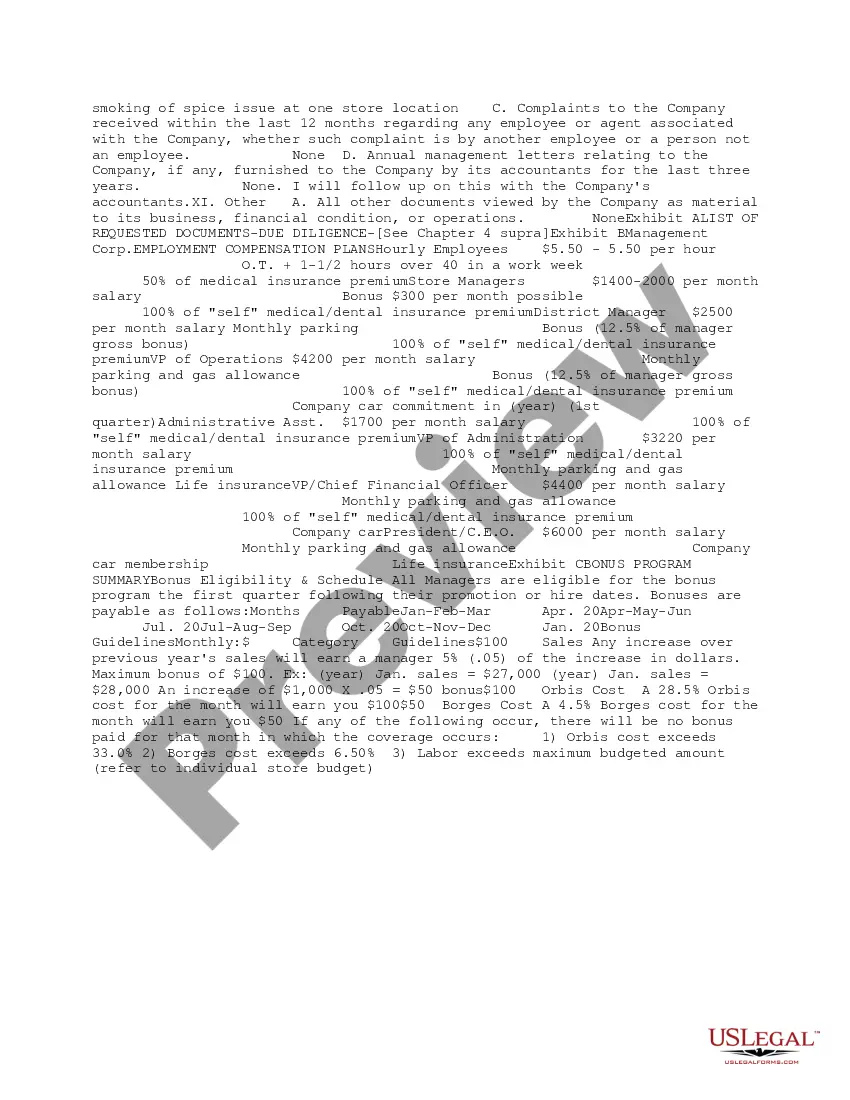

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

Travis Texas Summary Initial Review of Response to Due Diligence Request

Description

How to fill out Summary Initial Review Of Response To Due Diligence Request?

Organizing documentation for business or individual requirements always represents a significant obligation.

When composing a contract, a government service request, or a power of attorney, it's vital to consider all federal and state regulations of the specific area.

Nonetheless, small counties and even municipalities also possess legislative processes that must be taken into account.

Access the one that fulfills your needs using the search tab in the page header. Reconfirm that the template adheres to legal standards and click Buy Now. Select the subscription plan, then Log In or create an account with US Legal Forms. Utilize your credit card or PayPal to pay for your subscription. Download the selected file in the desired format, print it, or complete it electronically. The remarkable aspect of the US Legal Forms library is that all documents you have ever obtained remain accessible – you can retrieve them in your profile under the My documents tab at any time. Enroll in the platform and swiftly obtain verified legal forms for any use case with just a few clicks!

- All these factors render it challenging and time-intensive to develop a Travis Summary Initial Review of Response to Due Diligence Request without professional assistance.

- It is feasible to circumvent spending funds on lawyers for drafting your documents and create a legally sound Travis Summary Initial Review of Response to Due Diligence Request independently, utilizing the US Legal Forms online library.

- This is the most extensive online assortment of state-specific legal templates, which are professionally vetted, ensuring their legitimacy when selecting a sample for your county.

- Previous subscribers only need to Log In to their accounts to retrieve the necessary document.

- If you have yet to subscribe, follow the sequential instructions below to obtain the Travis Summary Initial Review of Response to Due Diligence Request.

- Review the page you have accessed and verify if it contains the document you need.

- To achieve this, utilize the form description and preview if these options are available.

Form popularity

FAQ

A due diligence checklist serves as a guiding tool to ensure all necessary documents and information are obtained and reviewed. For anyone involved in a Travis Texas Summary Initial Review of Response to Due Diligence Request, having a checklist helps streamline the process and avoid oversights.

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

Due Diligence is a process that involves conducting an investigation, review, or audit to verify facts and information about a particular subject. In simple words, Due Diligence means doing your homework and acquisitions of required knowledge before entering into any agreement or contract with another company.

Generally speaking, any given response to a due diligence request should: Determine what question the potential buyer is truly trying to answer. Determine if existing / prior documents can satisfy their request. If necessary, reframe or refocus the request to align with available information.

1. Company information Who owns the company? What is the company's organizational structure? Who are the company's shareholders?What are the company's articles of incorporation? Where is the company's certificate of good standing from the state in which the business is registered? What are the company bylaws?

Due Diligence is a process that involves conducting an investigation, review, or audit to verify facts and information about a particular subject. In simple words, Due Diligence means doing your homework and acquisitions of required knowledge before entering into any agreement or contract with another company.

Due Diligence Statement means the statement regarding the provision of documentation to be used in the diligence review of the Company Parties by the Purchaser, executed by the Company and delivered to the Purchaser.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property and the board of directors.

In financial setting, due diligence means an investigation or audit of a potential investment consummated by a prospective buyer. The objective is to confirm the accuracy of the seller's information and appraise its value. These investigations are typically undertaken by investors and companies considering M&A deals.

Due Diligence Examples A business exhaustively examining another to determine whether it is a sound investment prior to initiating a merger. Consumers reading reviews online prior to purchasing an item or service. People checking their bank accounts and credit cards frequently to ensure that there is no unusual