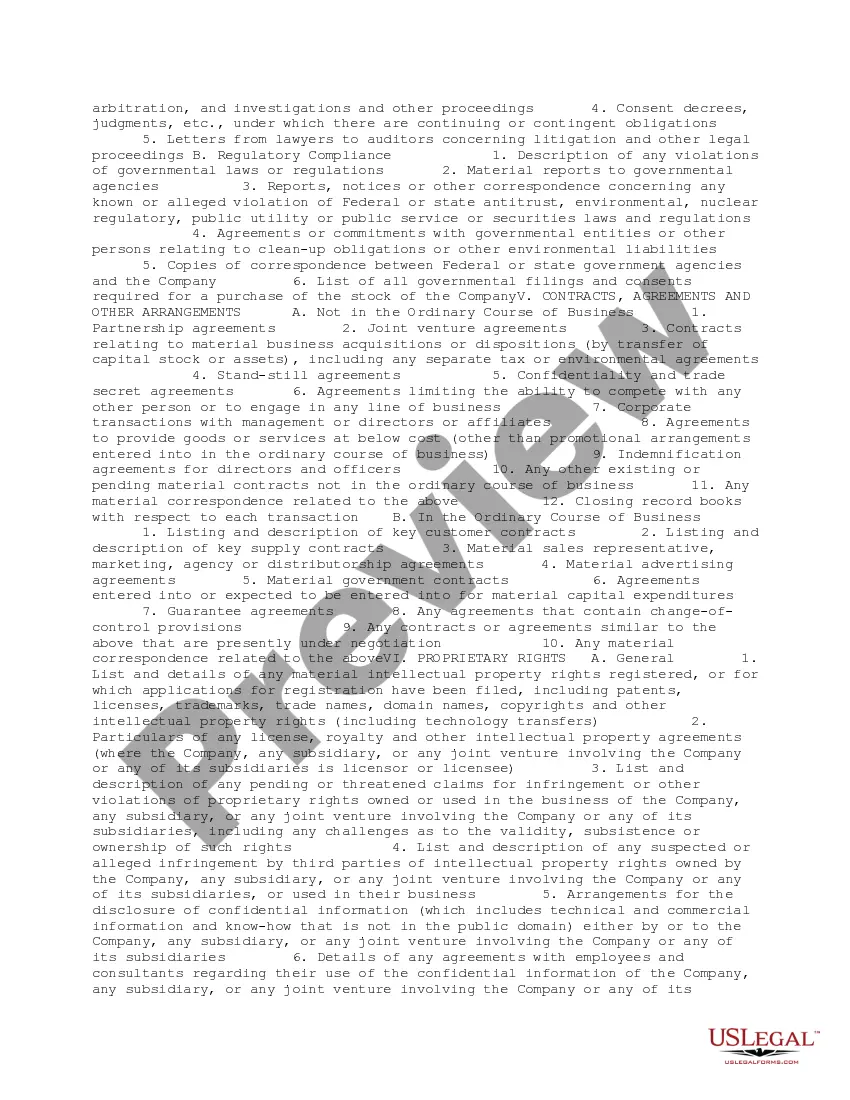

This form is a list of requested due diligence documents from a technology company for the purchase of shares of stock. The list consists of documents and information to be submitted to the due diligence team.

Clark Nevada Request for Due Diligence Documents from a Technology Company

Description

How to fill out Clark Nevada Request For Due Diligence Documents From A Technology Company?

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Clark Request for Due Diligence Documents from a Technology Company is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Clark Request for Due Diligence Documents from a Technology Company. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Clark Request for Due Diligence Documents from a Technology Company in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

