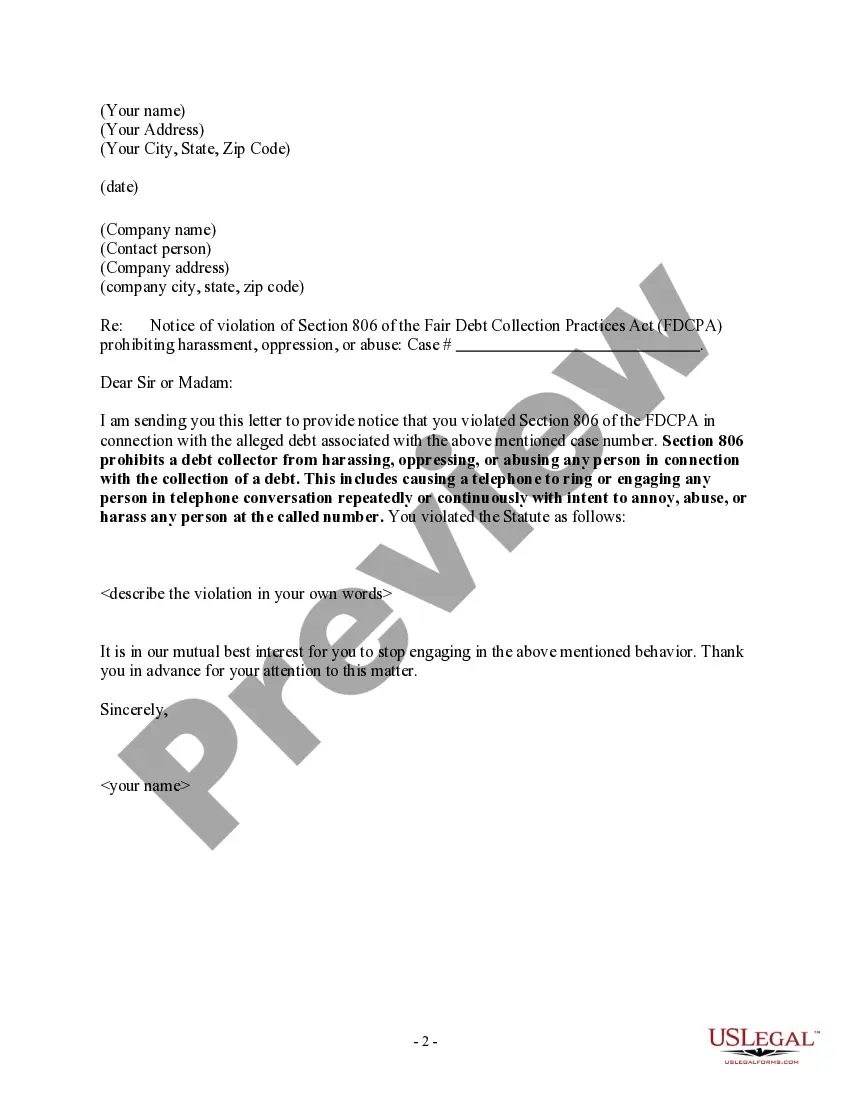

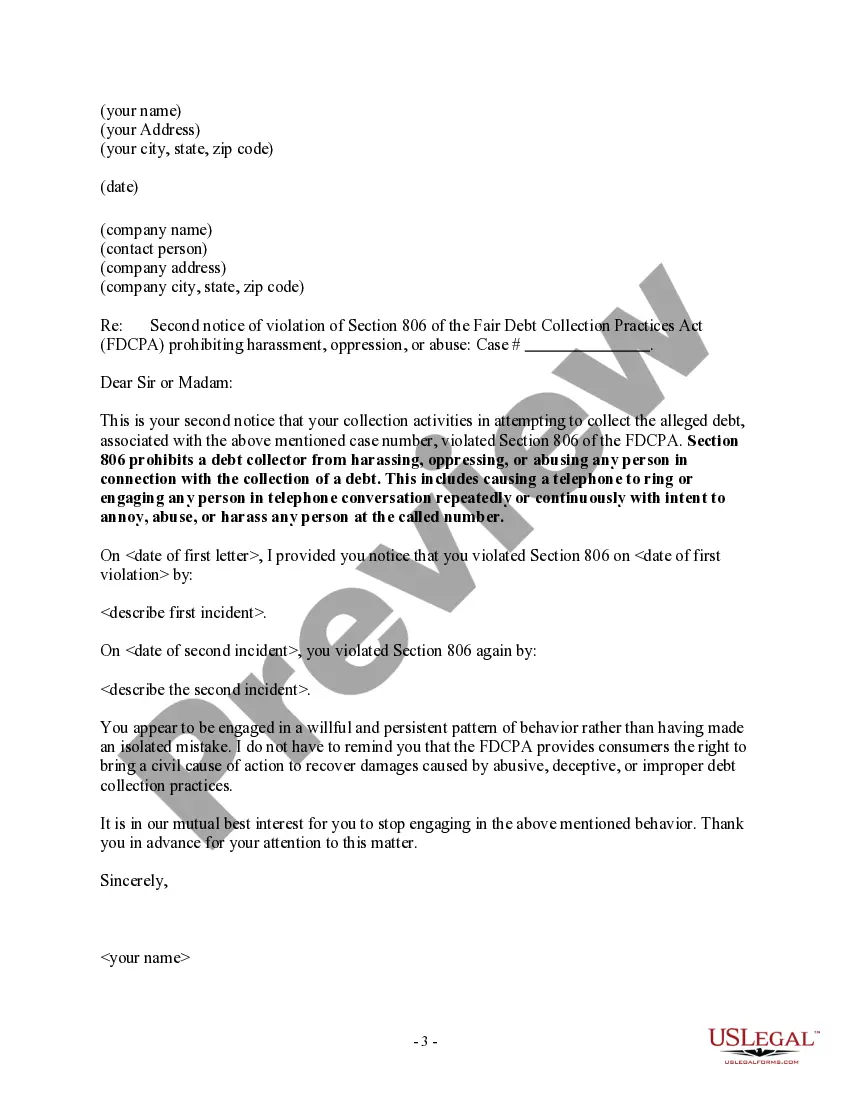

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes causing a telephone to ring or engaging any person in telephone conversation repeatedly or continuously with intent to annoy, abuse, or harass any person at the called number.

Clark Nevada Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls

Description

How to fill out Notice To Debt Collector - Unlawful Repeated Or Continuous Telephone Calls?

Whether you aim to launch your enterprise, enter into a contract, request your identification renewal, or settle family-related legal matters, you need to prepare specific documentation in accordance with your local laws and regulations.

Locating the correct documents may require considerable time and effort unless you utilize the US Legal Forms library.

This platform offers users over 85,000 expertly drafted and verified legal documents suitable for any personal or business scenario. All documents are categorized by state and purpose, making it quick and simple to select a form like the Clark Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls.

Documents available in our library are reusable. With an active subscription, you can access all previously acquired paperwork at any time in the My documents section of your profile. Stop wasting time on a perpetual search for current official documents. Register for the US Legal Forms platform and keep your paperwork organized with the most extensive online form library!

- Ensure the template meets your specific needs and complies with state law regulations.

- Review the form description and examine the Preview if available on the page.

- Make use of the search tool at the top to find another template for your state.

- Click Buy Now to purchase the document once you identify the correct one.

- Choose the subscription plan that fits you best to proceed.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Clark Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls in your preferred file format.

- Print the document or fill it out and sign it electronically through an online editor to save time.

Form popularity

FAQ

Write to the Collector to Request it Stop Contacting You (If That's What You Want) Under the federal FDCPA, if you request that a debt collector stop contacting you completely, it must do so, subject to a few exceptions. Your request must be in writing.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).

How to Stop Debt Collector Harassment Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from placing repeated or continuous telephone calls or conversations to you with the intent to harass, oppress, or abuse you. The Debt Collection Rule. Within seven days after engaging in a telephone conversation with you about the particular debt

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

You Will Probably Be Sued If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court. If you are served with a lawsuit and ignore this court filing, the debt collection company will then be able to get a default judgment against you.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

According to the FDCPA, a debt collector cannot call a debtor more than once per day for each debt. This means that if you only have one outstanding debt, then your debt collector is only allowed to call you one time per day.

Can I stop my creditors calling me? If you don't want to receive any phone calls you can ask your creditors to remove your number from their records. We have an example 'stop a creditor from calling' letter (PDF) you can use to ask for this. It's important you still read letters or emails from your creditors.