Wisconsin Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

About this form

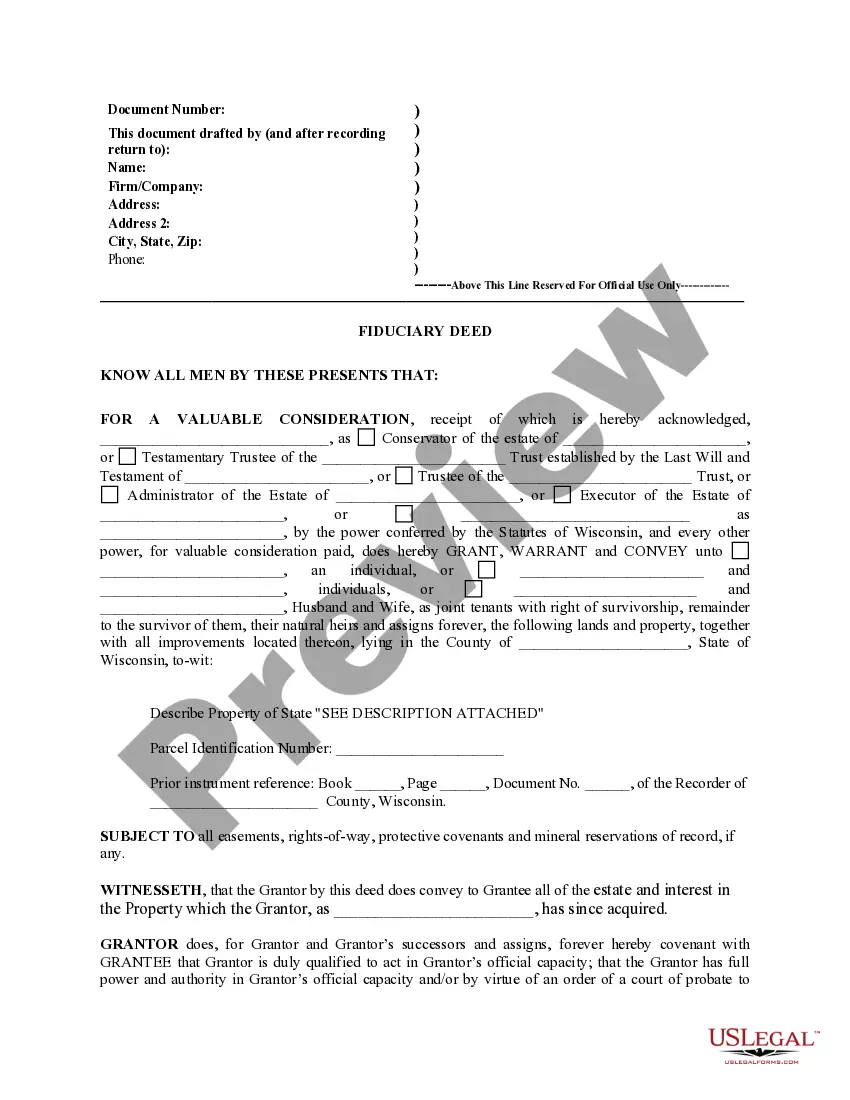

The Fiduciary Deed is a legal document used to transfer property from a fiduciary, such as an executor, trustee, or administrator, to another party. This form outlines the authority of the grantor, who holds the legal power to convey the property based on their position. Unlike standard property deeds, a fiduciary deed explicitly recognizes the role of the fiduciary in executing the transfer, ensuring clarity and legality in property transactions involving estates or trusts.

Key parts of this document

- Identification of the grantor and grantee.

- Property description, including parcel identification number.

- References to prior instruments related to the property.

