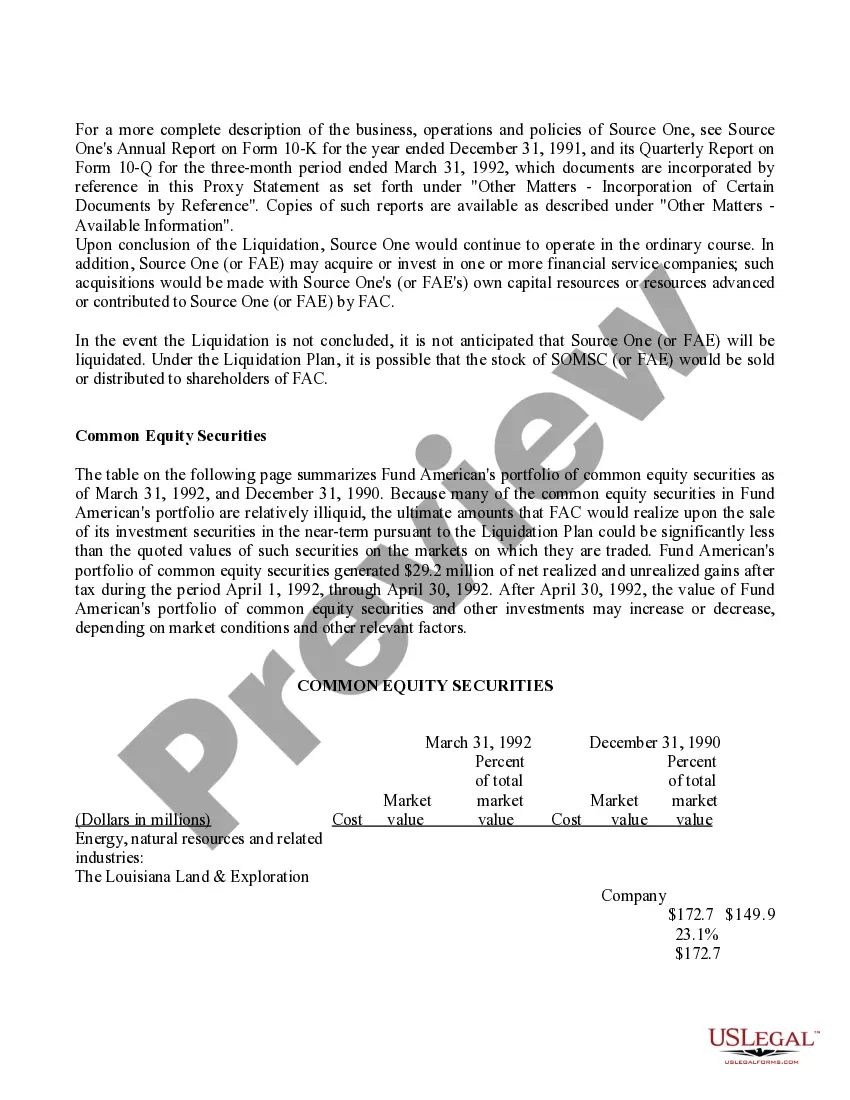

Travis Texas Proposal - Conclusion of the Liquidation with exhibit

Description

How to fill out Proposal - Conclusion Of The Liquidation With Exhibit?

Whether you plan to launch your enterprise, engage in an agreement, submit your identification update, or address family-oriented legal matters, you need to prepare specific documents in accordance with your local statutes and regulations.

Locating the appropriate files may consume considerable time and energy unless you utilize the US Legal Forms library.

The platform offers users over 85,000 professionally crafted and verified legal templates for any personal or business event. All documents are categorized by state and area of application, making it quick and easy to select a form like the Travis Proposal - Conclusion of the Liquidation with exhibit.

Documents available from our library are multi-usable. With an active subscription, you can access all of your previously obtained documents anytime in the My documents section of your account. Stop wasting time searching for updated official documents. Join the US Legal Forms platform and keep your paperwork organized with the most extensive online form library!

- Ensure the template fulfills your personal requirements and state law criteria.

- Review the form description and examine the Preview if available on the page.

- Utilize the search bar specifying your state above to locate another template.

- Click Buy Now to purchase the document when you find the right one.

- Select the subscription plan that best fits your needs to proceed.

- Log in to your account and process the payment using a credit card or PayPal.

- Download the Travis Proposal - Conclusion of the Liquidation with exhibit in your preferred file format.

- Print the document or complete it and sign it electronically via an online editor to save time.

Form popularity

FAQ

Shareholders and liquidation The shareholders will only get paid any return on their shares in an insolvent liquidation after all creditors get paid in full. If shareholders also have a claim as a creditor, then they may receive a payment as a creditor (separate from any return on shares).

The easiest way to find out about a company's liquidation status is through the relevant ASIC-operated websites. There are several ASIC sites through which trading partners can ascertain whether a company is in liquidation and include the Published Notices website.

If you can raise enough money to pay the debt in full, or negotiate with your creditor(s) for payment in instalments, you'll stop your company being liquidated. You may be able to secure alternative finance to do this, and this typically involves a speedy application process.

Liquidation implies that the business is not able to pay its debts. Liquidation further implies that the business will cease to operate (generally as a result of financial problems).

In order to terminate a liquidation, the Court requires the termination application to show that the company is in fact solvent, with: payment being made to all creditors and the liquidator fees; shareholders approving the termination application; and. ASIC being notified.

When a company goes into liquidation its assets are sold to repay creditors and the business closes down. The company name remains live on Companies House but its status switches to 'Liquidation'.

If your company has been put into liquidation, what can you do? There are still options available to help you get your company back. Even after a company has been ordered into liquidation, Courts can terminate the liquidation any time after the appointment of a liquidator.

Shareholders and liquidation The shareholders will only get paid any return on their shares in an insolvent liquidation after all creditors get paid in full. If shareholders also have a claim as a creditor, then they may receive a payment as a creditor (separate from any return on shares).

What Is Liquidation? Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.

When you liquidate a company, its assets are used to pay off its debts. Any money left goes to shareholders. You'll need a validation order to access your company bank account. If that money has not been shared between the shareholders by the time the company is removed from the register, it will go to the state.