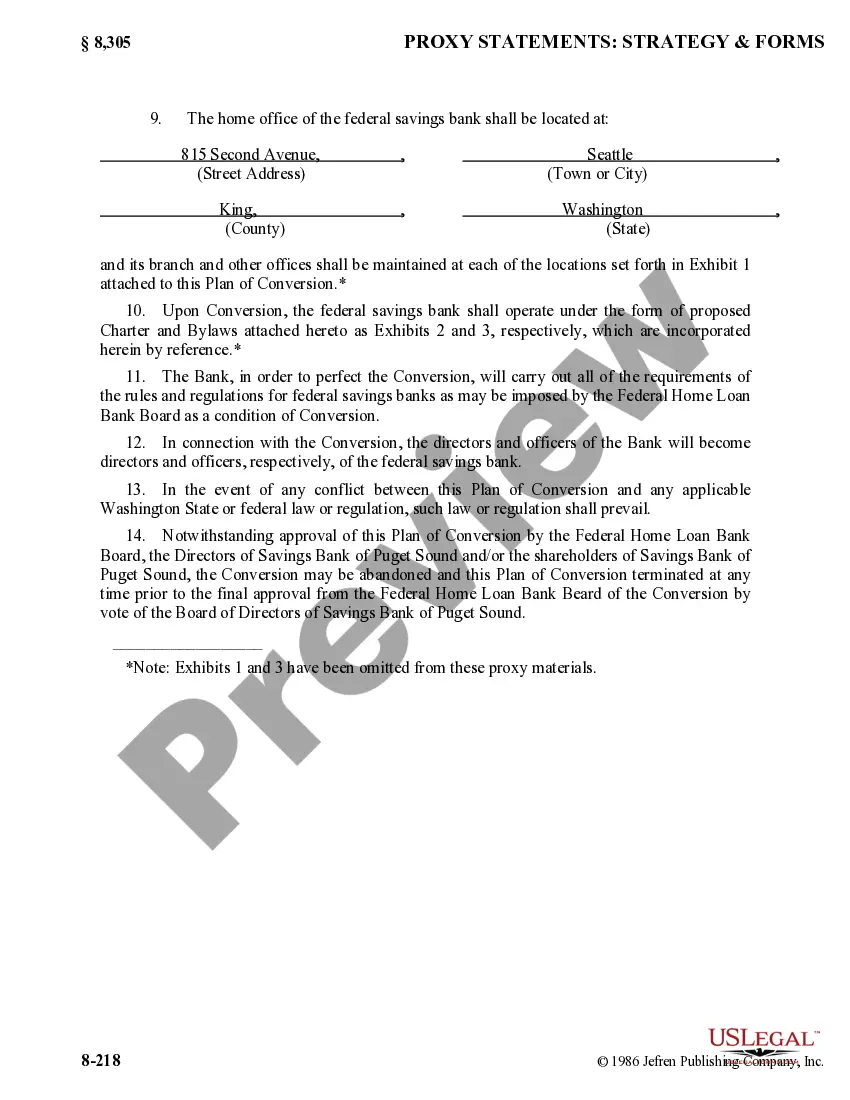

Bexar Texas Plan of Conversion from state stock savings bank to federal stock savings bank

Description

How to fill out Plan Of Conversion From State Stock Savings Bank To Federal Stock Savings Bank?

Are you seeking to swiftly generate a legally-binding Bexar Plan of Conversion from state stock savings bank to federal stock savings bank or potentially any other method to manage your personal or corporate affairs.

You have two choices: engage a legal consultant to prepare a legitimate document for you or create it entirely by yourself.

Firstly, ensure that the Bexar Plan of Conversion from state stock savings bank to federal stock savings bank complies with your state's or county's regulations.

If the document includes a description, confirm its intended purpose.

- The good news is, there's another option - US Legal Forms.

- It will assist you in obtaining professionally drafted legal documents without incurring exorbitant costs for legal assistance.

- US Legal Forms boasts a vast collection of over 85,000 state-specific form templates, including Bexar Plan of Conversion from state stock savings bank to federal stock savings bank and corresponding form packages.

- We provide documents for a wide range of scenarios: from divorce forms to real estate paperwork templates.

- We've been operating for over 25 years and have established a strong reputation among our clientele.

- Here’s how you can join them and acquire the required document without any hassle.

Form popularity

FAQ

Check conversion is a reformatting service offered by banking merchants. Check conversion allows banks to convert paper checks into electronic ones and then send them to the appropriate receiving bank. The electronic check is forwarded via the automated clearing house (ACH).

A thrift holding company that is owned by shareholders but controlled by the depositors of the subsidiary thrift. A mutual holding company holds a majority of the voting stock of the subsidiary thrift, while the remaining 49.9% of the thrift's stock can be sold to outside investors.

No member control: Mutual savings banks are mutual associations, meaning they are owned, but not controlled, by depositors. Instead, control goes to a board of trustees that often remains the same for years. The board self governs and answers to no one.

A conversion merger is when a mutual institution simultaneously acquires a stock institution at the same time it completes a standard stock conversion. A mutual FSA may acquire another insured institution that is already in the stock form of ownership at the time of its stock conversion transaction.

Mutual to stock conversions are highly complex corporate reorganizations where a company which is owned by its depositors (if it is a financial institution such as a savings bank) or by its members or policyholders (if it is a mutual insurer) changes its form of organization to one where the mutual members' rights

Accounts receivable conversion (ARC) is a process that allows paper checks to be electronically scanned and converted into an electronic payment through the Automated Clearing House (ACH). This refers explicitly to checks that companies receive in payment for an account receivable.

Bank Conversion means the conversion of WFB into a national banking association under the name Western Financial Bank, National Association (or other permissible name). Sample 2. Bank Conversion means conversion of the Bank to the New Bank.

Mutual banks are owned by their borrowers and depositors. Ownership and profit sharing are what differentiate mutual banks from stock banks, which are owned and controlled by individual and institutional shareholders that profit from them.

With a bank or savings association mutual-to-stock conversion, however, eligible depositors have a unique opportunity to participate and purchase shares because federal and state banking regulations require that the bank or savings association give depositors first priority to purchase the stock over all other