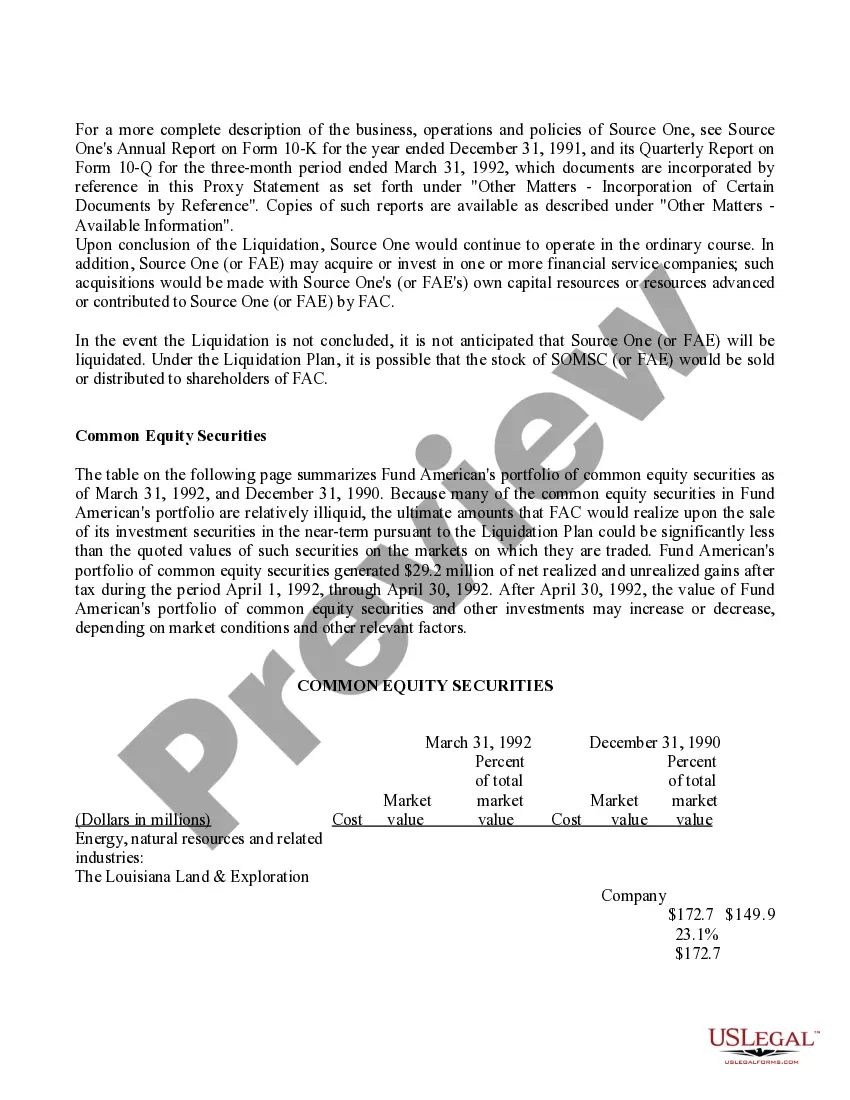

King Washington Proposal - Conclusion of the Liquidation with exhibit

Description

How to fill out Proposal - Conclusion Of The Liquidation With Exhibit?

Do you require to swiftly generate a legally enforceable King Proposal - Conclusion of the Liquidation with exhibit or perhaps any other document to manage your personal or business issues.

You have two alternatives: reach out to a legal consultant to prepare a legal document for you or construct it entirely by yourself. The positive aspect is, there's a third option - US Legal Forms.

If the form has a description, be sure to confirm its purpose.

If the form isn’t what you were seeking, restart the search using the search bar in the header.

- It will assist you in obtaining well-crafted legal documents without incurring exorbitant costs for legal services.

- US Legal Forms provides an extensive collection of over 85,000 state-specific document samples, including King Proposal - Conclusion of the Liquidation with exhibit and form sets.

- We supply templates for a wide range of life situations: from divorce filings to real estate document templates.

- We have been in the industry for more than 25 years and have maintained an impeccable reputation among our clients.

