Riverside California Private Placement Subscription Agreement

Description

How to fill out Riverside California Private Placement Subscription Agreement?

Preparing documents for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Riverside Private Placement Subscription Agreement without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Riverside Private Placement Subscription Agreement by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Riverside Private Placement Subscription Agreement:

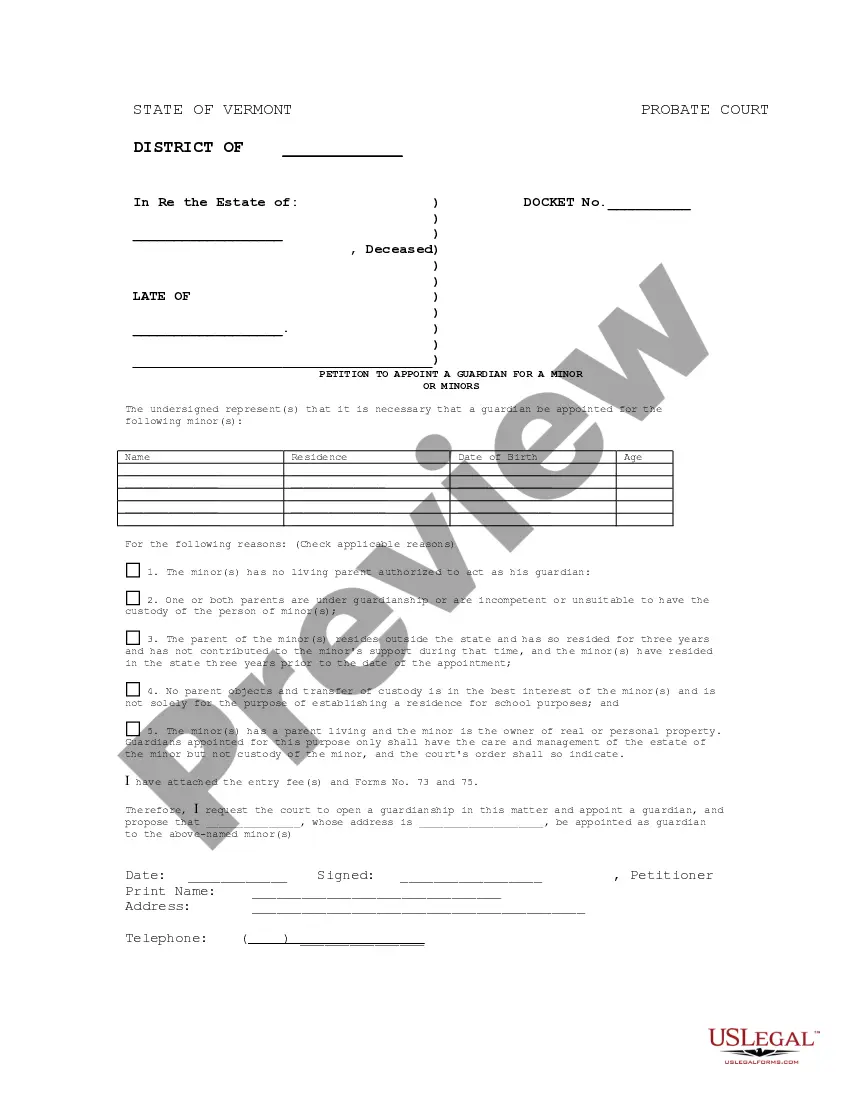

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

A subscription agreement is an agreement that defines the terms for a party's investment into a private placement offering or a limited partnership (LP). Regulation D lets companies doing specific types of private placements raise capital without needing to register the securities with the SEC.

Private companies tend to use subscription agreements if they want to raise capital from investors that are private. This can be done by selling either shares or the company's ownership without needing to register with the SEC.

A subscription agreement is an agreement that defines the terms for a party's investment into a private placement offering or a limited partnership (LP). Rules for subscription agreements are generally defined in SEC Rule 506(b) and 506(c) of Regulation D.

A subscription contract is an investor`s request to join a single limited partnership. It is also a bilateral guarantee between a company and a subscriber. The company agrees to sell a certain number of shares at a certain price and, in return, the participant promises to buy the shares at the predetermined price.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

A subscription license agreementor SLA for shortis an agreement between the manufacturer of a product and the consumer who wishes to use that product. These agreements exist to both protect proprietary software from abuse and prevent fraud.

An LLC subscription agreement is an investor's application to join a limited liability company (LLC). It is also a two-way guarantee between a company and a new shareholder (subscriber).

Issuing in the private placement market offers companies a variety of advantages, including maintaining confidentiality, accessing long-term, fixed-rate capital, diversifying financing sources and creating additional financing capacity.

Just as the PPM provides disclosure to the client regarding the company's financial status,the Subscription Agreement provides full disclosure to the company regarding the investor's financial status.