form W-9.Fill out the account number you have assigned to the independent contractor.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Instead, ending a contractor relationship involves terminating the professional services agreement and statement of work between your company and the contractor. For this reason, as long as you have correctly classified your independent contractor, labor laws do not apply to your relationship with this individual.

Generally, California employees are not required by law to give any advance notice to their employer before they quit their job. In some cases, however, the terms of an employment contract could require a specific time or manner of notice.

The short answer is no. You can't fire a contractor like you would an employee because they are self-employed, not your employee. But you can terminate your relationship if the worker fails to deliver according to the terms of your contractif you have one.

employed person refers to any person who earns their living from any independent pursuit of economic activity, as opposed to earning a living working for a company or another individual (an employer).

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.