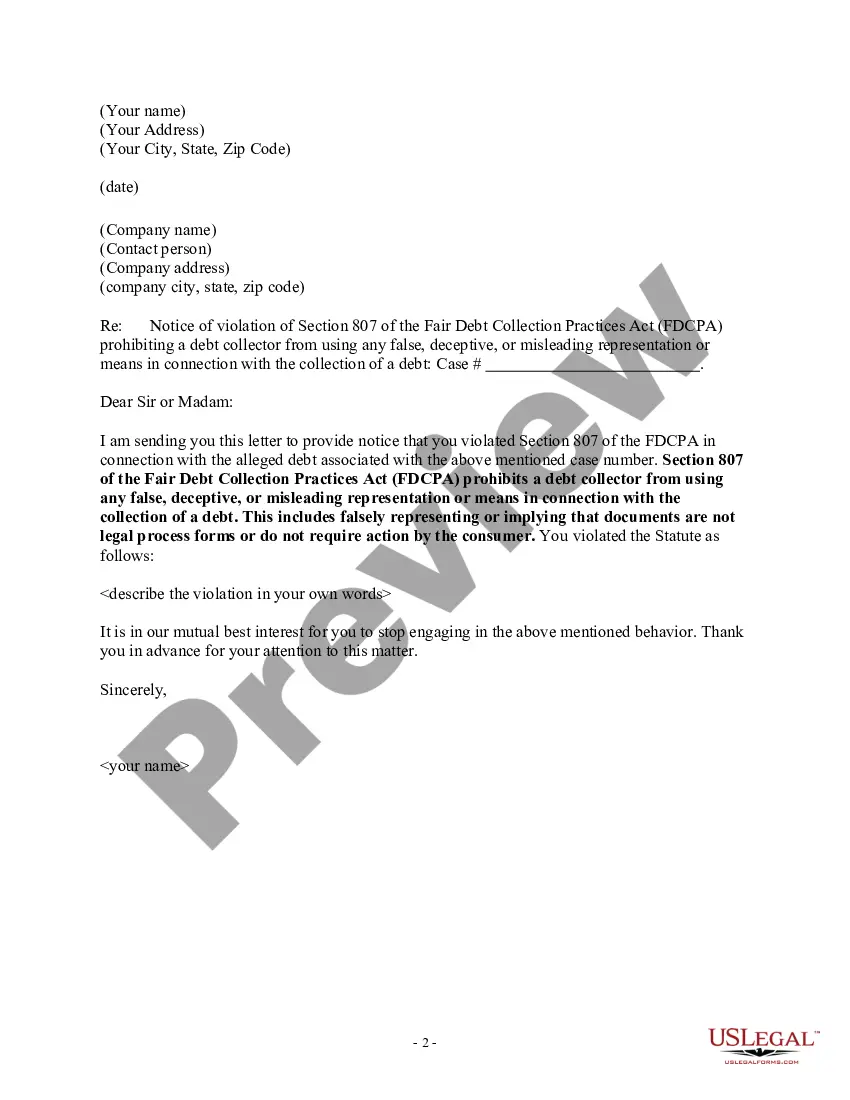

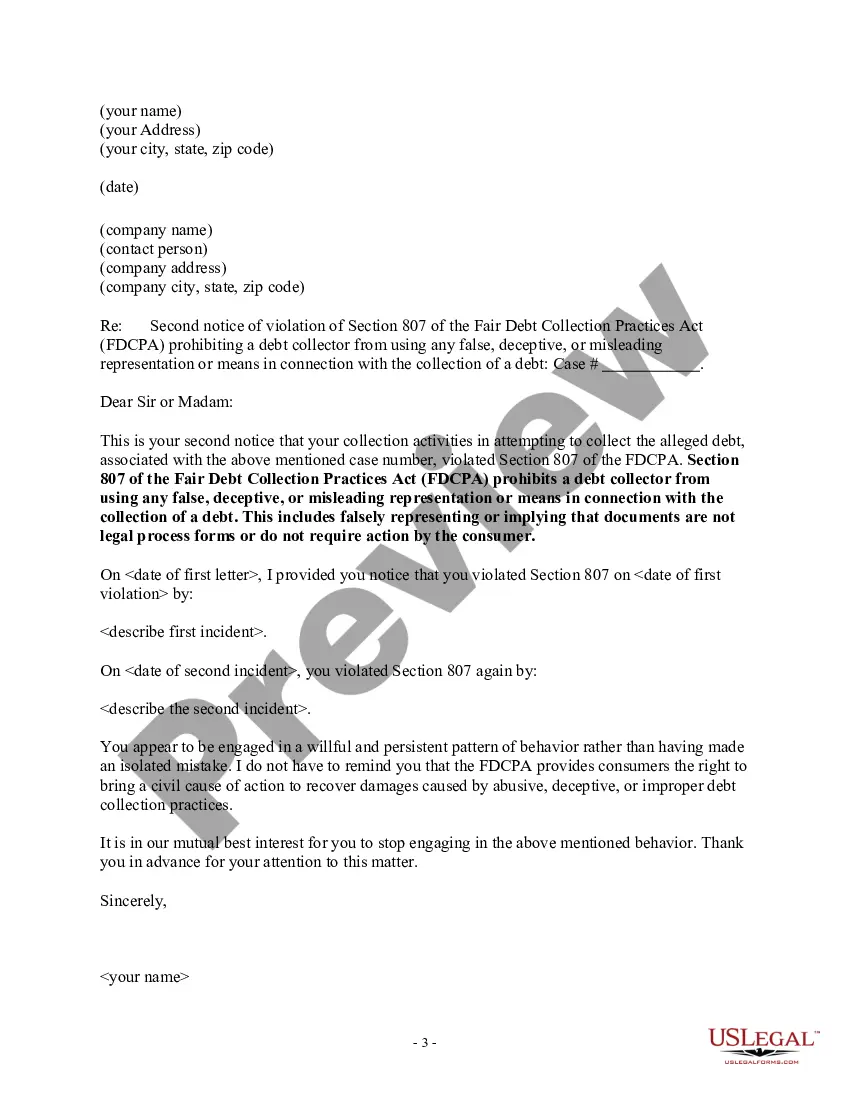

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Montgomery Maryland Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

If you are searching for a trustworthy legal document provider to obtain the Montgomery Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Entail Action, look no further than US Legal Forms. Whether you wish to initiate your LLC venture or oversee your asset division, we are here to assist you. You don't need to possess extensive legal knowledge to find and download the required form.

Just opt to search or browse the Montgomery Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action, either through a keyword or by the relevant state/county for which the document is meant. After locating the necessary form, you can Log In and download it or store it in the My documents section.

Don't have an account? It's simple to get started! Just find the Montgomery Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action template and check the form's preview and brief introductory details (if available). If you are satisfied with the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly accessible for download once the payment is completed. Now you can fill out the form.

Managing your legal matters doesn’t have to be costly or time-consuming. US Legal Forms is here to demonstrate that. Our extensive collection of legal forms makes these tasks less expensive and more accessible. Establish your first company, organize your advance care planning, draft a real estate agreement, or complete the Montgomery Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action - all from the comfort of your couch.

Sign up for US Legal Forms today!

- You can explore over 85,000 templates organized by state/county and circumstance.

- The user-friendly interface, abundant supporting resources, and devoted support staff simplify the process of obtaining and completing various documents.

- US Legal Forms is a reputable service supplying legal forms to millions of individuals since 1997.

Form popularity

FAQ

