Allegheny Pennsylvania Stock Option Agreement of Quantum Effect Devices, Inc. is a legal and binding document that outlines the terms and conditions related to stock options offered by Quantum Effect Devices, Inc. (QED). This agreement establishes the rights and obligations of both the company and the option holder regarding the purchase of QED's stock at a predetermined price within a specific timeframe. The Allegheny Pennsylvania Stock Option Agreement is tailored specifically for the jurisdiction of Allegheny Pennsylvania, ensuring compliance with local laws and regulations. It reflects the unique characteristics of QED as a company operating within the region and acknowledges the relevant legal framework governing stock option agreements. Some key elements covered in the Allegheny Pennsylvania Stock Option Agreement include: 1. Grant of Options: It specifies the number of stock options being granted to the option holder and the exercise price at which shares can be purchased. 2. Vesting Schedule: This outlines the timeframe during which the option holder will acquire the right to exercise their options. It typically follows a vesting schedule that incentivizes and rewards continued commitment and loyalty over a certain period, motivating employees to stay with the company long-term. 3. Expiration Date: The agreement specifies the expiration date or the last day on which the option holder can exercise their stock options. 4. Exercise of Options: It delineates the process by which option holders can exercise their options, including any necessary documentation, payment methods, and notification requirements. 5. Restrictions and Conditions: The agreement may include certain restrictions and conditions imposed on stock options, such as limitations on transferability, eligibility criteria, or compliance with company policies. It is important to note that while Allegheny Pennsylvania Stock Option Agreement of Quantum Effect Devices, Inc. describes a specific instance, similar agreements may exist with modified terms based on different factors such as the employee's position, stock option plan, or negotiations between parties. In conclusion, the Allegheny Pennsylvania Stock Option Agreement of Quantum Effect Devices, Inc. is a legally binding document outlining the terms and conditions of stock options granted by QED to its employees or other individuals associated with the company. It serves to protect the rights and interests of both parties involved and ensures compliance with local laws in Allegheny Pennsylvania.

Allegheny Pennsylvania Stock Option Agreement of Quantum Effect Devices, Inc.

Description

How to fill out Allegheny Pennsylvania Stock Option Agreement Of Quantum Effect Devices, Inc.?

Whether you plan to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Allegheny Stock Option Agreement of Quantum Effect Devices, Inc. is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Allegheny Stock Option Agreement of Quantum Effect Devices, Inc.. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law requirements.

