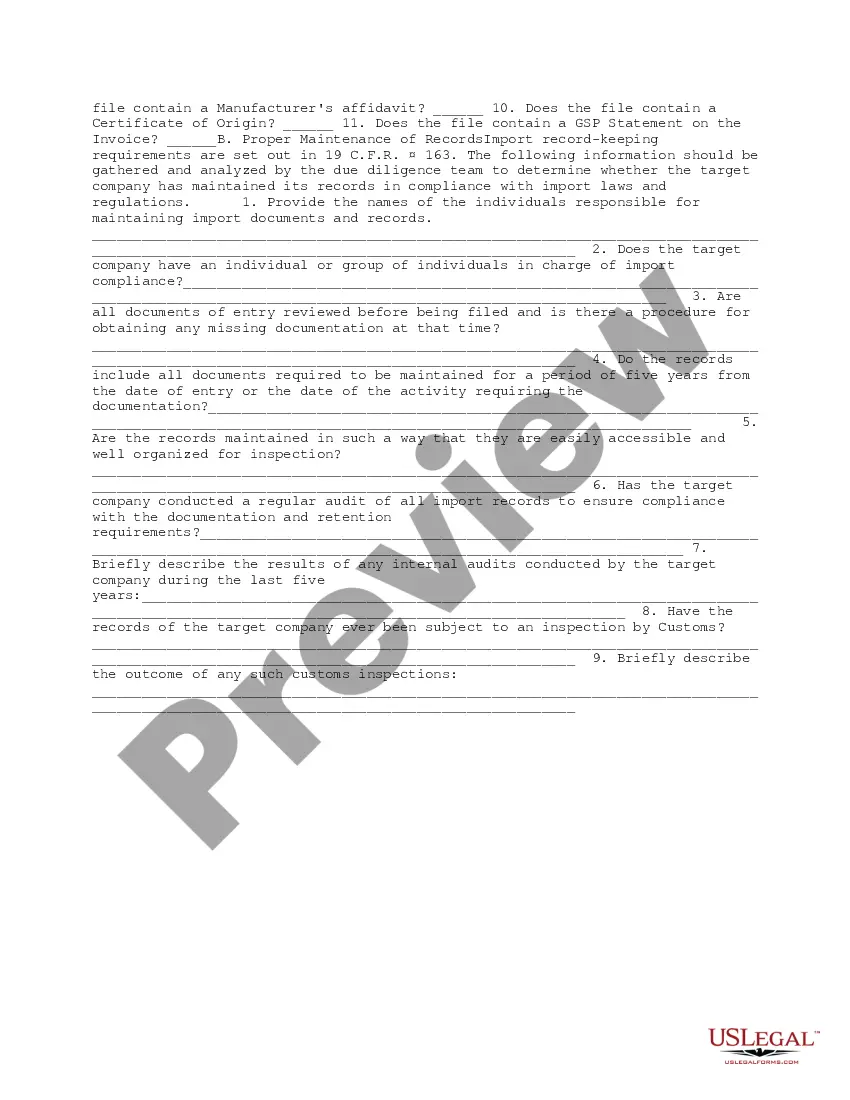

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Queens New York Import Compliance and Records Review Due Diligence

Description

How to fill out Import Compliance And Records Review Due Diligence?

A documentation routine consistently accompanies any legal action you undertake.

Launching a business, applying for or accepting a job offer, transferring ownership, and numerous other life situations necessitate that you prepare formal paperwork that differs across the nation.

That’s the reason gathering it all in one location is immensely beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal templates.

This is the easiest and most reliable way to acquire legal documents. All the templates offered by our library are professionally crafted and verified for compliance with local laws and regulations. Prepare your documentation and conduct your legal obligations properly with US Legal Forms!

- On this platform, you can effortlessly find and download a document for any personal or business purpose relevant to your area, including the Queens Import Compliance and Records Review Due Diligence.

- Finding templates on the site is remarkably easy.

- If you already subscribe to our library, Log In to your account, search for the sample using the search bar, and click Download to save it to your device.

- Once that’s done, the Queens Import Compliance and Records Review Due Diligence will be available for further utilization in the My documents section of your profile.

- If you're engaging with US Legal Forms for the first time, follow this brief guide to acquire the Queens Import Compliance and Records Review Due Diligence.

- Ensure you have opened the correct page with your localized form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to confirm the template meets your requirements.

- If the sample doesn't suit you, search for another document using the search option.

- Click Buy Now once you identify the necessary template.

- Select the appropriate subscription plan, then Log In or create an account.

- Choose your preferred payment method (with credit card or PayPal) to continue.

- Select file format and download the Queens Import Compliance and Records Review Due Diligence to your device.

- Utilize it as necessary: print it or fill it out electronically, sign it, and submit where requested.

Form popularity

FAQ

It is important to remember that regulatory responsibility for CDD remains with the company rather than the third party. Accordingly, companies should ensure that their CDD service provider fulfills certain compliance criteria, and is able to: Meet the compliance standards set out in FATF Recommendation 10.

Due diligence is defined as an investigation of a potential investment (such as a stock) or product to confirm all facts. These facts can include such items as reviewing all financial records, past company performance, plus anything else deemed material.

What is a Due Diligence Check? The due diligence process involves thoroughly identifying, evaluating and verifying all available information on a person, company or entity. A due diligence check is especially important when you're hiring or considering prospective business partners or new commercial relationship.

Due diligence is a process or effort to collect and analyze information before making a decision. It is a process often used by investors to assess risk.

A due diligence check is a thorough investigation to identify, evaluate and verify all available information on an individual or entity. Such checks are especially important when you're hiring or considering a prospective business partnership or new commercial relationship.

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.

13 Critical Things To Do During The Due Diligence Period Research Home Prices.Look up Taxes.Find a Seasoned Real Estate Agent.Find a Lender.Read Disclosures.Home Inspection.Cost of Repairs.Insurance.

Due diligence is the investigation or exercise of care that a reasonable business or person is normally expected to take before entering into an agreement or contract with another party or an act with a certain standard of care.

The complete list of due diligence documents to be collected Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.

Due Diligence Examples A business exhaustively examining another to determine whether it is a sound investment prior to initiating a merger. Consumers reading reviews online prior to purchasing an item or service. People checking their bank accounts and credit cards frequently to ensure that there is no unusual