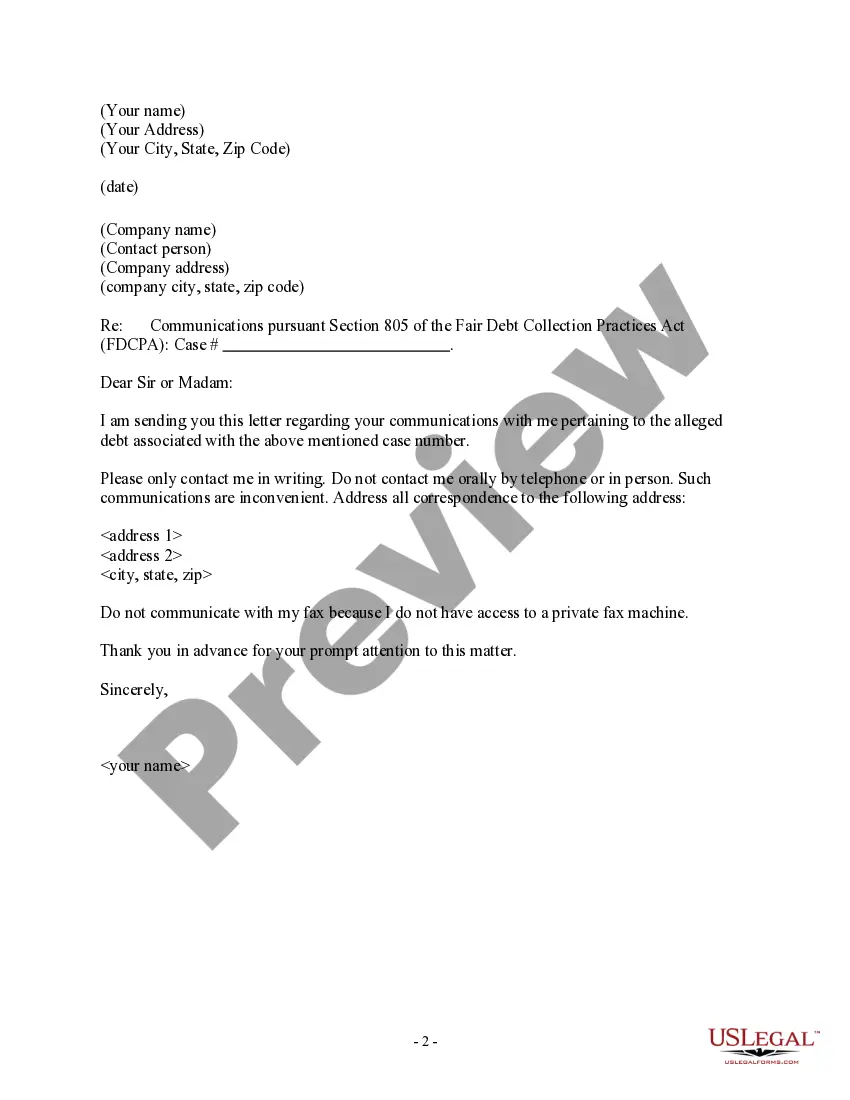

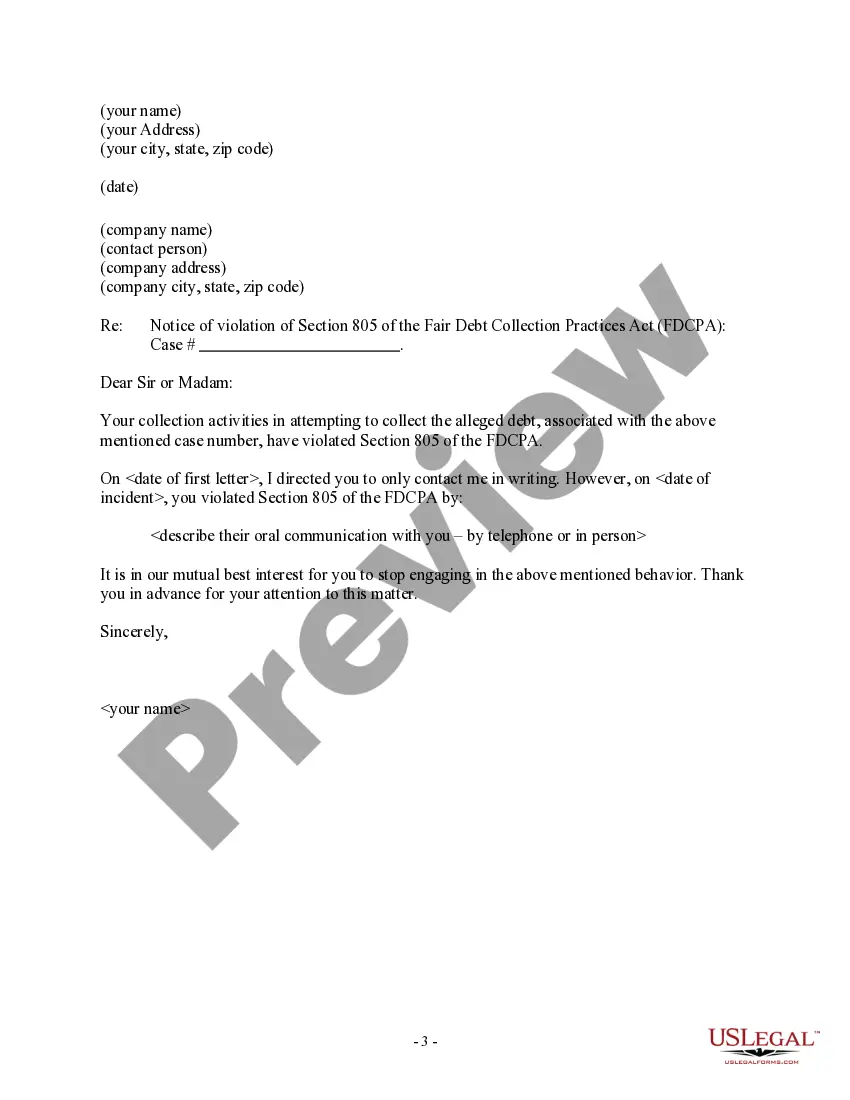

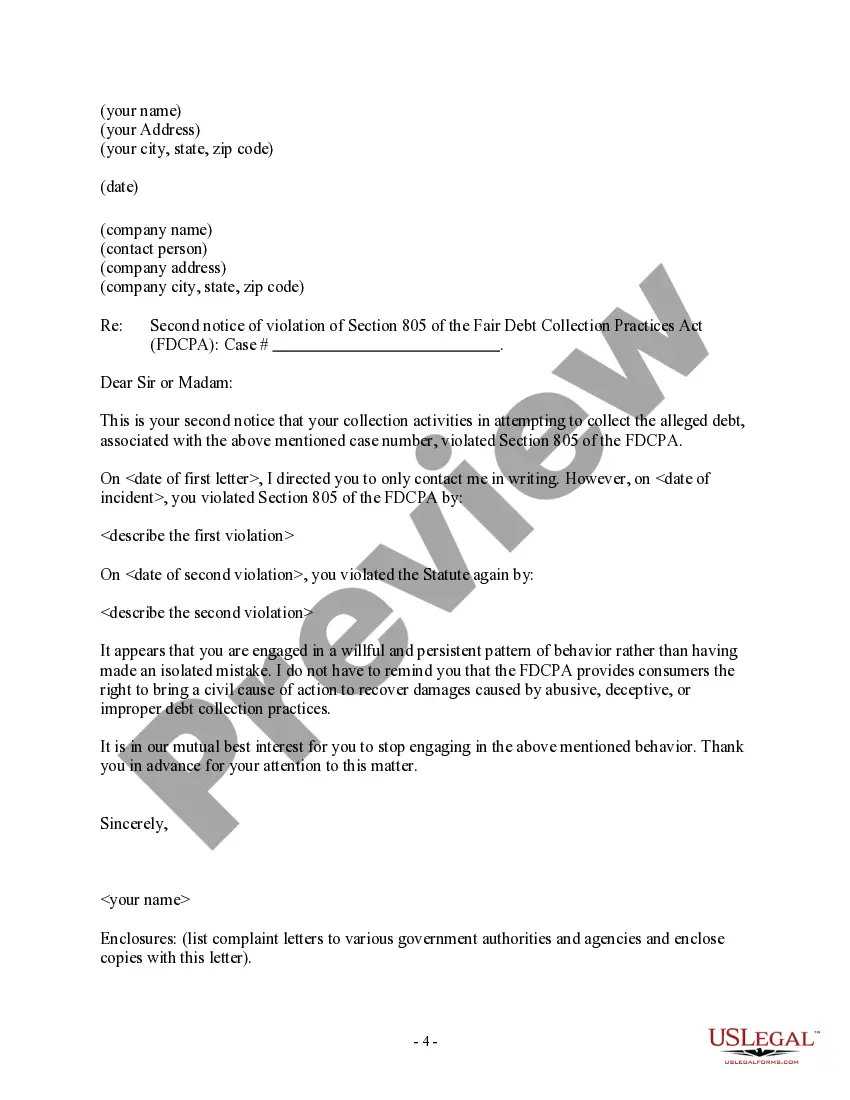

Bexar Texas Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

If you seek to discover a trustworthy legal form supplier to obtain the Bexar Letter to Debt Collector - Only Contact Me In Writing, your search ends here at US Legal Forms. Regardless of whether you wish to launch your LLC enterprise or manage your asset allocation, we have you accommodated. You don't need to be well-versed in law to locate and download the suitable template.

You can effortlessly search for or navigate to the Bexar Letter to Debt Collector - Only Contact Me In Writing, either through a keyword or by the state/county for which the document is devised.

After identifying the required template, you can Log In and download it or save it in the My documents section.

No account yet? It's simple to begin! Just locate the Bexar Letter to Debt Collector - Only Contact Me In Writing template and review the form's preview and description (if present). If you trust the template’s legal language, proceed to click Buy now. Create an account and choose a subscription plan. The template will be readily accessible for download once the payment is completed.