- Here's how you can join them and secure the required document without any additional complications.

- To begin, ensure that the King Proposal - Conclusion of the Liquidation with exhibit fits your state or county's guidelines.

Form popularity

FAQ

The Regulations provide that the liquidation process will usually be completed within 2 years of commencement, failing which the liquidator shall take the approval of the Adjudicating Authority for extension.

7 What is Liquidators Final Statement of Account? At the time of Liquidation of a company, the liquidator realises all the assets and discharge the liabilities and capital. The statement prepared to record to such receipts and payments is called Liquidator's Final Statement of Account.

Liquidation is the process of converting a company's assets into cash, and using those funds to repay, as much as possible, the company's debts. Liquidation results in the company being shut down.

Liquidation is the process of converting a company's assets into cash, and using those funds to repay, as much as possible, the company's debts. Liquidation results in the company being shut down.

Step 1 - A Creditor Issues a Statutory Payment Demand. Step 2 A Winding Up Petition is Issued. Step 3 A winding up order is granted. Step 4 The Company is Liquidated. Step 5 Post-Liquidation Investigation.

In any case, the first step in the liquidation process is for the company directors to seek impartial advice from an insolvency expert, before convening a meeting with shareholders to announce the intended liquidation.

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.

A Statement of Affairs is a document detailing a company's assets and liabilities. Generally prepared by a liquidator or appointed professional during certain insolvency proceedings, the document is later registered at Companies House, where it becomes available for public view.

