Clark Nevada Approval of authorization of preferred stock

Description

How to fill out Approval Of Authorization Of Preferred Stock?

A documentation process consistently accompanies any lawful action you undertake.

Starting a business, applying for or accepting an employment offer, transferring ownership, and numerous other life circumstances require you to prepare formal records that differ from state to state. That's why having everything gathered in one location is so beneficial.

US Legal Forms is the largest online compilation of current federal and state-specific legal templates. Here, you can effortlessly locate and obtain a document for any personal or commercial purpose utilized in your jurisdiction, including the Clark Approval of authorization of preferred stock.

Finding forms on the platform is exceptionally straightforward. If you already possess a subscription to our service, Log In to your account, search for the sample using the search field, and click Download to save it on your device. Subsequently, the Clark Approval of authorization of preferred stock will be available for further use in the My documents tab of your profile.

This is the simplest and most trustworthy method to acquire legal documents. All templates in our library are expertly drafted and confirmed for compliance with local laws and regulations. Organize your paperwork and manage your legal matters effectively with US Legal Forms!

- Ensure you have accessed the correct page with your localized form.

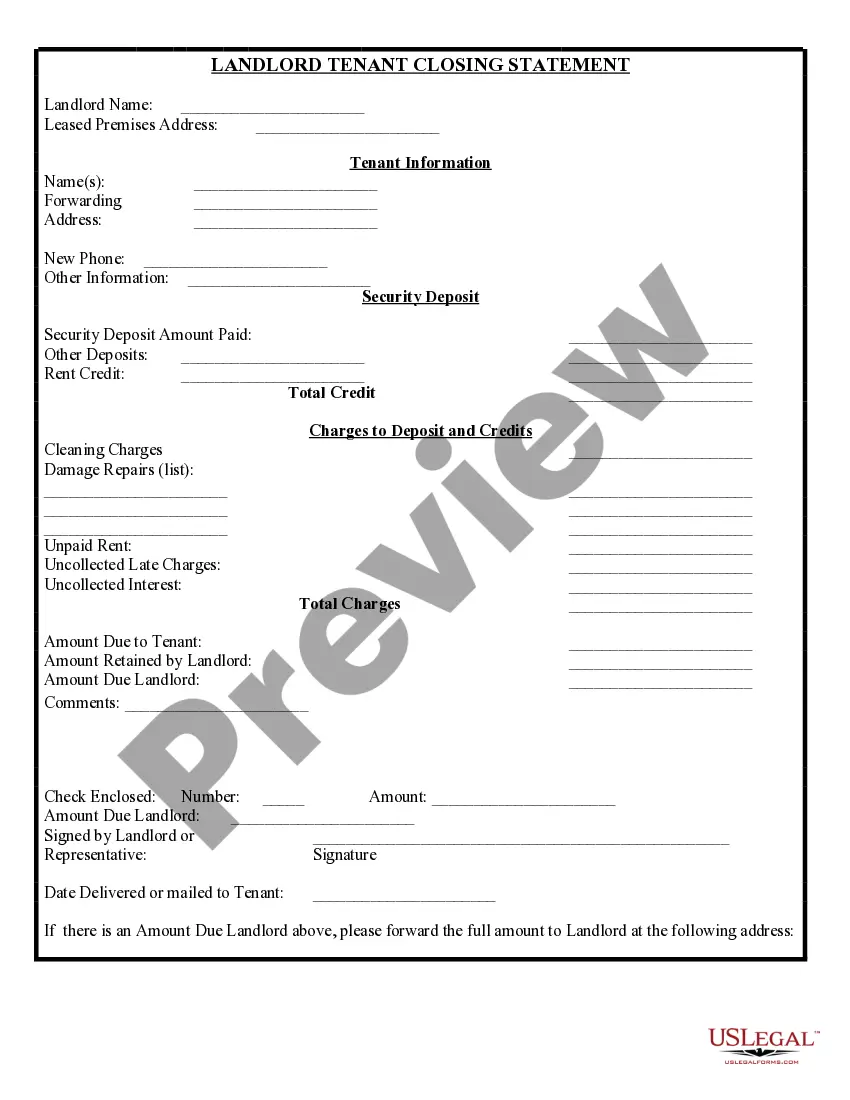

- Utilize the Preview mode (if available) and examine the template.

- Review the description (if any) to confirm the form aligns with your needs.

- Search for another document using the search option if the sample does not meet your requirements.

- Click Buy Now when you find the necessary template.

- Choose the appropriate subscription plan, then Log In or create a new account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Clark Approval of authorization of preferred stock on your device.

- Utilize it as necessary: print it or complete it electronically, sign it, and send it where required.

Form popularity

FAQ

The acquisition of controlling interest occurs when an entity obtains enough shares to dictate decisions within a corporation. This concept is crucial for investors and stakeholders, as it affects corporate governance and the direction of the company. When dealing with the Clark Nevada Approval of authorization of preferred stock, understanding this dynamic is essential for both new and existing shareholders.

FCA regulation 12 CFR § 615.5230(c) requires that each issuance of preferred stock by a Farm Credit System institution must be approved by a majority of the shares voting of each class of equities adversely affected by the preference, voting by class, whether or not such classes are otherwise authorized to vote.

Series A Dividends means the cumulative dividends on each share of Series A Preferred Stock equal to the product of the Series A Base Value (as adjusted for stock dividends, stock splits, combinations, recapitalizations or the like) times a rate per annum of 8%.

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

At a minimum, you need to record the sale date, the name and address of the buyer, the number of shares sold and the price per share. Each stock certificate must have preferred written on it, have a unique certificate number and bear the corporate seal on the front.

The four main types of preference shares are callable shares, convertible shares, cumulative shares, and participatory shares. Each type of preferred share has unique features that may benefit either the shareholder or the issuer.

Shareholder approval will only be required for issuances to a related party, and will not be required for issuances to 1) a subsidiary, affiliate, or other closely related person of a related party, or 2) any company or entity in which a related party has a substantial direct or indirect interest.

Most successful, venture-backed startup will have multiple financing rounds. For each round, there will typically be a distinct series of preferred stock tied to the financing series. So, if a startup had raised a Series A and a Series B, then it would likely have Series A Preferred Stock and Series B Preferred Stock.

Preferred stock is a form of equity, or a stake in the company's ownership. Instead of being a form of debt equity, preferred stock works more like a bond than it does like a share in a company. Companies issue preferred stock as a way to obtain equity financing without sacrificing voting rights.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.