Managing your legal matters doesn't have to be costly or laborious. US Legal Forms is here to prove it. Our vast range of legal templates makes this endeavor more affordable and budget-friendly. Establish your first business, arrange your advance care planning, draft a property agreement, or complete the Bexar Letter to Debt Collector - Only Contact Me In Writing - all from the comfort of your home.

- You can explore over 85,000 forms classified by state/county and circumstance.

- The user-friendly interface, availability of educational resources, and committed assistance facilitate the process of finding and completing various documents.

- US Legal Forms is a dependable service that has been providing legal forms to millions of clients since 1997.

Form popularity

FAQ

Harassment or Abuse Specifically, it can't: use or threaten to use violence. harm or threaten to harm you, another person, or your or another person's reputation or property. use obscene, profane, or abusive language.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from placing repeated or continuous telephone calls or conversations to you with the intent to harass, oppress, or abuse you.

Try not to let all of the calls badgering you from a debt collector get to you. If you need to take a break, you can use this 11 word phrase to stop debt collectors: Please cease and desist all calls and contact with me, immediately. Here is what you should do if you are being contacted by a debt collector.

He said, "if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them this '11-word phrase'." Advertisers later branded this simple tip as the "11-word phrase to stop debt collectors" and has stuck with debtors to date.

9 Things You Should (And Shouldn't) Say to a Debt Collector Do Ask to see the collector's credentials.Don't Volunteer information.Do Make a preemptive offer.Don't Make your bank account accessible.Maybe Ask for a payment-for-deletion deal.Do Explain your predicament.Don't Provide ammunition.

The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone.

I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

You should not ignore a debt collection letter as not responding to them in time (or at all) can lead to the collection agency filing a lawsuit against you. Not only will this result in you being responsible for additional fees, but it can allow them to take legal action to get the funds from you in other ways.

If you receive a notice from a debt collector, it's important to respond as soon as possibleeven if you do not owe the debtbecause otherwise the collector may continue trying to collect the debt, report negative information to credit reporting companies, and even sue you.