Phoenix Arizona Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

Description

How to fill out Pooling And Servicing Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. And Bank One?

Drafting documents, such as the Phoenix Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One, to manage your legal matters is a challenging and time-intensive undertaking.

Numerous situations necessitate an attorney’s participation, which also renders this endeavor somewhat unaffordable.

However, you can take control of your legal concerns and handle them independently.

Countless businesses and individuals are already benefiting from our vast library. Enroll now if you want to discover what additional benefits you can gain with US Legal Forms!

- US Legal Forms is here to assist you.

- Our site contains over 85,000 legal templates designed for diverse situations and life events.

- We ensure each document complies with the regulations of each state, so you won’t need to fret about possible legal complications regarding adherence.

- If you’re already familiar with our platform and maintain a subscription with US, you understand how simple it is to obtain the Phoenix Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One form.

- Just Log In to your account, download the document, and customize it to suit your preferences.

- Lost your document? No problem. You can retrieve it from the My documents section in your account - accessible on both desktop and mobile.

Form popularity

FAQ

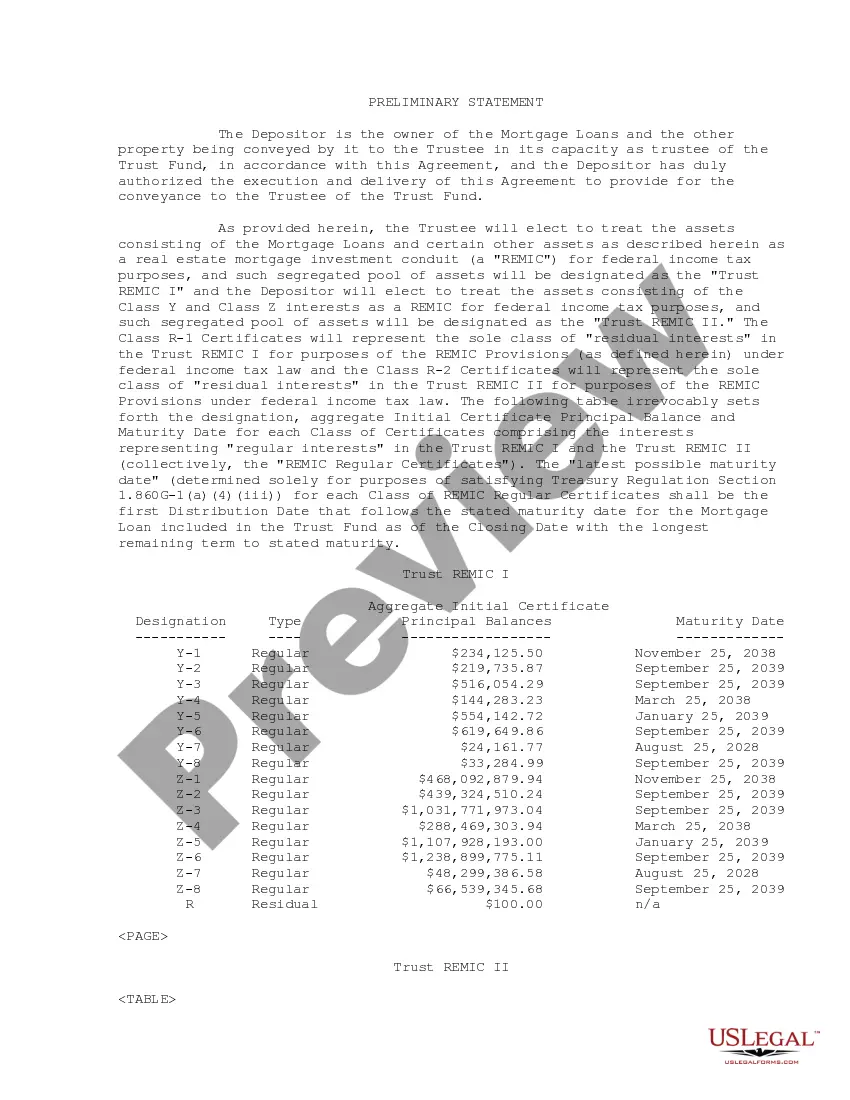

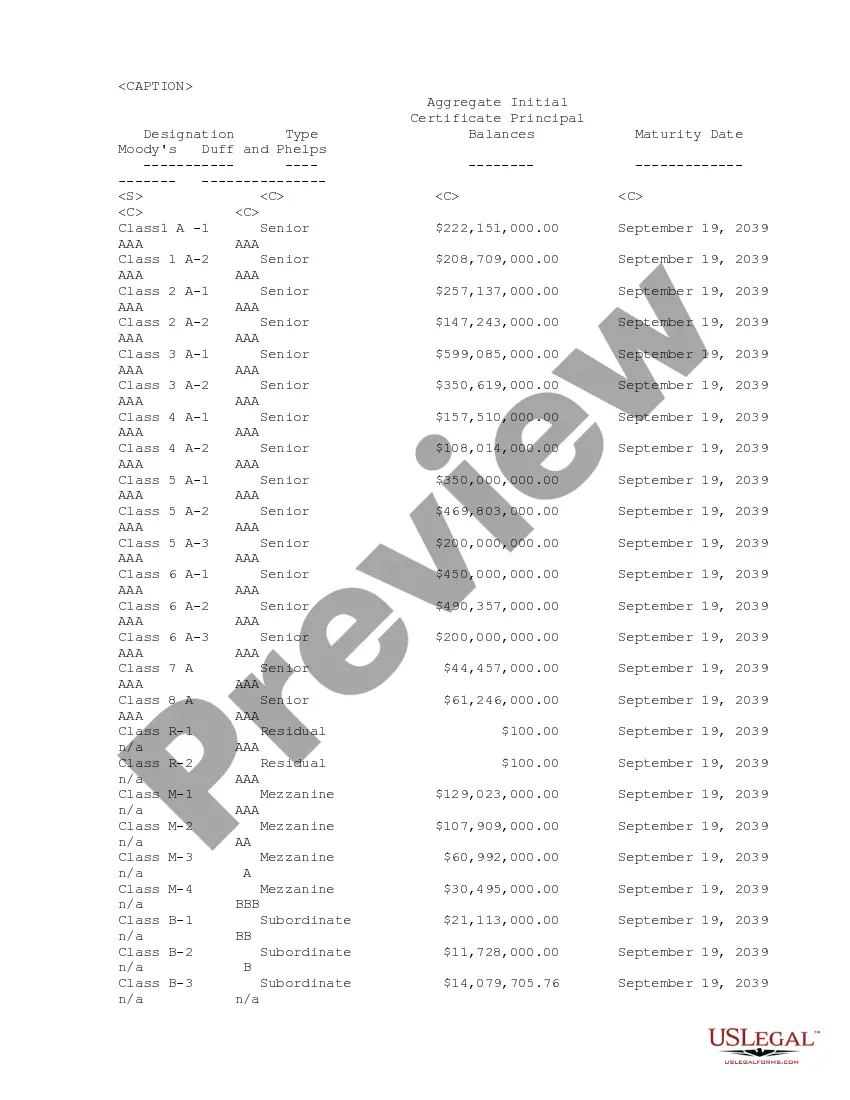

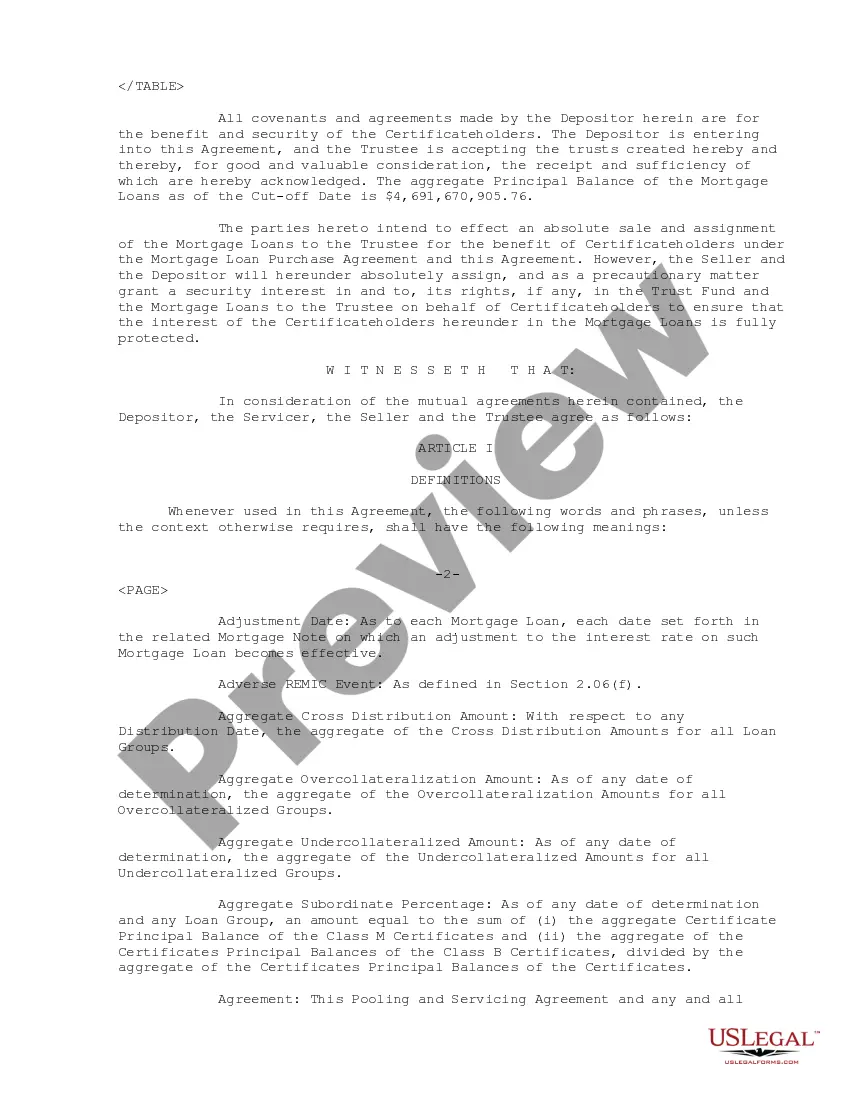

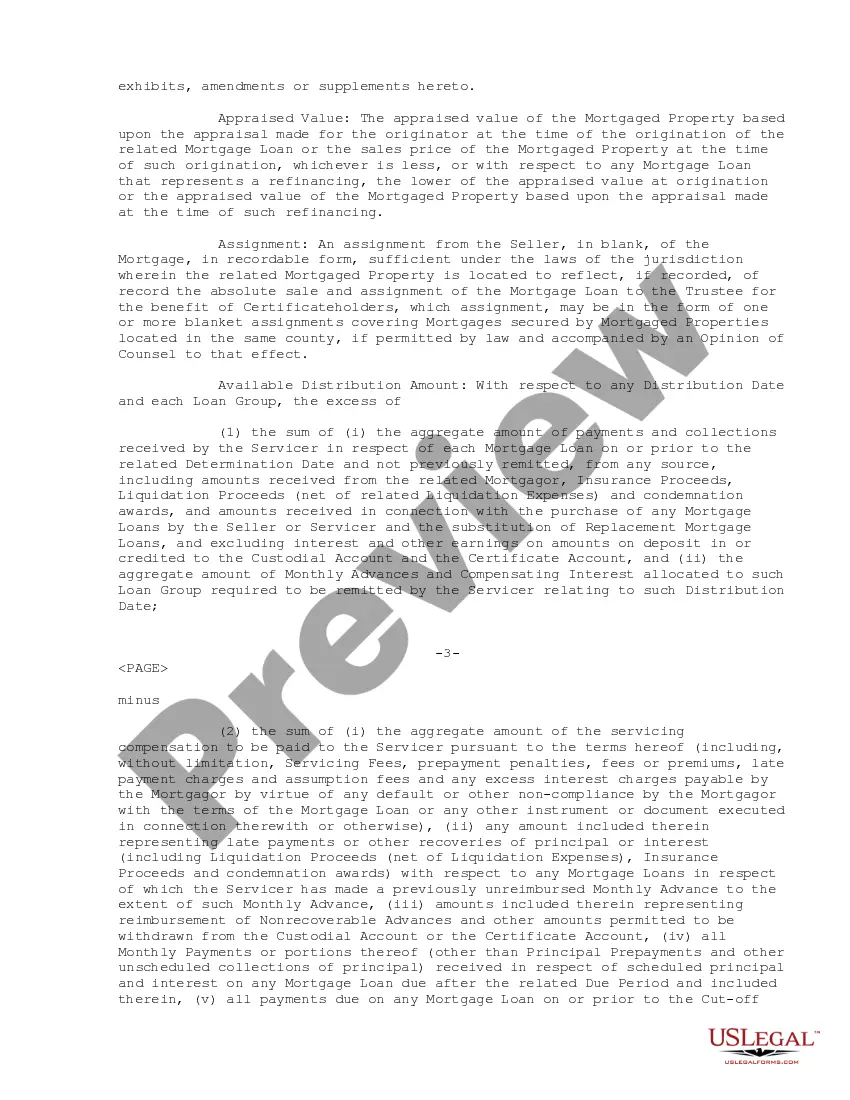

A pooling and servicing agreement outlines the terms under which a group of mortgage loans are pooled together for investment purposes. In the case of the Phoenix Arizona Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One, the agreement describes how the loans will be managed, serviced, and distributed to investors. This agreement is crucial as it ensures transparency and efficiency in handling mortgage-backed securities. By utilizing platforms like uslegalforms, individuals and organizations can easily access templates and services related to creating or understanding these agreements.

