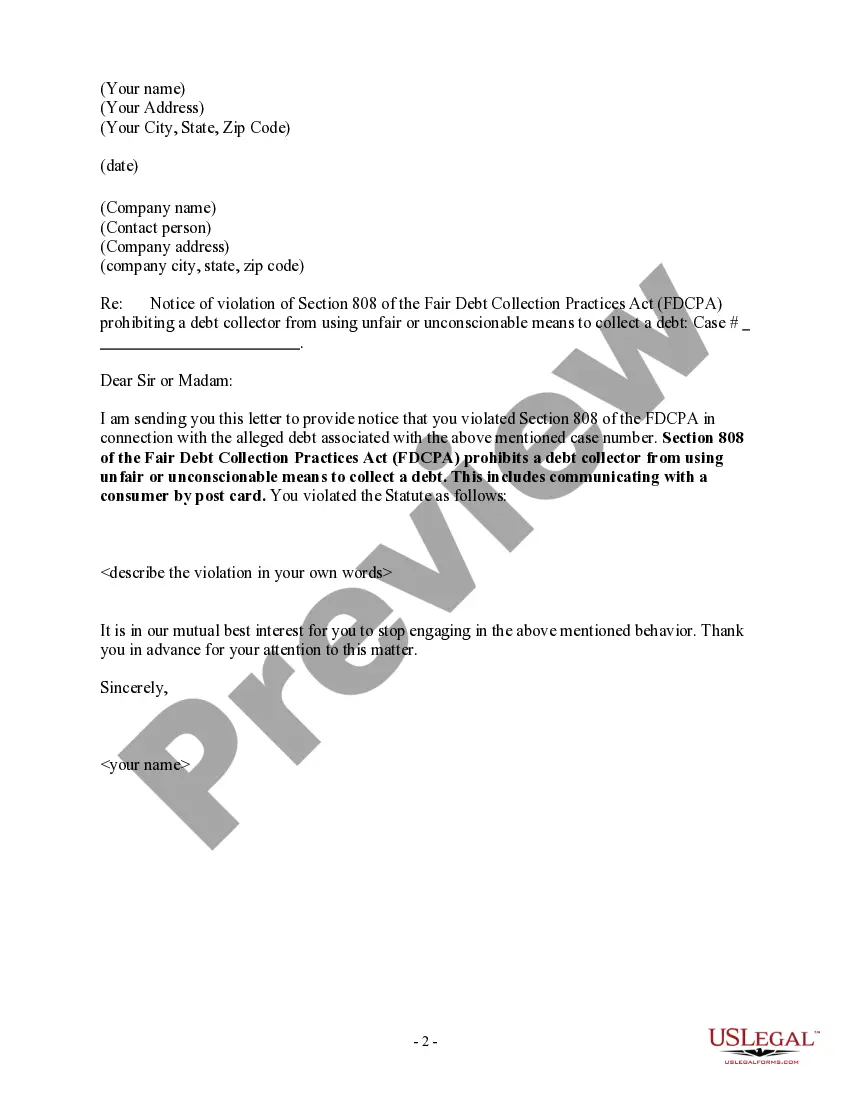

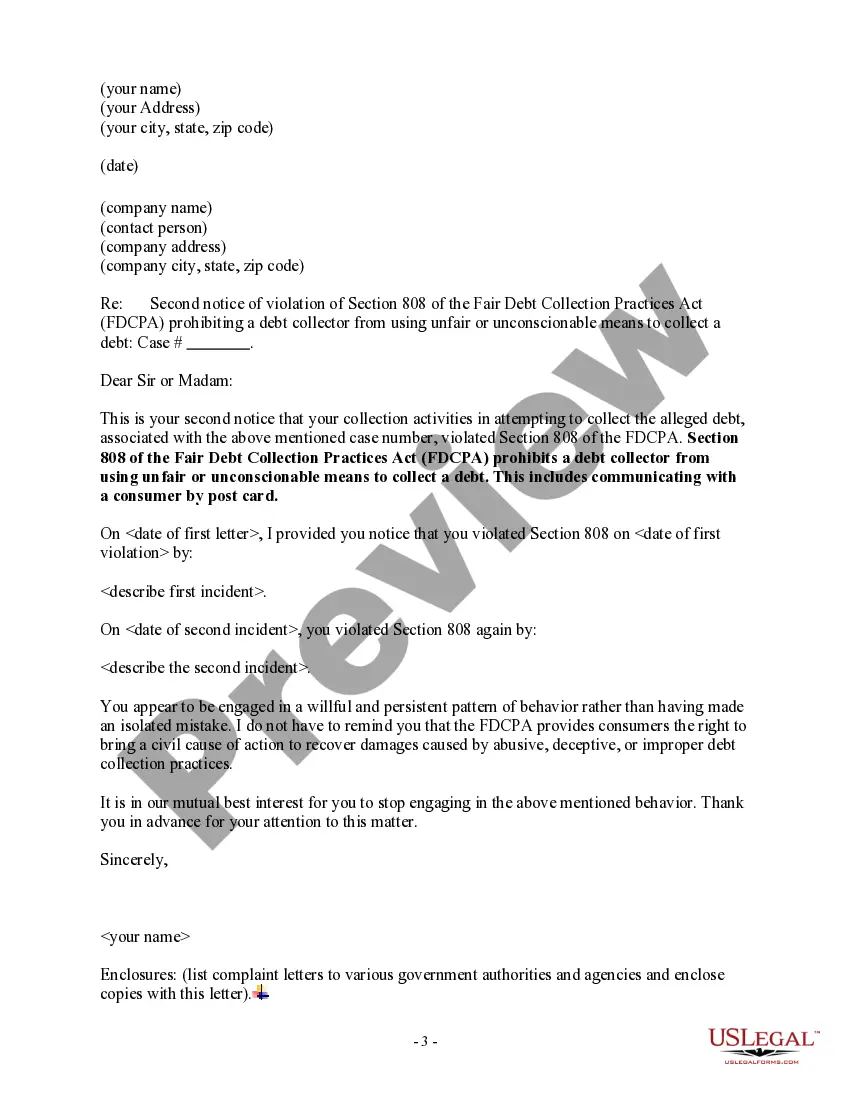

King Washington Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

What is the typical duration it takes for you to compose a legal document.

Since every jurisdiction has its statutes and regulations for various life scenarios, finding a King Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard that meets all local standards can be tiresome, and hiring a professional attorney can be expensive.

Many online platforms provide the most sought-after state-specific documents for download, but utilizing the US Legal Forms library is the most advantageous.

Choose the subscription plan that best fits your needs. Create an account on the platform or Log In to move on to payment choices. Process the payment through PayPal or with your credit card. Change the file format if necessary. Click Download to store the King Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard. Print the form or utilize any preferred online editor to complete it digitally. Regardless of how many times you wish to use the downloaded template, you can access all the forms you have ever obtained in your profile by clicking on the My documents tab. Give it a shot!

- US Legal Forms is the largest online repository of templates, organized by state and areas of use.

- In addition to the King Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard, you may locate any specific form to conduct your business or personal matters, adhering to your county regulations.

- Experts verify all templates for their relevance, ensuring that you can complete your documentation accurately.

- Using the service is quite straightforward.

- If you already possess an account on the site and your subscription is active, you merely need to Log In, select the desired form, and download it.

- You can keep the document in your profile for future access.

- Otherwise, if you are unfamiliar with the platform, you will have a few additional steps to follow before obtaining your King Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

- Review the page content you are on.

- Examine the description of the template or Preview it (if offered).

- Look for another form using the related option in the header.

- Click Buy Now once you are confident in your selected document.

Form popularity

FAQ

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone.

What are the provisions of the FDCPA? Call Time Restrictions.Honoring Workplace Opt-Outs.Honoring Home Phone Opt-Outs.Restrictions Against Harassment.Restrictions Against Unfair Practices.Restrictions Against False Lawsuit Threats.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

A debt collector may contact you in person, or by mail, telephone, telegram, or fax. A debt collector may NOT contact you by postcard. These days, most debt collection contacts occur by telephone.

They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

The Australian Collectors & Debt Buyers Association Code of Practice (Code) is the industry code of the Australian Collectors & Debt Buyers Association (ACDBA). Compliance with this Code is a compulsory obligation for ACDBA members.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.