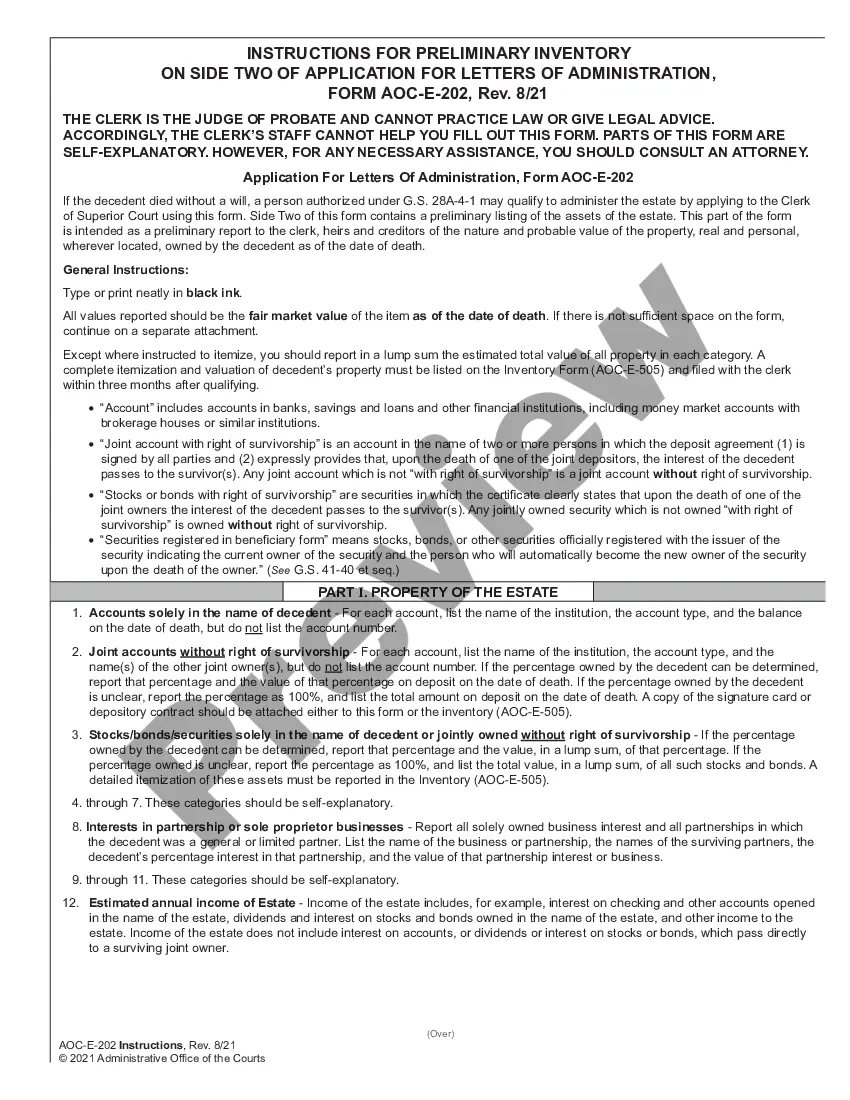

The complete list of due diligence documents to be collected Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.

Sample Due Diligence Request List Formation documents and operating agreements. Detailed ownership information and member register. Details of any other investment or ownership interest in any other entity held by the company.

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.

Due Diligence Process Steps, Policies and Procedures Evaluate Goals of the Project. As with any project, the first step delineating corporate goals.Analyze of Business Financials.Thorough Inspection of Documents.Business Plan and Model Analysis.Final Offering Formation.Risk Management.

There are seven necessary steps to conduct effective IT due diligence. Step 1: Initiate.Step 2: Prepare.Step 3: Conduct the on-site discovery.Step 4: Discovery defines the issues.Step 5: Analyze the information and prioritize your initiatives.Step 6: Develop an IT due diligence report.

These processes usually include information about assets, financial projections, contracts, intellectual property ownership, equity holdings, information about your team, and/or outstanding legal issues.

During the due diligence process, an investor will request information about your company that will inform their investment decision moving forward. In addition to asking questions of you and key members of your management team during meetings or phone calls, they will provide you with a request list.

5 Essential Steps to Ensure Due Diligence in Private Company Acquisitions 1) Construct an Investment Thesis. 2) Analyze Your Competitive Position. 3) Measure the Strength and Stability of the Acquired Company. 4) Revenue Synergy. 5) Integration. Conclusion.

What Is a Due Diligence Checklist? Preparing an audited financial statement or annual report. A public or private financing transaction. Major bank financing. A joint venture. An initial public offering (IPO) General risk management.

13 Critical Things To Do During The Due Diligence Period Research Home Prices.Look up Taxes.Find a Seasoned Real Estate Agent.Find a Lender.Read Disclosures.Home Inspection.Cost of Repairs.Insurance.

Interesting Questions

More info

As you read this guide, be aware that these are the types of programs that you would consider for your own operations. The best programs are one-time investments. This is especially the case when you do a quick valuation. You'll be doing that with us, so we can provide you with realistic results. If you see something in your valuation that is not realistic, you can easily revise it later. We're a community of partners, so everyone has our back. Our team here at Office of Business Services, as well as those of other partners on our site, will go through the process with you and ensure the program is the best for you. The benefits of applying to the program: You know exactly what you won't get with most companies' business development projects. The experience we are going to give you will be unique and not available anywhere else. We will put your program's benefits to work for you. There is no cost to you to enroll. The fees for the study and application are not set in stone.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.