Maricopa Arizona Notice to Debt Collector - Unlawful Messages to 3rd Parties

Description

A debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes leaving telephone messages with neighbors or other 3rd parties when the debt collector knows the consumer's name and telephone number and could have contacted the consumer directly.

How to fill out Notice To Debt Collector - Unlawful Messages To 3rd Parties?

Drafting legal paperwork can be tedious. Moreover, if you opt to enlist a lawyer to prepare a business contract, documents for ownership transfer, premarital agreement, divorce documents, or the Maricopa Notice to Debt Collector - Unlawful Messages to 3rd Parties, it could cost you significantly.

So, what is the most sensible approach to save both time and money while producing valid documents in full adherence to your regional and local laws.

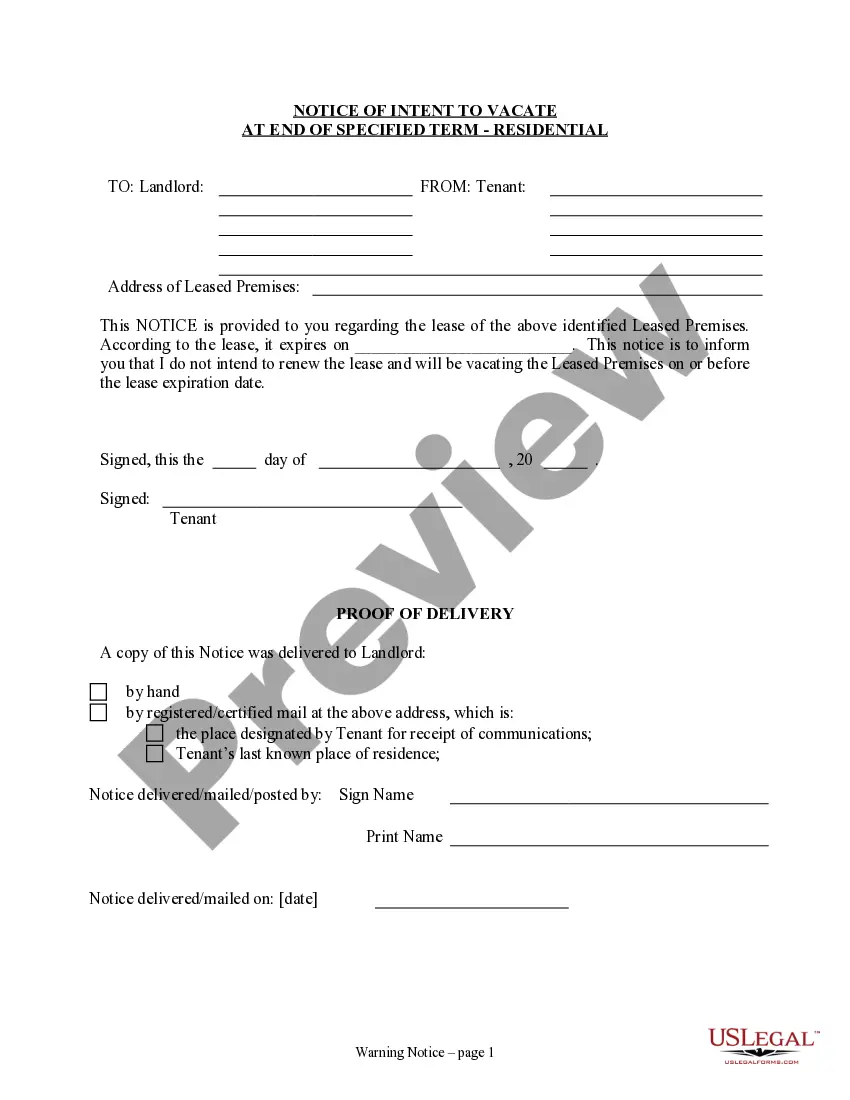

Review the form description and utilize the Preview option, if accessible, to ensure it's the correct template you require.

- US Legal Forms is an excellent solution, regardless of whether you need forms for personal or business purposes.

- US Legal Forms boasts the largest online compilation of state-specific legal documents, offering users access to current and professionally validated templates for every situation, all centralized in one location.

- As a result, if you require the latest version of the Maricopa Notice to Debt Collector - Unlawful Messages to 3rd Parties, you can conveniently find it on our platform.

- Acquiring the documents takes very little time.

- Users with existing accounts should verify the validity of their subscription, Log In, and select the template using the Download button.

- If you haven't registered yet, here's how to obtain the Maricopa Notice to Debt Collector - Unlawful Messages to 3rd Parties.

- Browse the page and confirm that there is a template for your locality.

Form popularity

FAQ

Although they are legally allowed to leave you a voicemail, it can only be done on a private cell phone where they are sure it will not be heard by a third party. Do not stand for debt collectors that violate the FDCPA. Always save your voicemail messages and any proof that may be usable in court.

Debt collectors are allowed to contact third parties to obtain or confirm location information, but the FDCPA does not allow debt collectors to leave messages with third parties. Location information is defined as a consumer's home address and home phone number or workplace and workplace address.

Use These Tips to Beat Accredited Collection Services in Court Never Ignore a Debt. The first step in any debt lawsuit is to make sure you do not ignore it.Never Accept Liability for a Debt.Ask for Proof of the Debt.Choose the Right Defenses to Fight Debt Collectors.

And although it does require an opt-out option in every message, it authorizes collectors to send these messages without consumer consent. Those messages are permitted for every debt you have in collections.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Only when you fall behind on payments owed and your debt goes into collections does it then get sold to debt collectors. At no time is a third-party debt collector classified as a creditor.

As of Nov. 30, 2021, debt collectors have new options for how they may communicate with you about debts they're trying to collect. Now they can text you. Text messages, along with emailing and direct messages on social media, are allowed as part of an update to the Fair Debt Collection Practices Act (FDCPA).

Generally, a debt collector can't discuss your debt with anyone other than: You. Your spouse. Your parents (if you are a minor) Your guardian, executor, or administrator. Your attorney, if you are represented with respect to the debt.

Acting as a middleman between the creditor and the consumer, agencies will try to obtain payment in full, negotiate payment arrangements, agree on a settlement amount (if authorized to do so by the creditor), or help the consumer work through the process of disputing the debt for various reasons.

Debt collectors are allowed to contact third parties to obtain or confirm location information, but the FDCPA does not allow debt collectors to leave messages with third parties. Location information is defined as a consumer's home address and home phone number or workplace and workplace address.