The secondary market for mortgage-backed securities is a marketplace where these securities are bought and sold after their initial issuance. This market enables investors to liquidate their holdings, providing value and flexibility. The Phoenix Arizona Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One plays a significant role in this market, as it outlines the agreements and responsibilities necessary for the effective transfer and servicing of these securities.

Mortgage-backed securities serve as the primary security on the secondary market that utilizes a pool of mortgages as collateral. Essentially, these MBS allow investors to trade their interests in mortgage repayments, providing liquidity and flexibility. By grasping the concept of mortgage-backed securities, especially in the context of the Phoenix Arizona Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One, you can make informed investment decisions.

Securities backed by pools of residential mortgages are known as mortgage-backed securities (MBS). These securities provide investors with an opportunity to earn returns based on the mortgage payments made by homeowners. The Phoenix Arizona Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One details the structure and management of these securities, offering insight into their function and benefits.

A pooling agreement refers to the arrangement that allows various loans to be combined and backed by mortgage-backed securities. The purpose of a pooling agreement, such as the Phoenix Arizona Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One, is to aggregate risk and provide liquidity to the mortgage market. Understanding this concept can be crucial for investors looking to navigate the mortgage-backed securities landscape.

To find a pooling and servicing agreement like the Phoenix Arizona Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One on the SEC website, start by visiting the SEC's EDGAR database. Here, you can use the company name or the specific agreement title as search terms. This will help you locate the relevant documents, allowing you to review the detailed terms and conditions.

Yes, pooling and servicing agreements, including the Phoenix Arizona Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One, are generally considered public documents. They are part of the public record and can be accessed by anyone interested in understanding the terms and conditions governing mortgage-backed securities. For further information, you can visit legal information platforms that compile such documents for easier access.