Kings New York Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock

Description

How to fill out Kings New York Form Of Certificate Of Designations, Preferences And Rights Of Series C Convertible Preferred Stock?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Kings Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the current version of the Kings Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Kings Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock:

- Glance through the page and verify there is a sample for your area.

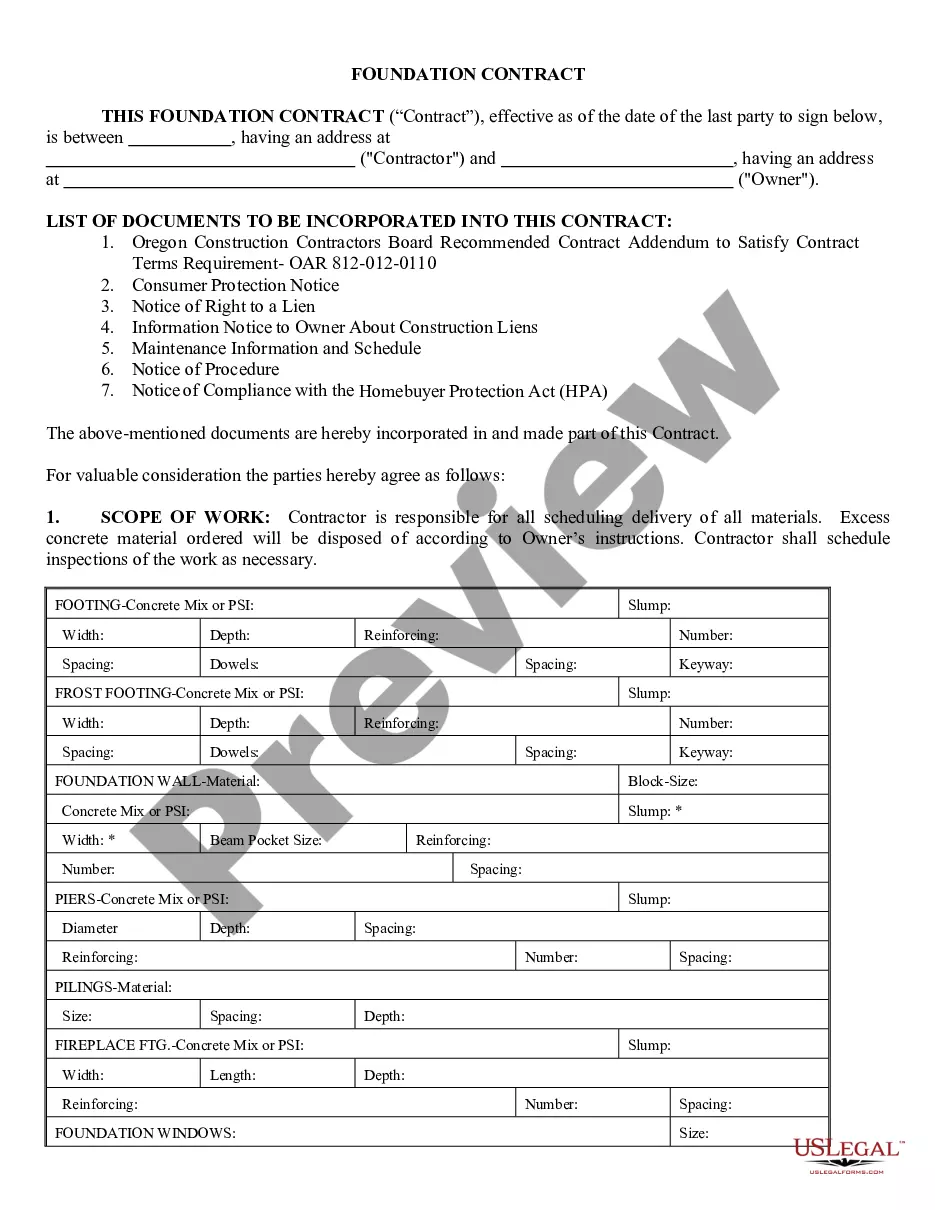

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Kings Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

The definition of a designation is the act of pointing someone out with a name, a title or an assignment. An example of designation is someone being named president of an organization. That which designates; a distinguishing mark or name; distinctive title; appellation. A distinguishing name, title, etc.

After multiplying the number of preferred shares by the conversion ratio, we can calculate the number of convertible common shares. Then, the conversion price can be calculated by dividing the par value of the convertible preferred stock by the number of common shares that could be received.

Stock Designation with respect to a share of Company Common Stock means a designation by the holder of such share, provided by the Company to Parent no later than the Designation Deadline, to the effect that such share is designated to receive the Stock Designation Consideration.

Preferred Designation means the Certificate of Designation with respect to the Series D Preferred Stock, the Series E Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock, the Series H Preferred Stock and the Series I Preferred Stock adopted by the Board of Directors of the Company and duly filed

The CCPS helps the start-up Companies founders to control their stake at the funding stage of new investors without an infusion of new funds. CCPS are also anti-dilution securities and founders can manage their equity stake to keep control of the Company by holding a substantial stake in the Company.

A preferred stock certificate is a document that identifies the ownership share of an investor in a corporation.

Key Takeaways Convertible preferred shares can be converted into common stock at a fixed conversion ratio. Once the market price of the company's common stock rises above the conversion price, it may be worthwhile for the preferred shareholders to convert and realize an immediate profit.

A certificate which contains a copy of the board resolution setting out the powers, designations, preferences or rights of a class or series of a class of stock of a corporation (typically a series of preferred stock) if they are not already contained in the certificate of incorporation of the corporation.

That said, convertible preferred shareholders, unlike common shareholders, rarely have voting rights. By buying Acme convertible preferred shares, the worst investors would ever do is receive a $4.50 annual dividend for each share they own. But these securities offer the owners the possibility of even higher returns.

More Definitions of Series C Convertible Preferred Stock Series C Convertible Preferred Stock means the Series C Convertible Redeemable Preferred Stock, par value $. 01 per share, of the Company, having the same voting rights as the Class A Common Stock determined on an as converted basis.