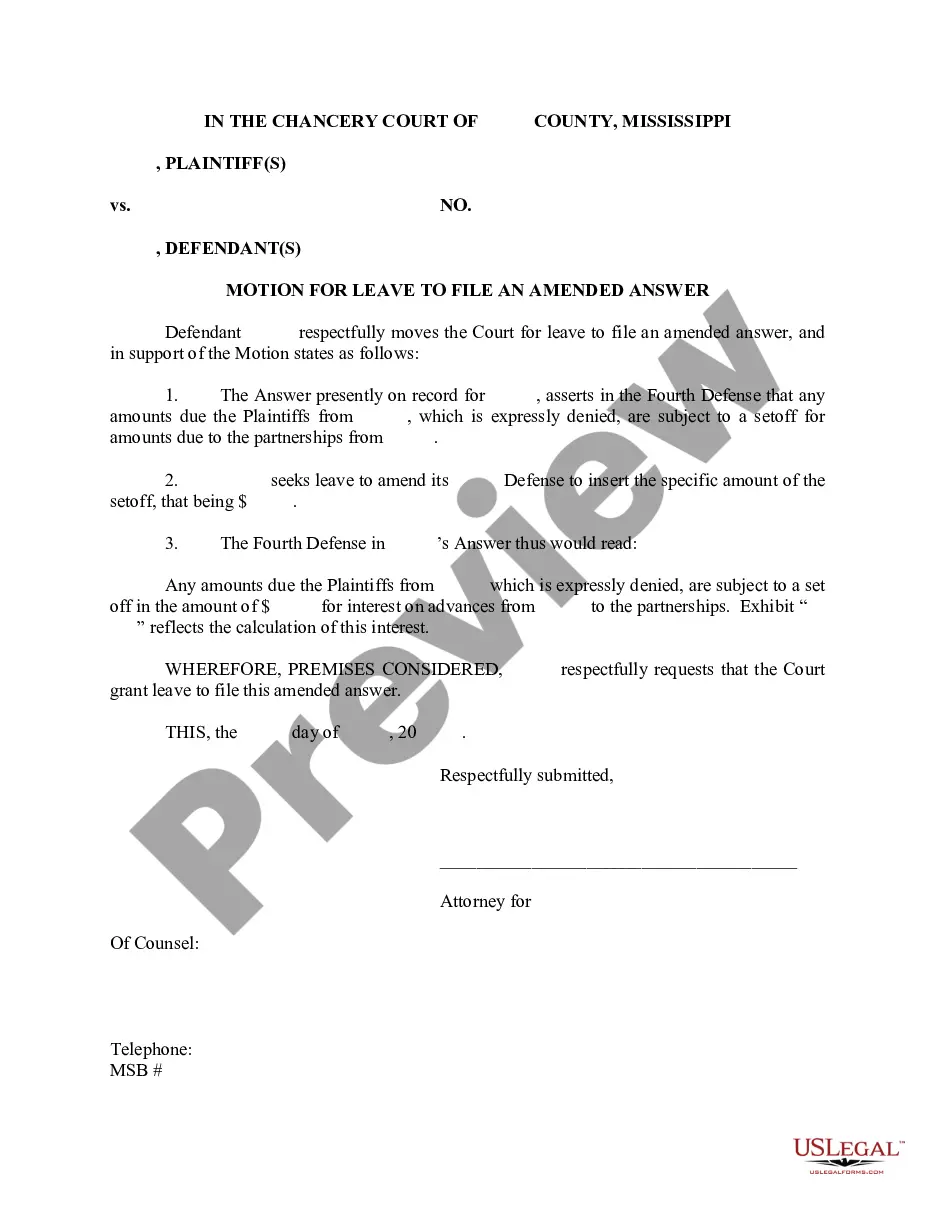

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Stock Option Agreement of Quantum Effect Devices, Inc. in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

For example, a stock option is for 100 shares of the underlying stock. Assume a trader buys one call option contract on ABC stock with a strike price of $25. He pays $150 for the option. On the option's expiration date, ABC stock shares are selling for $35.

What Is a Stock Option? A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date. There are two types of options: puts, which is a bet that a stock will fall, or calls, which is a bet that a stock will rise.

Employee Stock option plan or Employee Stock Ownership Plan (ESOP) is an employee benefit scheme that enables employees to own shares in the company. These shares are purchased by employees at price below market price, or in other words, a discounted price.

If you exercised nonqualified stock options (NQSOs) last year, the income you recognized at exercise is reported on your W-2. It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation.

Stock options are commonly used to attract prospective employees and to retain current employees. The incentive of stock options to a prospective employee is the possibility of owning stock of the company at a discounted rate compared to buying the stock on the open market.

These options come in the form of regular call options and give the employee the right to buy the company's stock at a specified price for a finite period of time. Terms of ESOs will be fully spelled out for an employee in an employee stock options agreement.

For nonstatutory options without a readily determinable fair market value, there's no taxable event when the option is granted but you must include in income the fair market value of the stock received on exercise, less the amount paid, when you exercise the option.

With nonqualified stock options, for employees the spread at exercise is reported to the IRS on Form W-2 For nonemployees, it is reported on Form 1099-MISC (starting with the 2020 tax year, it will be reported on Form 1099-NEC ). It is included in your income for the year of exercise.

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

What are the cons of offering employee stock options? Although stock option plans offer many advantages, the tax implications for employees can be complicated. Dilution can be very costly to shareholder over the long run. Stock options are difficult to value.