King Washington Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out King Washington Term Sheet - Series A Preferred Stock Financing Of A Company?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the King Term Sheet - Series A Preferred Stock Financing of a Company, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the King Term Sheet - Series A Preferred Stock Financing of a Company from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the King Term Sheet - Series A Preferred Stock Financing of a Company:

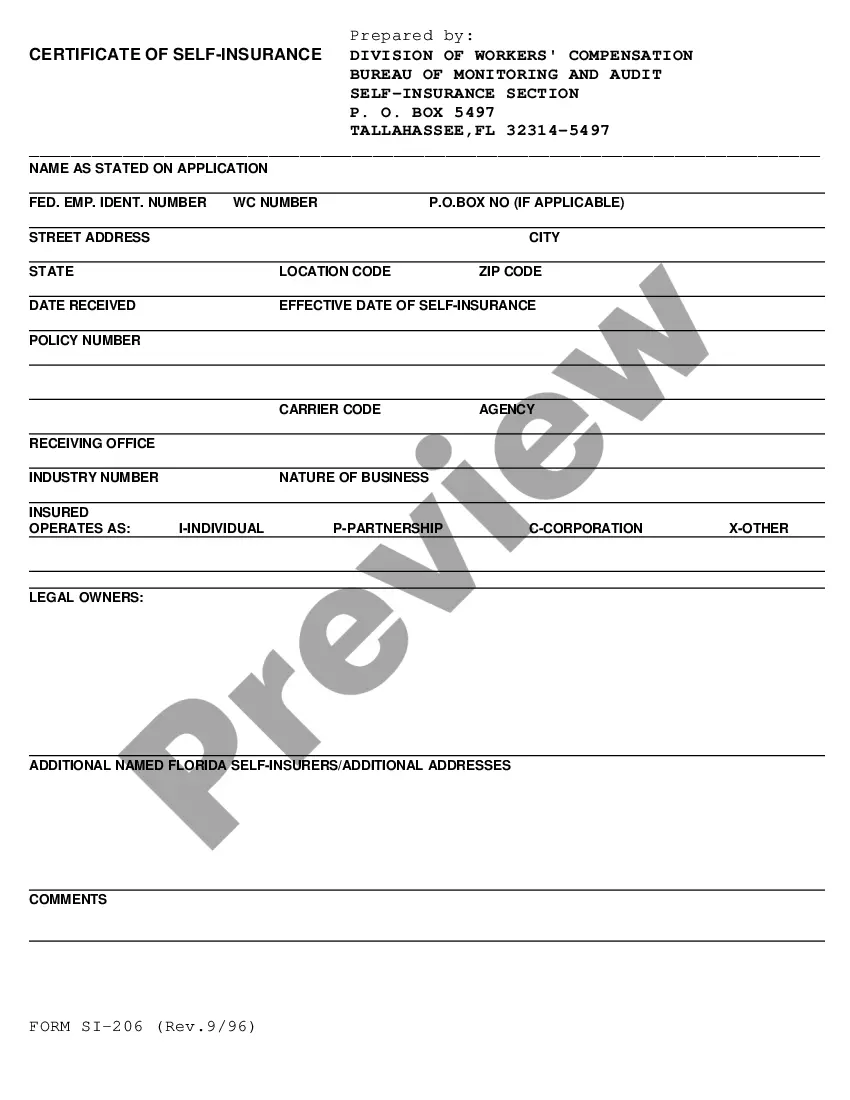

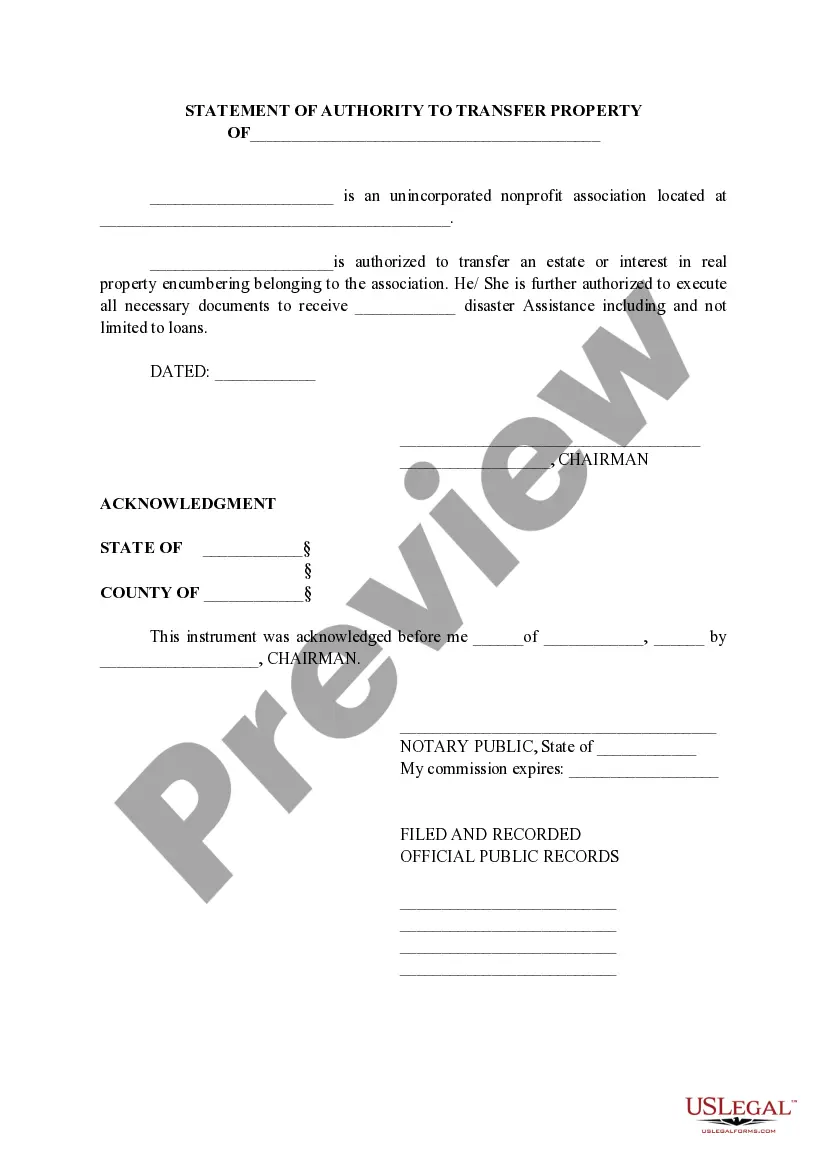

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

What Is the Purpose of a Term Sheet? The purpose of a term sheet is to profile an understandable and detailed document that investors and company founders can use to negotiate and agree upon the important terms of their agreement without the fine detail or permanency of a binding document.

A Series A term sheet is a basic agreement that outlines all the terms and conditions of the investment. Term sheets usually focus on two key areas; control of company shares and how financials will be divided if an exit occurs.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

In a seed round, the investor will typically be the one providing the term sheet. This may change, especially when there are multiple investors in later and larger rounds. Common items in a term sheet include: Who is issuing the note or stock.

Preferred stock gives you a financing alternative to taking on debt. You generally maintain greater control over your company than if you issue new common shares. You can also remain flexible for future financing rounds by keeping debt off of your balance sheet and retaining a call option.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with startups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

Series A Dividends means the cumulative dividends on each share of Series A Preferred Stock equal to the product of the Series A Base Value (as adjusted for stock dividends, stock splits, combinations, recapitalizations or the like) times a rate per annum of 8%.

A term sheet represents a good faith agreement between a company and an investor to move forward one financing transaction under the major terms outlined in it. Term sheets are typically non-binding, meaning that there is no obligation on either party to actually consummate the transaction.

The term sheet is the document that outlines the terms by which an investor (angel or venture capital investor) will make a financial investment in your company. Term sheets tend to consist of three sections: funding, corporate governance and liquidation.