Cuyahoga Ohio Investor Certification Form

Description

How to fill out Investor Certification Form?

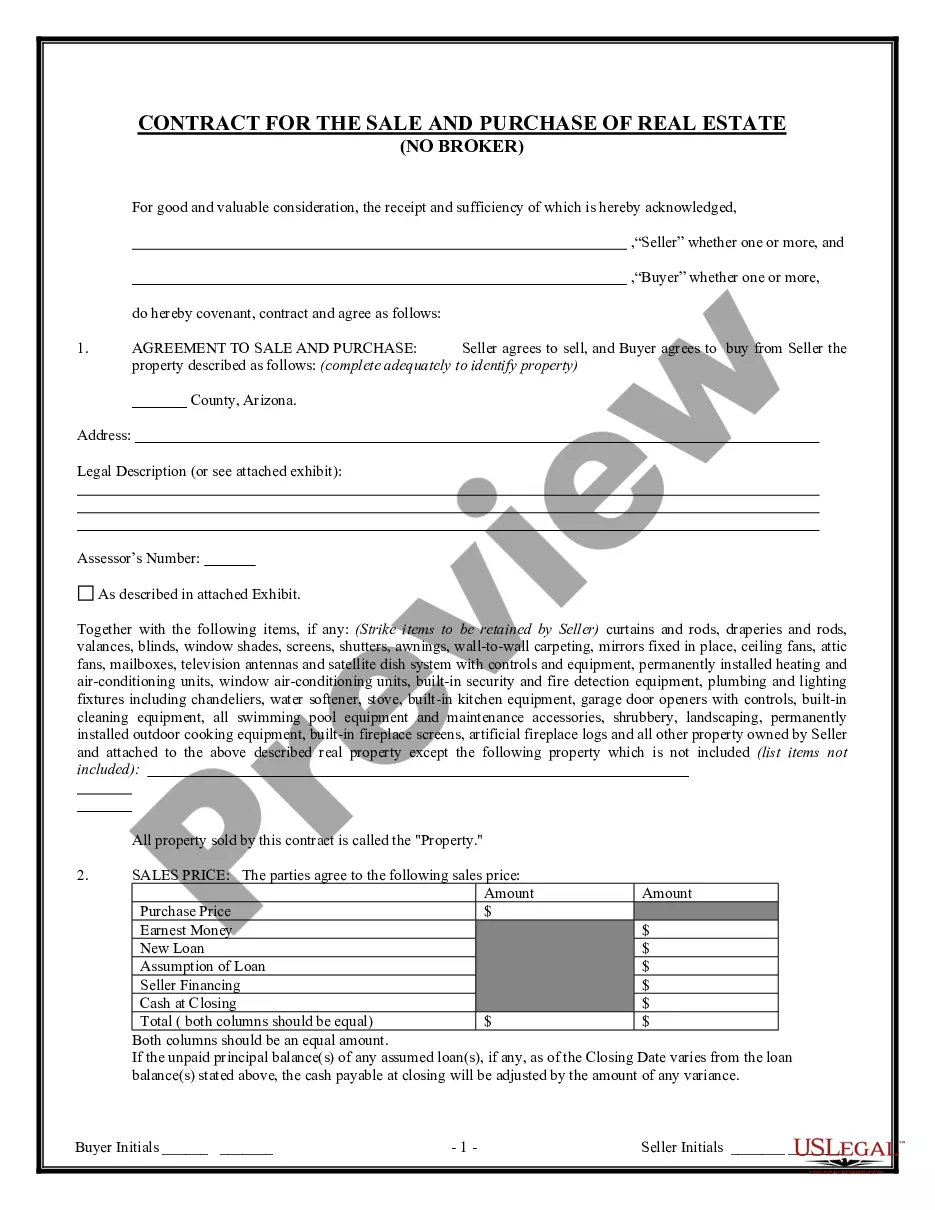

Do you require to promptly create a legally-enforceable Cuyahoga Investor Certification Form or perhaps any alternate document to manage your personal or business affairs.

You can choose between two alternatives: employ a legal consultant to prepare a legitimate document for you or craft it entirely independently. Fortunately, there's another option - US Legal Forms.

If the document includes a description, ensure to confirm its intended use.

Revisit the search process if the form isn’t what you were searching for by using the search field in the header.

- It will assist you in obtaining professionally composed legal documents without incurring exorbitant fees for legal services.

- US Legal Forms boasts a vast collection of over 85,000 state-specific form templates, which includes the Cuyahoga Investor Certification Form and form bundles.

- We provide documents for a diverse range of life situations: from divorce filings to real estate forms.

- With more than 25 years of experience, we've built a solid reputation among our clientele.

- Here's how you can join them and acquire the necessary template without undue hassle.

- To begin, verify that the Cuyahoga Investor Certification Form complies with your state's or county's regulations.

Form popularity

FAQ

Completing a paper probate application form If there's not a will, fill in form PA1A. You can do this yourself or you can call the probate and inheritance tax helpline for help completing the form.

Most estates will need to go through probate in Ohio unless they are part of a living trust. However, there are different types of probate, and some estates may qualify for a simplified version.

2117.02: If you are the executor or administrator of an estate, this spells out the procedures and requirements necessary if you want to make a claim against the estate in probate court. Claims must be filed within 3 months of the decedent's death.