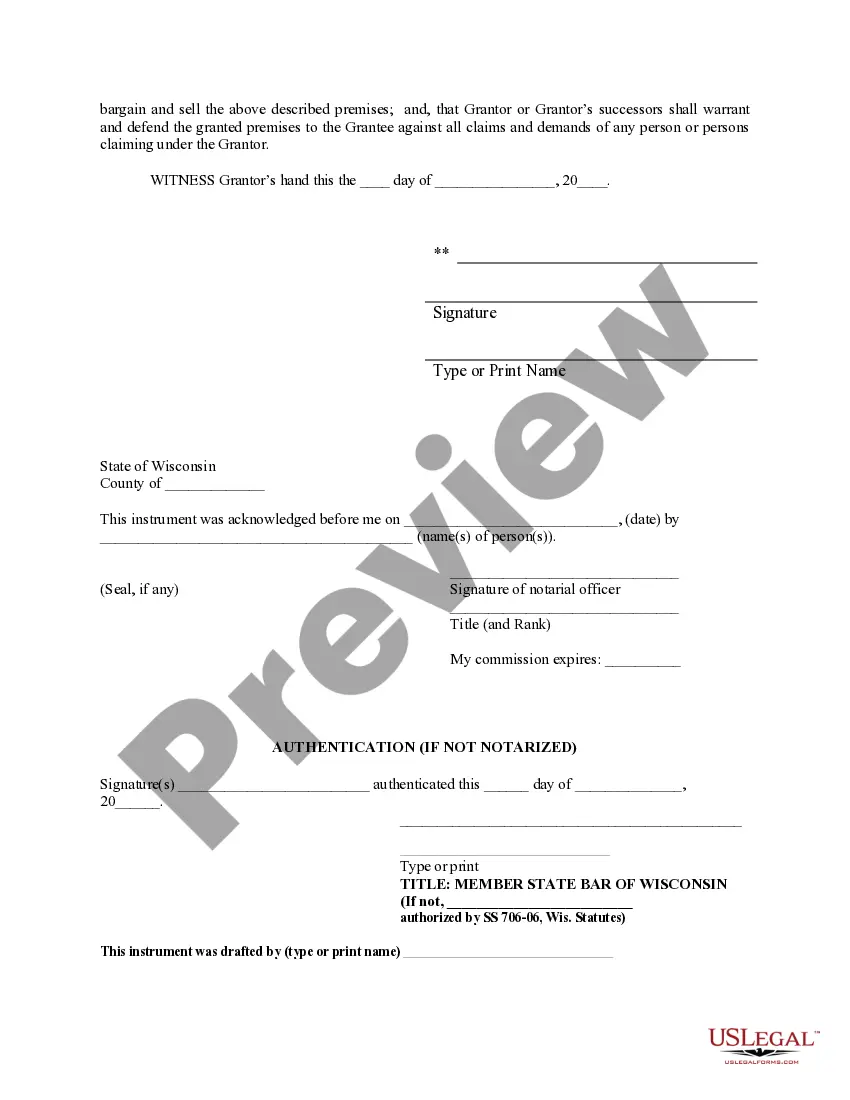

- Notary acknowledgment section for legal validation.

- Specific language indicating the grantor's fiduciary status.

Common use cases

This form is needed when a fiduciary is responsible for conveying ownership of real estate. Common scenarios include when an executor transfers property as part of settling an estate, or when a trustee sells trust property. Additionally, it may be used by guardians or conservators acting on behalf of individuals unable to manage their affairs.

Who needs this form

- Executors managing the estate of a deceased person.

- Trustees responsible for administering a trust.

- Administrators appointed to oversee intestate estates.

- Guardians or conservators acting on behalf of incapacitated individuals.

Completing this form step by step

- Identify the grantor (fiduciary) and grantee by entering their names and addresses at the top of the form.

- Describe the property being transferred, including detailed information such as parcel identification number.

- Enter any prior instrument references related to the property.

- Complete the notary acknowledgment section, ensuring it is signed and dated appropriately.

- Provide any additional signatures required by relevant parties.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include complete property descriptions.

- Leaving required signatures blank or incomplete.

- Neglecting to submit the necessary accompanying forms, such as the Wisconsin Real Estate Transfer Return Form.

- Not having the document notarized, if required by local statutes.

Benefits of completing this form online

- Convenience of downloading and completing the form at your own pace.

- Editable fields that allow for easy data entry and correction.

- Access to attorney-drafted content combined with user-friendly technology.

- Reliable source with up-to-date legal forms compliant with state laws.

Looking for another form?

Form popularity

FAQ

An administrator will take title legally on the estate's assets, and has legal responsibility to file all tax returns and pay all related taxes.In certain cases, the administrator may have personal liability for any unpaid tax amounts due for the estate.

Trustees, executors, administrators and other types of personal representatives are all fiduciaries.Executor - (Also called personal representative; a woman is sometimes called an executrix) An individual or trust company that settles the estate of a testator according to the terms of the will.

Yes an estate can have 2 administrators but it is not likely. If a names co-executors the Court may allow this, but if two people want to serve as co-administrators most Courts say "No" to the future conflicts between adminsitrators.

The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who is/are the equitable owner(s) of the trust property. Trustees thus have a fiduciary duty to manage the trust to the benefit of the equitable owners.

Residents of California may wonder what is involved in trust administration. A trust has two parts, income and principal, and the administrator, also known as the fiduciary, is in charge of managing both of those parts.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

A trustee is the person in charge of a trust. An administrator is the person appointed by the probate court to oversee a decedent's estate when there is no will.Probate is the process to administer a decedent's estate when there is either no will or there is a will but not a trust.

In most situations, it's not a good idea to name co-executors. When you're making your will, a big decision is who you choose to be your executorthe person who will oversee the probate of your estate. Many people name their spouse or adult child. You can, however, name more than one person to serve as executor.

The Executor is responsible for wrapping up the deceased person's affairs and distributing the assets to, or for the benefit of, the persons named in the will (beneficiaries). An Administrator is the person in charge of the estate when my someone dies without a Last Will and Testament.