Montgomery Maryland Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit

Description

How to fill out Montgomery Maryland Proposal To Amend Certificate To Reduce Par Value, Increase Authorized Common Stock And Reverse Stock Split With Exhibit?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Montgomery Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the recent version of the Montgomery Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Montgomery Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit:

- Look through the page and verify there is a sample for your area.

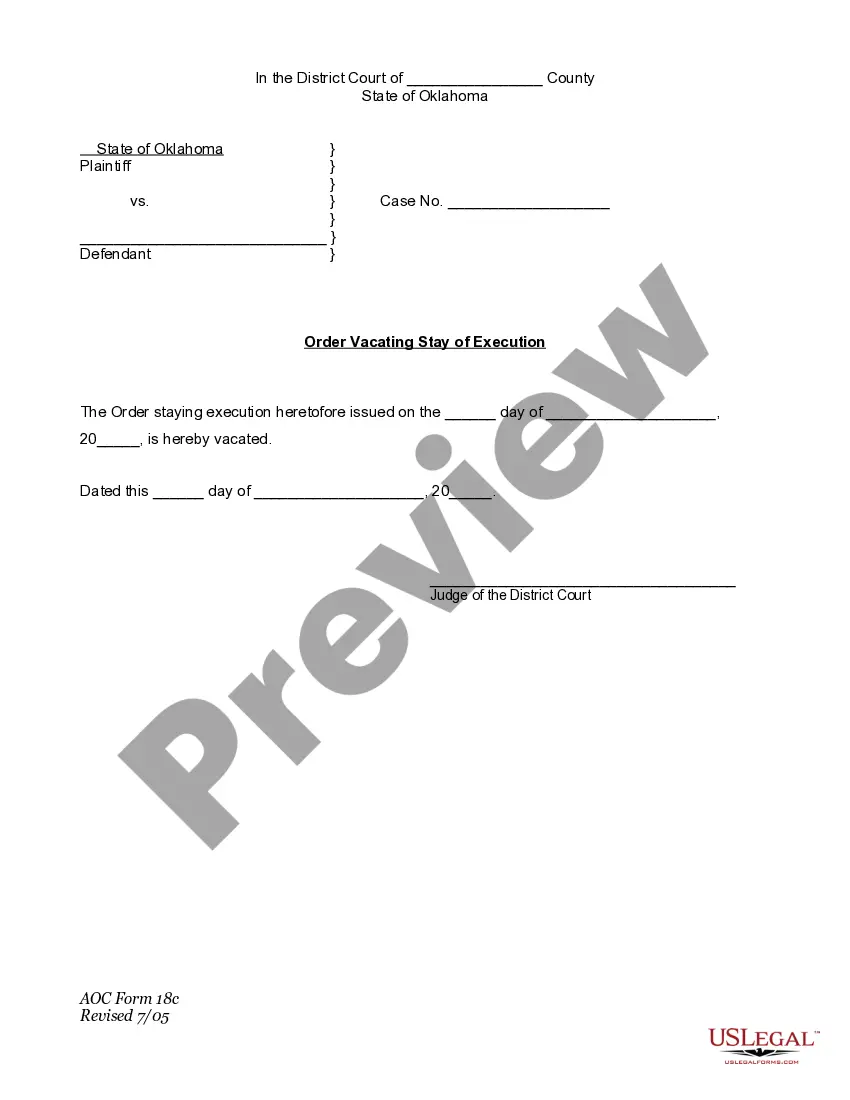

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Montgomery Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Generally, the split must be approved by either the board of directors or shareholders, depending on the company's bylaws and state corporate law. Public companies that file with the SEC can notify shareholders about an upcoming reverse stock split with a proxy statement on forms 8-K, 10-Q, or 10-K.

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split).

For example: For a 1-for-2 reverse stock split, enter 1 in the New Shares field and 2 in the Old Shares field. Open the account you want to use. Click Enter Transactions. In the Enter Transaction list, select Stock Split. Use this dialog to record the split. Click a link below for more information. Transaction date.

When a company's stock splits, the change in the par value is offset by a corresponding change in the number of shares so the total par value remains the same. The total stockholders' equity is unaffected by the stock split and no entries are recorded.

You can help keep your company private by reducing the number of stock shares available for purchase. A reverse split raises your stock's par value and reduces the number of shares at the same time. The reverse split doesn't change the value of the retained earnings, paid-in capital or cash accounts.

A change in par value usually occurs when a company's stock is split. The par value is typically listed on stock certificates and usually does not represent the stock's actual value.

If coupon rate equals the interest rate then the bond will trade at its par value. However, if interest rates rise then the price of a lower-coupon bond must decline to offer the same yield to investors, causing it to trade below its par value.

Although the SEC has authority over a broad range of corporate activity, state corporate law and a company's articles of incorporation and by-laws generally govern the company's ability to declare a reverse stock split and whether shareholder approval is required.

What is required should an issuer choose to do a reverse stock split? Generally, a public company can declare a reverse split if it obtains the approval of its board of directors. Most often shareholder approval is not required.

Will the reverse stock split change the par value of the share? Yes, the par value of each share will be increased proportionally to the exchange ratio, i.e. it will be multiplied by 20.