Kings New York Sample Proposed purchase of 300,000 shares with copy of Agreement

Description

How to fill out Sample Proposed Purchase Of 300,000 Shares With Copy Of Agreement?

Drafting documents, such as Kings Sample Proposed acquisition of 300,000 shares with copy of Agreement, to manage your legal matters is a demanding and lengthy endeavor.

Numerous situations necessitate a lawyer’s participation, which also renders this job costly.

Nonetheless, you can take control of your legal matters and handle them independently.

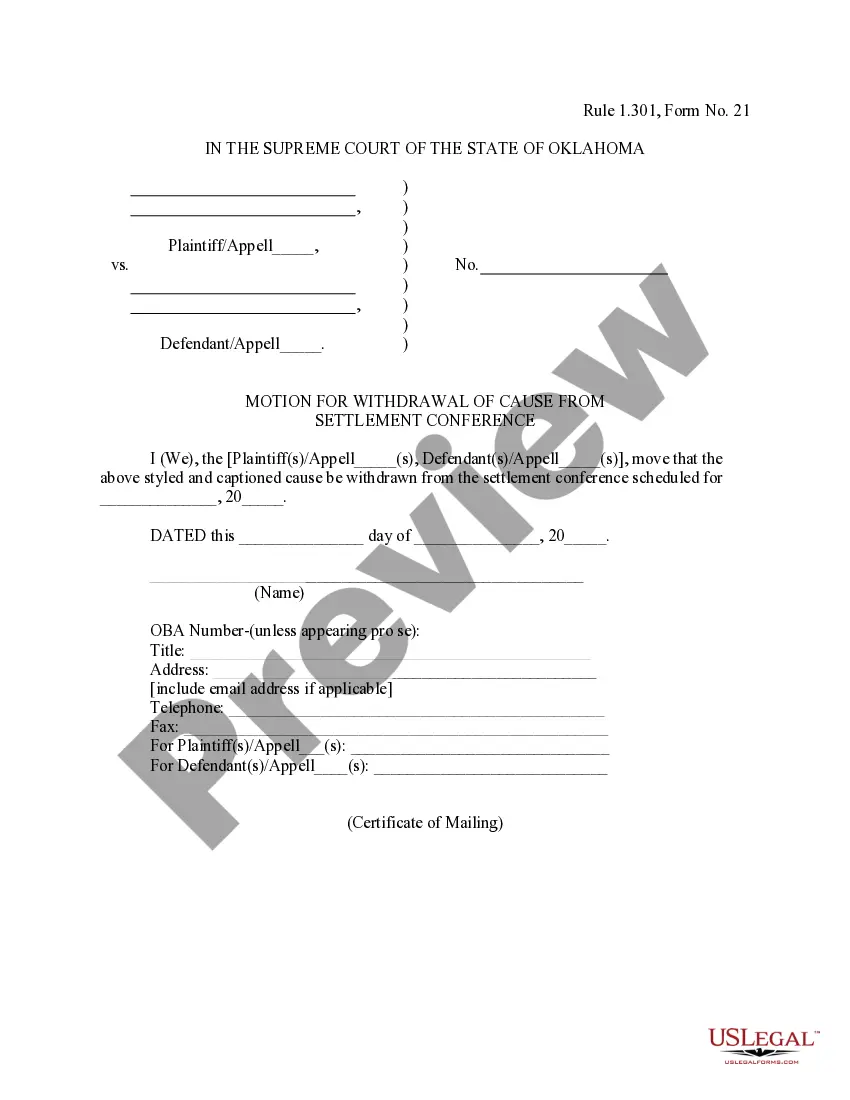

The onboarding process for new users is quite straightforward! Here’s what you must do before acquiring the Kings Sample Proposed acquisition of 300,000 shares with copy of Agreement: Ensure your template meets your state/county regulations since the criteria for crafting legal documents may vary from one state to another.

- US Legal Forms is here to assist.

- Our platform includes over 85,000 legal documents designed for various circumstances and life events.

- We ensure that each document complies with state laws, so you don’t have to be concerned about possible legal issues related to compliance.

- If you are already familiar with our site and hold a subscription with US, you understand how straightforward it is to access the Kings Sample Proposed acquisition of 300,000 shares with copy of Agreement template.

- Simply Log In to your account, retrieve the template, and customize it to fit your needs.

- Have you misplaced your document? Not to worry. You can find it in the My documents section of your account - on desktop or mobile.

Form popularity

FAQ

Unlike an asset purchase, where the buyer simply buys the assets of the company, an equity purchaser actually buys the company itself, which can be beneficial if the company is performing well or has additional value as a going concern.

5 easy steps to file share purchase agreement Review of the share purchase agreement by both the parties. Signature by both the parties.Copies should be made for a purchaser, seller and the company. Giving the certificate after the payment. It can register if you meet certain criteria.

Equity Purchase means the purchase by Parent using the net cash proceeds of the IPO, of the membership interests in Holdings.

Important clauses in share purchase agreement that need professional attention Parties.Definitions and interpretation.Sale and purchase of shares.Price.Sale conditions.Best and reasonable endeavours.Flexible and deferred payments, and earn-out clauses.Completion.

A Share Sale and Purchase Agreement is an agreement for the sale and purchase of a stated number of shares at an agreed price. The shareholder selling their shares is the seller and the party buying the shares is the buyer. This agreement details the terms and conditions of the sale and purchase of the shares.

The key provisions detail the terms of the transaction: the number and type of stock sold (i.e. common, preferred) the purchase price.

5 easy steps to file share purchase agreement Review of the share purchase agreement by both the parties. Signature by both the parties.Copies should be made for a purchaser, seller and the company. Giving the certificate after the payment. It can register if you meet certain criteria.

The key provisions detail the terms of the transaction: the number and type of stock sold (i.e. common, preferred) the purchase price.

EQUITY INTEREST PURCHASE AGREEMENT WHEREAS, upon completion of the purchase by Buyer of all of the Transferred Interests, Buyer will own 100% of the outstanding Equity Interests of the Company, and, at the Closing, Buyer shall, and Parent shall cause Buyer to, pay to Seller the Closing Date Purchase Price.

An equity purchase agreement, also known as a share purchase agreement or stock purchase agreement, is a contract that transfers shares of a company from a seller to a buyer. Equity purchases can be used to acquire a business in whole or in part.