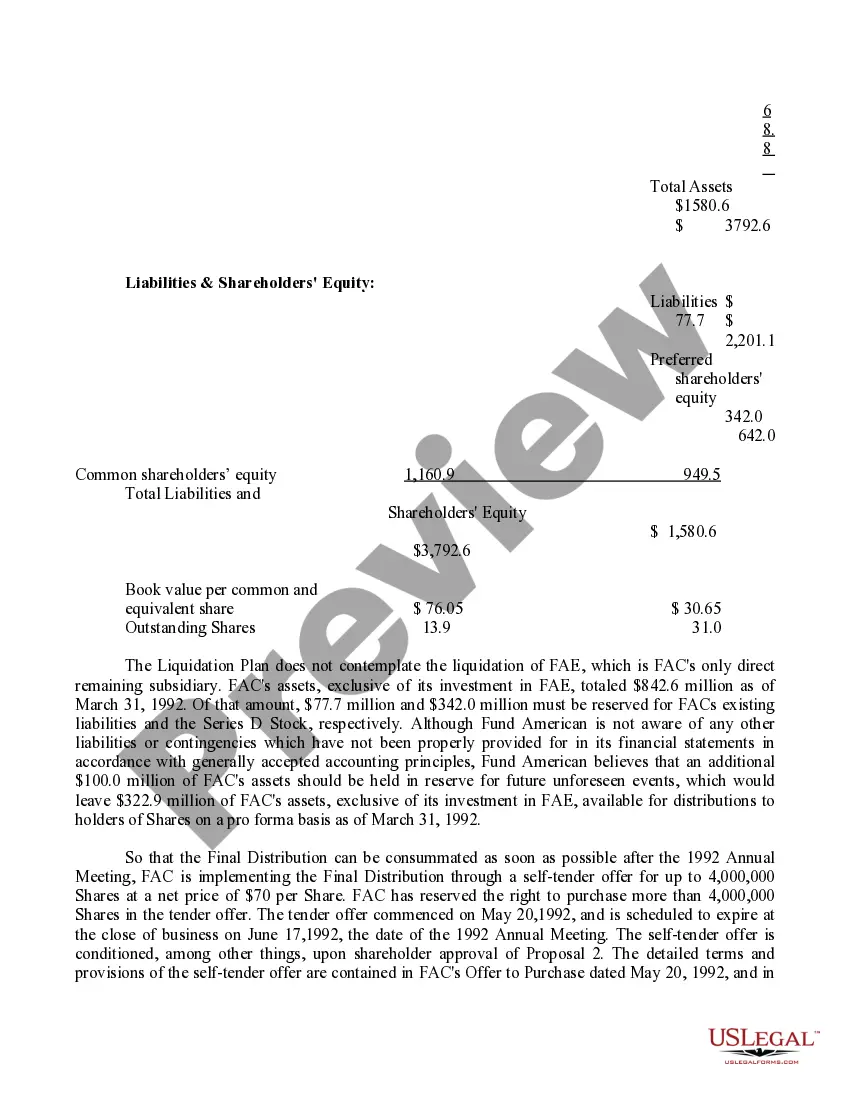

Financial statements prepared using the liquidation basis of accounting are now required by GAAP to include a statement of net assets in liquidation and a statement of changes in net assets in liquidation, as well as all disclosures necessary to present relevant information about an entity's expected resources in

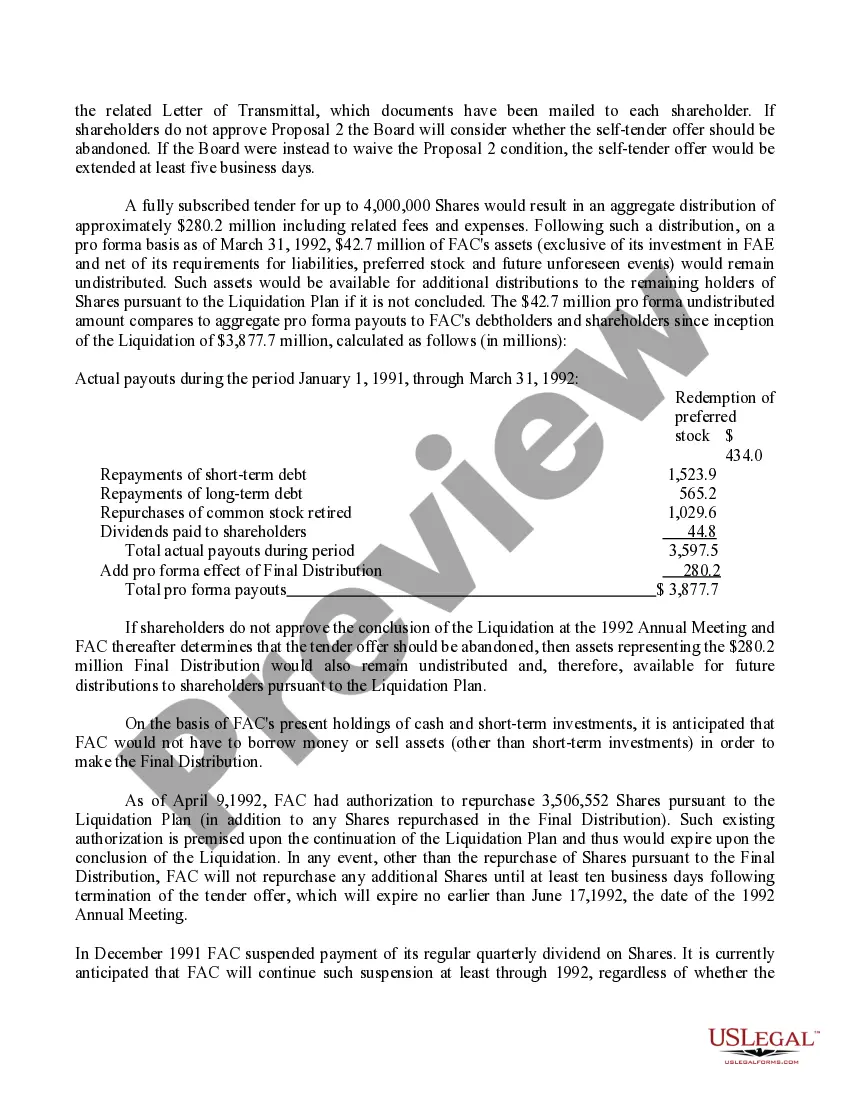

The statement of partnership liquidation is prepared to depict the progress of the liquidation over the specified period of time. Here, the assets of the partnership entity are sold off to pay off the entire liabilities and if any balance is left thereafter, it is shared among the partners as per the pre-agreed ratio.