Unlike other states, like Colorado, which require a will to be submitted to probate within days of the death, or Pennsylvania, which has a criminal statute for failing to submit a will for probate, Ohio has neither a strict time limit nor a criminal penalty for failing to probate a will.

Basic Ohio Probate Forms Version 8 - YouTube YouTube Start of suggested clip End of suggested clip Form thirteen point seven at the same time I may as well send the two children to the required formsMoreForm thirteen point seven at the same time I may as well send the two children to the required forms you can see how quickly that is I just clicked to another person in the worksheet.

Documents Needed to Apply for Probate The original Will and any codicils. Codicils are small additions to a Will. Two copies of the Will and any codicils on plain A4.The death certificate or an interim one. The correct Inheritance Tax Form, whether Inheritance Tax is payable or not.

To the executor or administrator in a writing, and to the probate court by filing a copy of the writing with it; In a writing that is sent by ordinary mail addressed to the decedent and that is actually received by the executor or administrator within the six month time frame.

The executor has three months from their assignation to prepare and file a complete list of the estate's assets. Note that, under Ohio probate law, creditors have six months to file any claims.

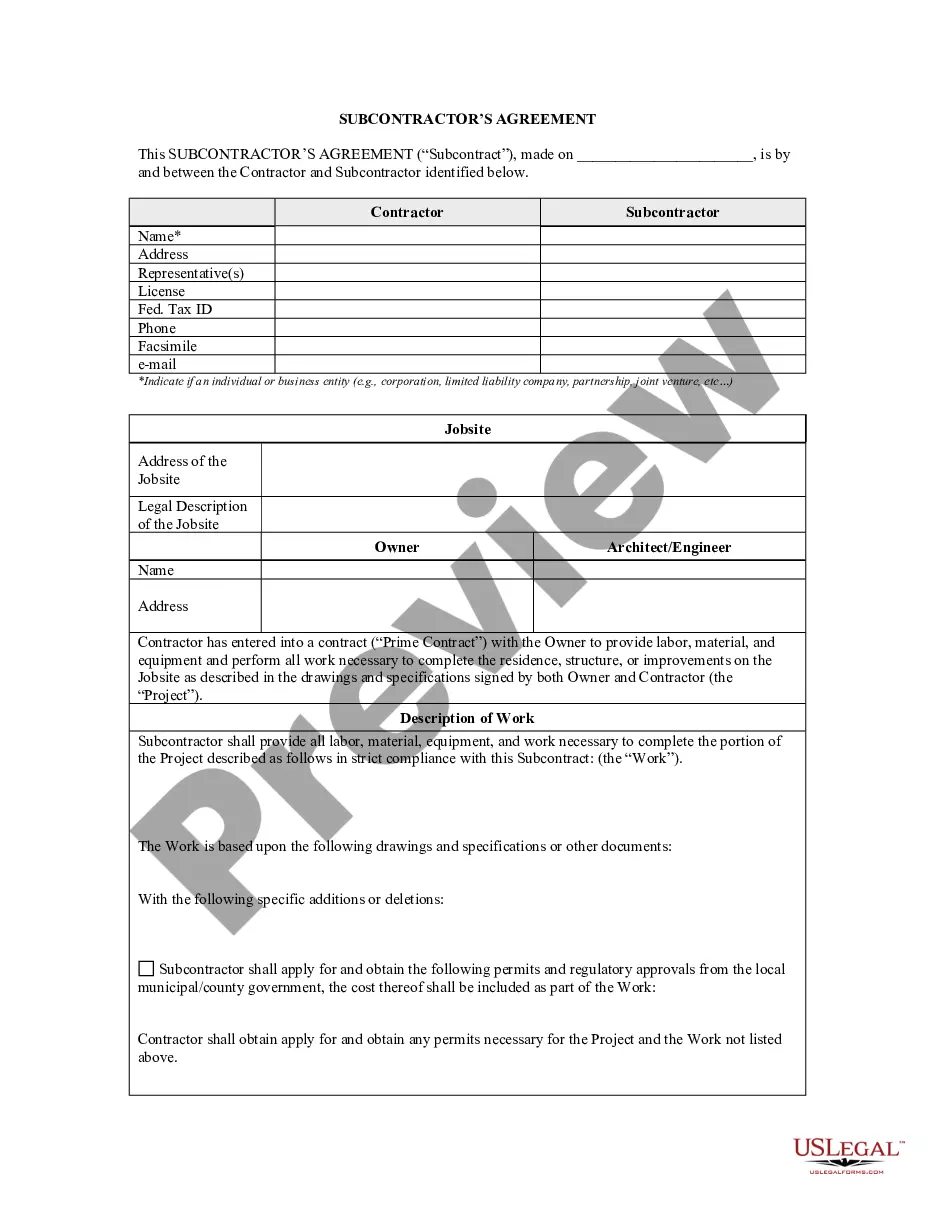

Tax Abatement is available to both homeowners and developers. All work must be completed under a true and accurate permit issued by the City of Cleveland Department of Building and Housing, and the property must be located in the City of Cleveland.

To probate a will in Ohio, take the following steps: Step 1: Find and File the Decedent's Will.Step 2: Order Decedent's Death Certificate.Step 3: Petition for Probate.Step 4: The Probate Is Opened and Letters of Authority Are Issued.Step 5: Administration, Creditors, and Inventory of the Estate.