The 11-word phrase often referenced in discussions about debt is: 'I do not recall taking out this debt; please validate it.' Using this phrase can prompt the collector to provide proper documentation. If you find yourself receiving a Montgomery Maryland Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action, employing this phrase may help you address the situation. Being proactive can set the tone for your negotiations.

Here are a few suggestions that might work in your favor: Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing.Dispute the debt on your credit report.Lodge a complaint.Respond to a lawsuit.Hire an attorney.

Legal rights when dealing with debt collectors Under the Australian Consumer Law, a debt collector must not: use physical force or coercion (forcing or compelling you to do something) harass or hassle you to an unreasonable extent. mislead or deceive you (or try to do so)

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

The answer is yes, but the process is not as simple as collection agencies make it seem. Collection agencies have the right to take you to court if you haven't paid your overdue bills, but the likelihood of them acting on that right is low, especially if you don't have an income that can be garnished or own any assets.

Once you're on a debt collector's radar, it can become a full-time job trying to dodge them. Yes, debt collectors have a right to their money. But they don't have a right to harass you or your family, garnish your wages, arrest you, threaten you, or break the law in any way to get what they're due.

The Australian Collectors & Debt Buyers Association Code of Practice (Code) is the industry code of the Australian Collectors & Debt Buyers Association (ACDBA). Compliance with this Code is a compulsory obligation for ACDBA members.

Ignoring or avoiding the debt collector may cause the debt collector to use other methods to try to collect the debt, including a lawsuit against you. If you are unable to come to an agreement with a debt collector, you may want to contact an attorney who can provide you with legal advice about your situation.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.